Understanding California Intestate Succession and Inheritance: Who Gets What?

What happens to your belongings if you pass away without a will? In California, the answer lies in the legal framework known as intestate succession.

These laws determine exactly who inherits your property when you have not left instructions. Understanding California intestate succession laws is essential whether you are planning your own estate or navigating the inheritance process after losing a loved one.

Every year, thousands of California families face the confusion of settling an estate without a will. Questions arise immediately: Is my spouse next of kin? Who is first in line for inheritance? What happens to the house?

This guide answers those questions using plain language and current California law.

Key Takeaways

- California intestate succession laws (Probate Code Sections 6400 to 6414) govern inheritance when there is no valid will, with spouses and children typically receiving priority.

- All community property passes to the surviving spouse, while separate property is distributed according to a specific hierarchy of heirs.

- Next of kin in California follows a legal order: spouse, children, parents, siblings, grandparents, then extended family members.

- Adopted children have identical inheritance rights to biological children under California law, while stepchildren do not inherit unless legally adopted.

- Creating a will or trust allows you to override intestate succession and ensure your property goes exactly where you intend.

California’s Inheritance Laws: Who Inherits When There’s No Will?

Overview of Inheritance Laws in California

When someone dies without a valid will in California, state law governs the distribution of their property. This default distribution system ensures assets pass to surviving family members in a predictable order.

California’s inheritance laws recognize that most people would want their closest family members to inherit their property. The system is designed to approximate what the average person would choose if they had created a will. However, these laws may not match your specific wishes, which is why estate planning remains so essential for San Diego County residents and all Californians.

What is Intestate Succession under California Law?

Intestate succession is the legal process that determines who inherits property when someone dies without a valid will. The term “intestate” means dying without a will.

California Probate Code Sections 6400 through 6414 govern intestate succession. These laws establish a hierarchy of heirs, with the closest family members taking precedence. If someone in one category exists, more distant relatives generally do not inherit.

Here is what you need to understand: intestate succession only applies to assets that would typically pass through probate. Retirement accounts with named beneficiaries, life insurance policies, joint tenancy property, and assets held in trust all pass according to their own terms, regardless of intestate succession laws.

Importance of Knowing California’s Inheritance Laws

Understanding how California distributes property without a will matters for several reasons. First, it helps you assess whether the default distribution aligns with your preferences. Many people assume everything automatically goes to their spouse, but that is not always the case with separate property.

Second, if you expect to inherit from someone who died without a will, understanding the rules helps you understand your rights. You will know whether you qualify as an heir and roughly what share you might receive. This knowledge can help prevent family conflicts and inform decisions during a difficult time.

