If you have ever reviewed an estate planning document or spoken with a California trust attorney, you may have come across the phrase Rule Against Perpetuities.

It sounds intimidating, and for good reason. It has confused law students, attorneys, and families for centuries. Even experienced lawyers sometimes trip over its technical details.

Here is the good news. If you are creating or reviewing a trust in Carlsbad, San Diego County, or anywhere in California, you do not need to master this rule on your own.

Modern California law has significantly simplified it. Still, understanding the basics can help you appreciate why certain provisions appear in your trust and how they protect your family over time.

This guide explains the rule against perpetuities in plain English, explores its historical roots, and shows how California’s modern approach makes estate planning more practical and predictable.

Key Takeaways

The Rule Against Perpetuities prevents property from being controlled indefinitely by requiring ownership to become clear within a set time limit.

California uses a simplified 90-year vesting period under the Uniform Statutory Rule Against Perpetuities, found in Probate Code section 21205.

Most professionally drafted California trusts already comply with the rule, so standard family trusts rarely face perpetuities problems.

DIY or AI-generated trusts and older documents are more likely to contain provisions that raise perpetuities issues.

What Is the Rule Against Perpetuities?

The Rule Against Perpetuities is a legal principle that limits how long ownership of property can remain uncertain.

In simple terms, it requires that future interests in property must either become fixed (vest) or fail entirely within a legally acceptable time period.

The rule exists to prevent property from being tied up indefinitely and to ensure that assets remain usable by living people.

Traditionally, the rule was stated this way:

“No interest in land is good unless it must vest, if at all, not later than twenty-one years after some life in being at the creation of the interest.”

That sentence has confused generations of lawyers.

In practical terms, it asks a simple question: Will we know who owns this property within a reasonable amount of time?

For example, imagine a trust that says a grandchild will receive property “when they turn 30.” If that grandchild has not yet been born when the trust is created, the law asks whether ownership will be resolved within an acceptable time frame. If the answer is uncertain, the provision may raise perpetuities concerns.

The original “life in being plus 21 years” formula created significant complexity, which is why California and many other states adopted a more workable approach.

Why the Rule Against Perpetuities Exists

The Rule Against Perpetuities exists for one simple reason: the law does not allow property to be controlled forever.

Centuries ago, wealthy families attempted to lock property into rigid inheritance plans that extended far into the future. These arrangements often made property difficult or impossible to sell, finance, or manage. Courts began to see that allowing unlimited long-term control harmed both families and society as a whole.

The Duke of Norfolk’s Case: The Origin Story

One of the most influential cases shaping this rule was The Duke of Norfolk’s Case, decided in England in the late 1600s. In that case, the Duke created a complicated estate plan that shifted ownership of land based on future events that might not occur for decades, if ever.

The court was forced to confront a fundamental question: should someone be able to control property long after their death?

The answer was no.

From this case emerged the core principle behind the Rule Against Perpetuities. Property ownership cannot remain uncertain forever. At some point, ownership must be resolved so that living people can use, manage, sell, or develop the property.

Over time, lawmakers recognized that the original common law rule was difficult to apply and often confusing for families and trustees. California responded by adopting a modern statutory version of the rule that preserves its purpose while simplifying its application.

Note: In California, most future interests in a trust must vest or fail within 90 years of the trust creation. This modern rule avoids complicated life-expectancy calculations while still preventing property from being tied up indefinitely.

Most professionally drafted California trusts rely on this 90-year rule rather than the older “life in being plus 21 years” formula.

How California Applies and Simplifies the Rule Today

California follows the Uniform Statutory Rule Against Perpetuities, codified in Probate Code sections 21200 through 21231. Under this framework, a future interest in a trust is valid if it satisfies either of two tests.

Estate planners generally rely on one of the following approaches:

Traditional approach: The interest vests within 21 years after the death of an individual who was alive when the interest was created.

Wait-and-see approach: The interest vests or fails within 90 years of when the trust is created, as permitted by Probate Code section 21205(b).

The 90-year rule is a significant improvement. It eliminates the need for complex analysis of family trees and hypothetical lifespans, while still ensuring that property is not locked up indefinitely.

For families working with estate planning attorneys in Carlsbad and throughout San Diego County, this approach provides flexibility, predictability, and peace of mind.