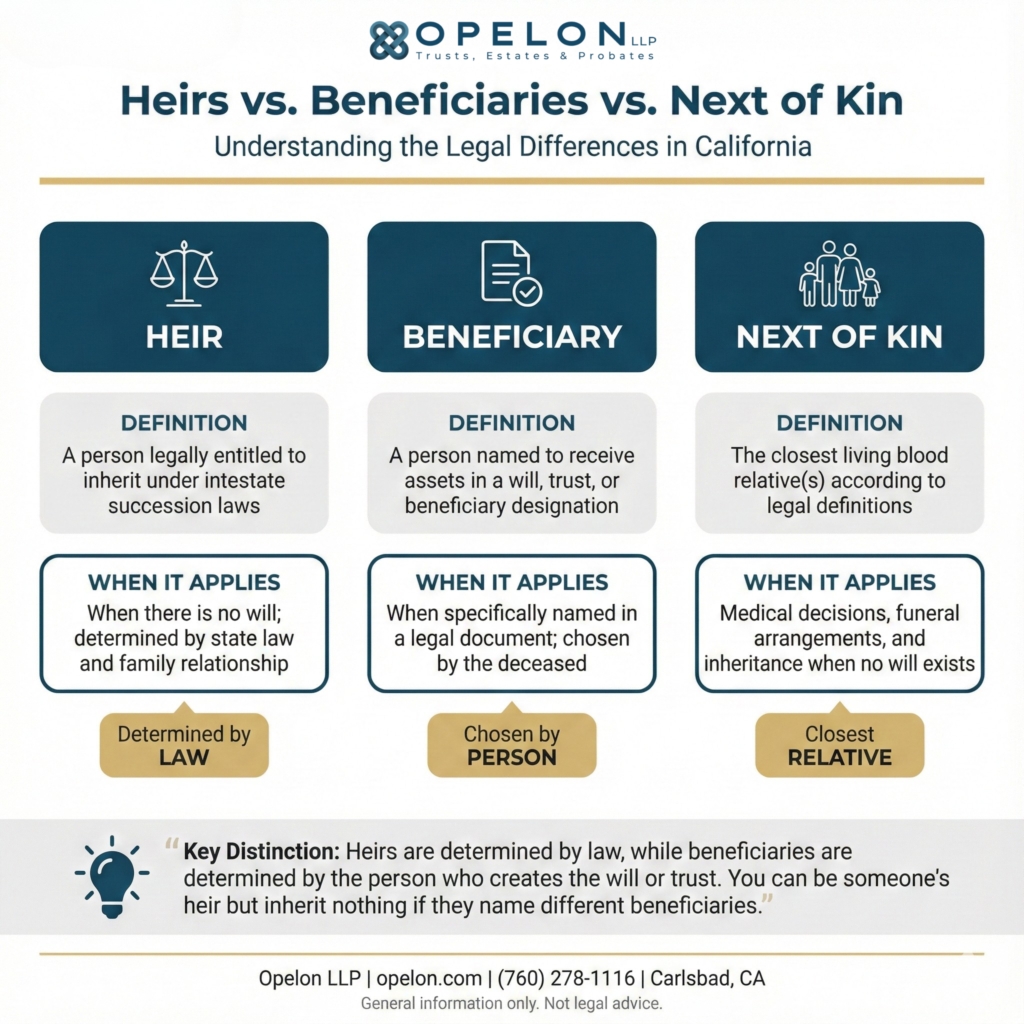

Heirs vs. Beneficiaries vs. Next of Kin

These three terms are often used interchangeably in everyday conversation, but they have distinct legal meanings in California probate law.

Understanding the differences helps you navigate estate matters more effectively.

Term | Definition | When It Applies |

Heir | A person legally entitled to inherit under intestate succession laws | When there is no will; determined by state law and family relationship |

Beneficiary | A person named to receive assets in a will, trust, or beneficiary designation | When specifically named in a legal document, chosen by the deceased |

Next of Kin | The closest living blood relative(s) according to legal definitions | Medical decisions, funeral arrangements, and inheritance when no will exists |

A key distinction: heirs are determined by law, while beneficiaries are determined by the person who creates the will or trust. You might be someone’s heir under intestate succession, but not inherit anything if they have a will naming different beneficiaries.

Understanding Next of Kin Under California Law

Next of Kin Definition

Next of kin refers to a person’s closest living relative or relatives. While this seems straightforward, the legal definition of next of kin varies depending on the context and purpose.

In everyday conversation, most people consider their spouse and children to be their next of kin. However, the legal meaning can differ. For inheritance purposes in California, next of kin follows the order established in the Probate Code. For medical decision-making purposes, different statutes apply.

Next of Kin Legal Definition

Under California law, the legal definition of next of kin establishes a specific hierarchy of relatives who have rights regarding a deceased person’s estate, medical decisions, and funeral arrangements.

For probate and inheritance purposes, California considers next of kin in this order: surviving spouse or registered domestic partner; children and their descendants; parents; siblings and their descendants; grandparents; aunts and uncles and their descendants; and more distant relatives. If no relatives are found after a thorough search, the property escheats (transfers) to the State of California.

Different Roles of Next of Kin

Being designated as next of kin confers several rights and responsibilities in California. These roles extend beyond inheritance to include essential decisions during and after a person’s final days.

Registering the Death

When someone passes away, the next of kin typically works with the funeral home or hospital to register the death and obtain death certificates. California requires official death registration within a specific timeframe. The next of kin provides information for the death certificate and authorizes the release of the body.

Funeral Arrangements

Under California Health and Safety Code Section 7100, specific individuals have the right to control the disposition of remains in a defined order. The surviving spouse comes first, followed by adult children, parents, siblings, and then other relatives. This person makes decisions about burial versus cremation, funeral services, and final resting place.

Medical Decisions

Before death, if someone cannot make their own medical decisions and has not designated a healthcare agent through an advance directive, California law establishes a hierarchy for surrogate decision makers. The spouse or domestic partner typically has priority, followed by adult children, parents, and siblings. This is why having a healthcare power of attorney is so vital for Carlsbad residents and anyone in San Diego County.

The Hierarchy of Heirs in California

What is the Order of Next of Kin?

The California Probate Code establishes a clear order of priority for inheritance when there is no will. This order of next of kin determines both who receives property and in what proportions.

Who is First in Line for Inheritance?

A surviving spouse or registered domestic partner is first in line for inheritance in California. They automatically receive all community property. For separate property, their share depends on whether the deceased had children or other close relatives.

If there is no surviving spouse, children are next in line. If there are no children, the property goes to parents, then to siblings, then to grandparents, and so on down the family tree. California law is designed to keep property within the family whenever possible.

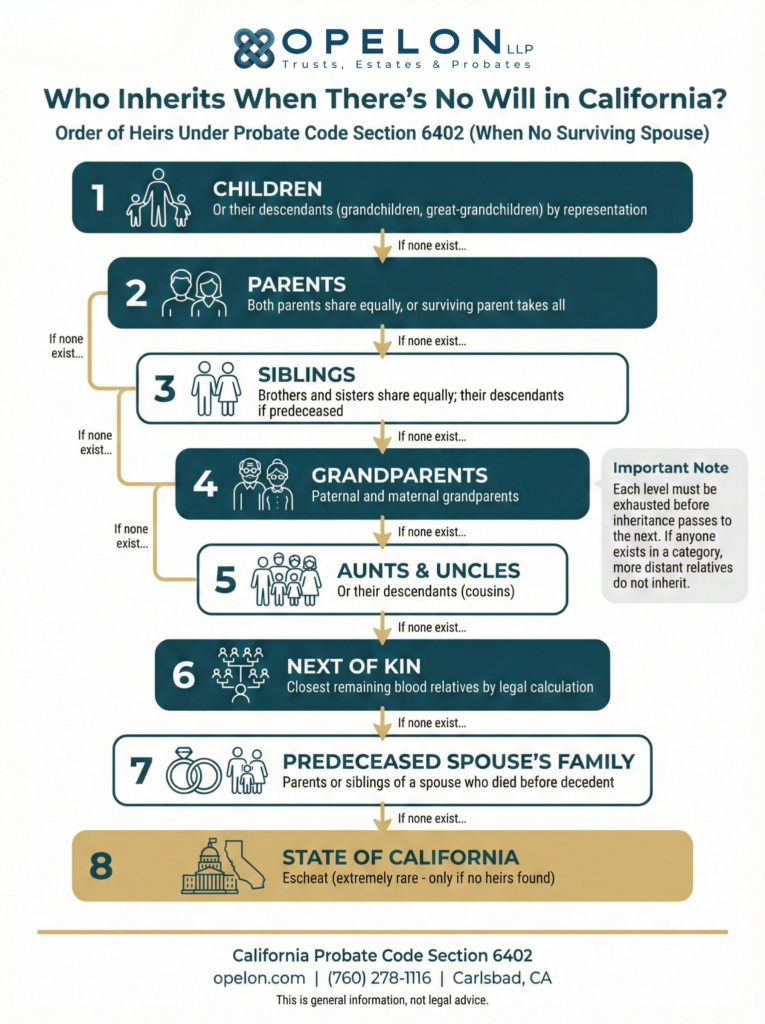

Order of Heirs in Intestate Succession in California

Under California Probate Code Section 6402, when there is no surviving spouse, property passes in the following order.

Each category must be empty before moving to the next level.

- Children or their descendants (grandchildren, great-grandchildren): They inherit equally, with descendants of a deceased child taking that child’s share by representation.

- Parents: If the deceased had no children, the parents inherit equally; otherwise, the surviving parent inherits all.

- Siblings or their descendants (nieces and nephews): Brothers and sisters share equally, with descendants of deceased siblings inheriting their parents’ share.

- Grandparents: If no closer relatives exist, grandparents on both sides inherit.

- Aunts, uncles, or their descendants (cousins): The Extended family inherits if no closer relatives survive.

- Next of kin: The closest remaining blood relatives according to legal calculations.

- Parents or siblings of a predeceased spouse: In rare cases, property may pass to the family of a spouse who died before the decedent.

- State of California (escheat): Only if no heirs can be found after diligent search does property go to the state. This outcome is extremely rare.

Legal Framework: California Intestate Laws

California Probate Code 6400

California Probate Code Section 6400 establishes the foundation for intestate succession. It states that any part of a decedent’s estate not effectively disposed of by will passes to the decedent’s heirs as prescribed in the Probate Code.

This section is the starting point for understanding intestate succession in California. It confirms that state law, not the wishes of relatives or friends, determines inheritance when there is no valid will. The subsequent sections (6401 through 6414) spell out precisely who qualifies as an heir and what share they receive.

Intestate Succession Definition

Intestate succession is the legal system that automatically transfers a deceased person’s property to their surviving relatives when they die without a valid will. The term “intestate” means without a testament (will).