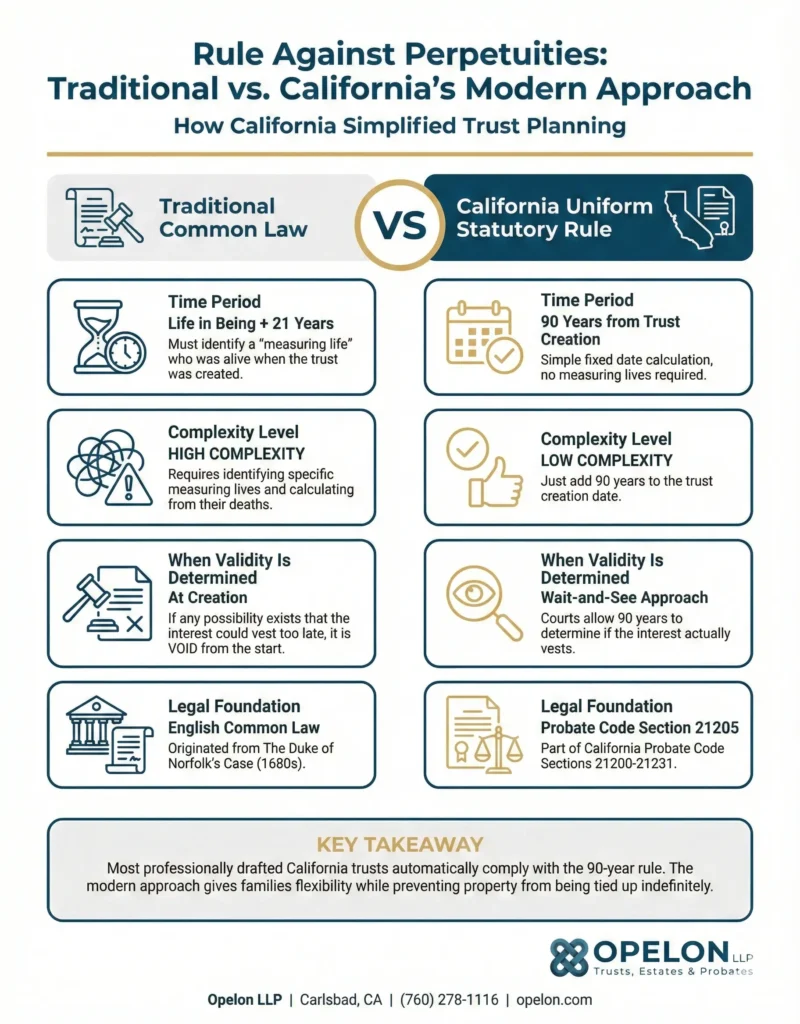

Comparing the Traditional and Modern Approaches to the Rule Against Perpetuities

Feature | Traditional Common Law | California USRAP |

Time Period | Life in being plus 21 years | 90 years from trust creation |

Calculation Complexity | Very complex, requires identifying measuring lives | Simple, fixed date calculation |

When Validity Determined | At creation (if possibly invalid, it is void) | Wait-and-see approach allows 90 years to determine |

Statutory Authority | English common law tradition | Probate Code Section 21205 |

Real-Life California Estate Planning Example

Consider a common modern scenario.

Maria, age 65, creates a revocable living trust in 2026. She wants to provide for her children and future grandchildren. Her trust provides that upon her last surviving child’s death, the trust assets will be distributed equally among all grandchildren who have reached age 30.

Under the traditional common law rule, this provision would require a detailed technical analysis. Questions could arise depending on how the class of beneficiaries is defined and whether future grandchildren might fall outside the permitted time frame.

Under California’s 90-year rule, the analysis is straightforward. As long as all grandchildren who will ever reach age 30 do so within 90 years of 2026, the provision is valid. In practical terms, that means the trust can operate exactly as Maria intended.

This example illustrates why California’s approach works well for modern families. It preserves flexibility without sacrificing legal certainty.

What Happens If a Trust Violates the Rule Against Perpetuities?

If a trust provision violates the Rule Against Perpetuities, that specific provision may be void. Importantly, this does not usually invalidate the entire trust.

California law allows courts to reform or modify problematic provisions when possible to better reflect the trust creator’s intent. The outcome depends on the specific language and circumstances, but courts often attempt to preserve the overall estate plan.