California’s intestate succession laws operate as a default estate plan. The legislature designed these rules to reflect what most people would want: property passing to close family members in reasonable proportions. However, the law cannot account for individual family dynamics, special needs, or specific wishes.

Understanding California Intestate Succession Laws

California intestate succession law treats community property and separate property differently. This distinction is crucial for understanding who gets what.

Community Property Distribution (Probate Code Section 6401)

Situation | Who Inherits |

Married with surviving spouse (regardless of children) | 100% to the surviving spouse |

Separate Property Distribution (Probate Code Sections 6401 and 6402)

Situation | Spouse Gets | Others Get |

Spouse + 1 child (or descendants of 1 child) | 1/2 | 1/2 to child or descendants |

Spouse + 2 or more children (or their descendants) | 1/3 | 2/3 divided among children |

Spouse + parents (no children) | 1/2 | 1/2 to parents |

Spouse + siblings (no children or parents) | 1/2 | 1/2 to siblings |

Spouse only (no children, parents, or siblings) | 100% | N/A |

Determining Next of Kin in California

How Do You Determine Next of Kin in California?

Determining next of kin involves identifying the closest living relatives according to the legal hierarchy. Courts and probate attorneys trace family relationships starting with the most immediate family and working outward.

The process begins by asking whether there is a surviving spouse or registered domestic partner. If yes, they are the primary next of kin. If not, investigators look for children and then move through the hierarchy. In complex cases involving distant relatives, genealogical research may be necessary to identify and locate all potential heirs.

Is Your Spouse Considered Next of Kin?

Yes, your spouse is considered next of kin in California. A legal spouse (and a registered domestic partner) has priority over all blood relatives for inheritance purposes, medical decisions, and funeral arrangements.

This might surprise people who assume “next of kin” only refers to blood relatives. Under California law, marriage creates a legal relationship that takes precedence over blood relationships in most contexts. Your spouse will receive all of your community property and at least a portion of your separate property under intestate succession.

Which Sibling is Recognized as Next of Kin?

When siblings are the next of kin, all siblings inherit equally regardless of age, gender, or birth order. California law does not give the oldest sibling any special priority or larger share.

Half-siblings (sharing one parent) are treated the same as full siblings for inheritance purposes under California law. If one sibling has predeceased the person who died intestate, that sibling’s children (the deceased’s nieces and nephews) inherit their parent’s share. This principle is called “per stirpes” distribution, meaning inheritance passes down through family lines.

3 Common Scenarios and Outcomes for Who Inherits

Understanding how California intestate succession works becomes clearer with practical examples. Here are common scenarios that San Diego County families encounter.

Case Example: Surviving Spouse

Scenario: Maria and Robert were married for 20 years. They owned a home worth $900,000 (purchased during the marriage), and Robert had a retirement account worth $200,000 from before the marriage. Robert dies without a will. They have no children.

Outcome: Maria receives 100% of the home because it is community property. The $200,000 retirement account is Robert’s separate property. Since they have no children, parents, or siblings, Maria also receives 100% of the separate property. If Robert had living parents, Maria would only receive half of the separate property.

Case Example: Children and Grandchildren

Scenario: William dies without a will. His wife predeceased him. He had three children: Anna, Ben, and Carol. Carol died two years ago, leaving two children of her own (William’s grandchildren).

Outcome: William’s estate is divided into three equal shares. Anna receives one-third, Ben receives one-third, and Carol’s share (one-third) passes to her two children (William’s grandchildren), who split it equally. Each grandchild gets one-sixth of the total estate.

Case Example: Collateral Heirs

Scenario: Dorothy dies without a will. She never married and had no children. Her parents are deceased. She has two surviving siblings and several nieces and nephews.

Outcome: Her two surviving siblings each inherit half of her estate. The nieces and nephews do not inherit because their parents (Dorothy’s siblings) are still alive. If one sibling had predeceased Dorothy, that sibling’s children would inherit their parent’s half.

Probate is the legal process after someone dies, while estate planning prepares for that event. A Carlsbad probate lawyer often works alongside estate planning attorneys to manage both areas.

Frequently Asked Questions About California Intestate Succession

What happens if your next of kin is a minor?

When a minor child inherits property through intestate succession, they cannot directly receive or manage significant assets. The court will appoint a guardian of the estate to manage the property until the child reaches 18. Alternatively, assets may be placed in a blocked account or custodial account under the California Uniform Transfers to Minors Act. This is one reason having a will with a children’s trust is so important.

Is a stepchild considered next of kin?

No, stepchildren are not considered next of kin under California intestate succession laws unless they have been legally adopted. Without formal adoption, stepchildren have no automatic inheritance rights from a stepparent who dies without a will. If you want your stepchildren to inherit, you must explicitly include them in a will or trust.

How long after someone dies can inheritance be claimed?

There is no specific deadline to claim inheritance, but practical limitations apply. Probate in California must typically be started within four years of death. Creditors generally have four months from the issuance of letters to file claims. Potential heirs should come forward promptly because delays can complicate the process and distribution of assets.

Will the spouse be the next of kin?

Yes, a legal spouse is considered next of kin in California and has priority for inheritance, medical decisions, and funeral arrangements. Registered domestic partners have the same rights as spouses. Former spouses (divorced) are not considered next of kin.

Can a spouse override a beneficiary?

Generally, no. Beneficiary designations on retirement accounts, life insurance policies, and similar assets typically override both wills and intestate succession. If your spouse is named as beneficiary, they receive the asset regardless of what a will says. However, ERISA-governed retirement plans require spousal consent to name a non-spouse beneficiary.

Can a friend or unmarried partner be your next of kin?

Under California intestate succession law, friends and unmarried partners are not considered next of kin and do not inherit automatically. Only legal relatives (including registered domestic partners) qualify. If you want a friend or unmarried partner to inherit, you must name them in a will or trust.

What does next of kin mean for adopted children vs. blood relatives?

Under California law, adopted children have identical inheritance rights to biological children. Once adoption is finalized, the adopted child is treated exactly the same as a biological child for all legal purposes, including intestate succession. The adopted child can inherit from adoptive parents but generally no longer inherits from biological parents.

Who is your next of kin if you are not married?

If you are unmarried, your next of kin for inheritance purposes are your children. If you have no children, next of kin are your parents, then siblings, then grandparents, then aunts and uncles, and so on. The law works outward through family relationships until someone is found.

Does the next of kin override a will?

No, a valid will takes precedence over next of kin rights under intestate succession. If someone has a will, the beneficiaries named in that will inherit the property, not the next of kin (unless they happen to be the same people). Next of kin only controls inheritance when there is no valid will.

What happens if you have no next of kin?

If no heirs can be found after a thorough search, property escheats to the State of California. This is extremely rare because the law extends to very distant relatives. Courts require extensive genealogical searches before declaring that no heirs exist. Even very remote cousins can inherit under California law.

Can you refuse to be next of kin?

You cannot refuse to be next of kin, but you can refuse to accept an inheritance (called a disclaimer). If you disclaim your inheritance within nine months of the death, your share passes as if you predeceased the decedent. People sometimes disclaim inheritances for tax planning or to allow property to pass to the next generation.

Does the oldest child inherit everything?

No, California does not follow primogeniture (inheritance by the eldest child). All children inherit equally regardless of age, gender, or birth order. If there are three children, each receives one-third. This equal distribution applies to all children, including those from different relationships.

Does the next of kin inherit debt?

Heirs do not personally inherit debt in California. However, the deceased person’s debts must be paid from the estate before heirs receive their inheritance. If debts exceed assets, heirs receive nothing but are not responsible for unpaid debts (with limited exceptions for certain community debts for surviving spouses).

Which sibling is next of kin?

All siblings are equally next of kin in California. There is no preference for older siblings, same-gender siblings, or full siblings versus half-siblings. All brothers and sisters share equally when they are the heirs under intestate succession.

Protecting Your Family Through Estate Planning

California intestate succession laws provide a default distribution plan that works for many families. However, relying on these laws means giving up control over who inherits your property and in what manner. The rules cannot account for your unique family relationships, special circumstances, or specific wishes.

Creating a will or trust allows you to make your own decisions about inheritance rather than leaving it to state law. You can provide for stepchildren, friends, or charities. You can create trusts to protect minor children or beneficiaries with special needs. You can minimize family conflict by clearly expressing your intentions.

If you have questions about how California intestate succession might affect your family, or if you are ready to create an estate plan that reflects your specific wishes, consider consulting with an experienced California estate planning attorney.

Take Control of Your Estate Plan

Every California family deserves an estate plan that reflects their unique circumstances. At Opelon LLP in Carlsbad, we help San Diego County residents create comprehensive estate plans that protect their families and provide peace of mind.

Contact us at (760) 278-1116 or visit opelon.com to schedule a consultation.

Legal Disclaimer

This article provides general information about California intestate succession and inheritance laws and is not legal advice. Laws change, and every family’s situation is different. Consult with a California estate planning attorney about your specific circumstances. The information in this article is current as of December 2025.

Opelon LLP | 1901 Camino Vida Roble STE 112, Carlsbad, CA 92008 | (760) 278-1116