Common situations where perpetuities issues arise include:

- Conditions tied to achievements or milestones without time limits

- Dynasty trusts lacking proper savings clauses

- DIY trusts created without legal guidance

- Older trusts drafted before California adopted the modern statutory rule

Practical Tips for California Trusts Related to the Rule Against Perpetuities

Include a perpetuities savings clause. Most professionally drafted California revocable living trusts include a clause that automatically terminates the trust and distributes assets if the perpetuities deadline approaches. This safety net protects against drafting errors.

Avoid overly uncertain conditions. Provisions tied to rare achievements or undefined future events can create problems. If incentive provisions are important, they should be carefully structured with clear time limits.

Review older trusts. If your trust was created many years ago or you serve as trustee of an older trust, a review under current California law is wise.

Be cautious with DIY trusts. Online templates often lack proper safeguards. Problems frequently surface only during trust administration, when fixing them becomes far more costly.

Why the Rule Against Perpetuities Still Matters

The Rule Against Perpetuities remains part of California estate planning law, not to complicate trusts, but to keep them workable and fair for future generations. It ensures that property ultimately passes to living people who can use and enjoy it.

For families in Carlsbad, San Diego County, and throughout California, the practical takeaway is simple: when a trust is professionally drafted and periodically reviewed, the rule rarely causes problems. Instead, it quietly protects your estate plan from unintended consequences.

A short review today can prevent costly litigation or unintended distributions years down the road.

Frequently Asked Questions: The Rule Against Perpetuities in California

Yes. California follows a modern version of the rule under the Uniform Statutory Rule Against Perpetuities (Probate Code Sections 21200-21231). It applies to most trusts created in California, although it is far more flexible than the old common-law rule. The 90-year vesting period makes compliance straightforward for properly drafted trusts.

In most cases, no. Standard revocable living trusts that distribute assets to children or grandchildren outright usually do not raise perpetuities issues. Problems tend to arise only when a trust includes long-term or highly conditional future distributions that could theoretically extend beyond 90 years.

If a provision violates the rule, that specific provision may be void. The rest of the trust can often still be administered, but the distribution may occur sooner or in a different way than the creator intended. California courts have the authority to reform invalid provisions to approximate the original intent.

Because modern California trusts are usually drafted to comply automatically with the 90-year rule. Estate planning attorneys include perpetuities savings clauses as standard practice. The issue often comes up only when reviewing older trusts, unusual conditions, or DIY estate plans that lack proper drafting.

If your trust includes conditions tied to future achievements, long timelines, or multiple generations, it is worth having it reviewed. A quick legal review can confirm whether the trust complies with current California law. For most standard trusts created by estate planning professionals, there is little cause for concern.

A perpetuities savings clause is a provision in a trust that automatically terminates the trust and distributes assets if the trust approaches the perpetuities deadline. This safety net ensures the trust remains valid even if the original terms would otherwise violate the rule. Most professionally drafted California trusts include this clause.

No. California does not allow perpetual trusts. The Rule Against Perpetuities requires that all interests in a trust must vest or fail within 90 years. Some states have abolished or modified the rule to allow longer or even perpetual trusts, but California is not one of them.

Need Help with Your San Diego Estate Plan?

Understanding the Rule Against Perpetuities is crucial for effective estate planning in California. This rule ensures that your estate plans remain valid and your loved ones are protected for generations to come. If you have questions about how this rule applies to your situation, need a trust reviewed for compliance, or want to create a new estate plan, Opelon LLP is here to help. Don’t leave your family’s future to chance; contact us for more information!

Our Carlsbad estate planning lawyers serve families throughout San Diego County and California. Schedule a consultation: (760) 278-1116

About the Author Matt Odgers

Matt Odgers, Esq. is a Founding Partner at Opelon LLP in Carlsbad, California. A San Diego County native, Matt earned his J.D. from Thomas Jefferson School of Law and his B.A. in Political Science from Purdue University. He has been recognized by Best Lawyers: Ones to Watch in America (2026) and as a Super Lawyers Rising Star.

Disclaimer: This article provides general information about California estate planning and the Rule Against Perpetuities. It is not legal advice. Laws change, and every family’s situation is different. Consult with a California estate planning attorney about your specific circumstances.