Flat-Fee Estate Planning Pricing in San Diego

How much does it cost to hire a San Diego Estate Planning attorney?

(Clear, Upfront, No Surprises)

San Diego Flat Fee Estate Planning

How much does estate planning cost?

Individualized consultations, comprehensive, flat fee estate plans made easy

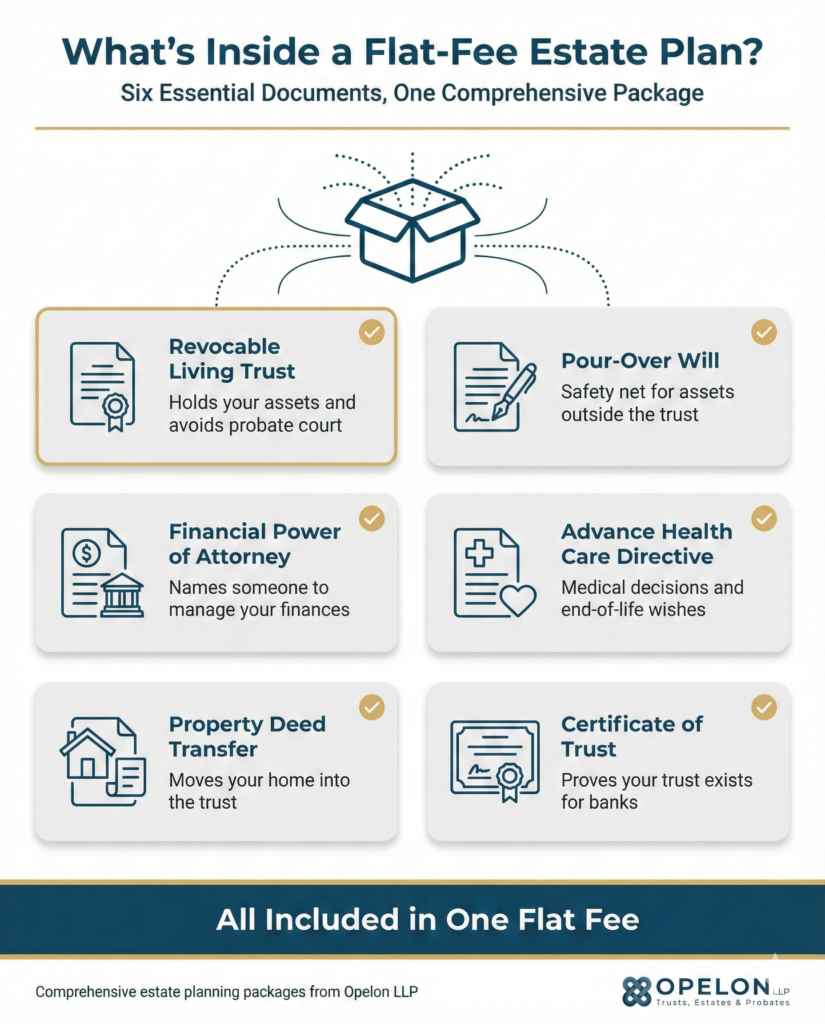

- Single Revocable Living Trust

- Last Will and Testament

- Power of Attorney for Finance

- Advance Health Care Directive

- HIPAA Authorization

- Certification of Trust

- Assignment of Personal Property to Trust

- Personal Property Memorandum

- Grant Deed to transfer primary residence

- Joint Revocable Living Trust

- Last Will and Testament for each spouse

- Powers of Attorney for Finances

- Advance Health Care Directives

- HIPAA Authorizations

- Certification of Trust

- Assignment of Personal Property to Trust

- Personal Property Memorandum

- Grant Deed to transfer primary residence

Custom Provisions

Our flat-fee packages cover everything most individuals and families need. For clients with more complex estates, we offer additional services at transparent, flat-fee pricing:

- Transfer of additional real properties into your trust (beyond primary residence)

- Special needs trust provisions

- Business or professional practice planning provisions

Not sure what you need?

We’ll walk you through everything during your consultation – no surprises.

Wondering how much estate planning actually costs? You are not alone. One of the biggest frustrations families face when searching for an estate planning attorney is the mystery surrounding legal fees. Some firms charge by the hour. Others quote vague ranges. Many will not discuss pricing until you are already sitting in their office.

At Opelon LLP, we believe San Diego County families deserve better. That is why we offer flat-fee estate planning with transparent pricing from your very first conversation. No surprises. No hidden charges. No billable hour anxiety. Just straightforward costs for comprehensive estate planning services from our Carlsbad office.

This guide explains exactly what flat rate estate planning includes, how our pricing compares to other options in California, and how to evaluate whether an estate plan represents good value for your family.

Summary of Key Takeaways for Cost of Estate Planning

- Flat-fee estate planning in San Diego typically ranges from $2,000 to $5,000 for comprehensive living trust packages, depending on complexity.

- Transparent pricing eliminates the anxiety of hourly billing and allows you to ask unlimited questions without watching the clock.

- A complete estate plan includes more than just a trust document, so always confirm what is included before comparing prices.

- Opelon LLP offers free consultations so you can understand your options and receive a clear price quote before making any commitment.

What Is Flat-Fee Estate Planning?

Flat-fee estate planning is a pricing model where you pay a single, agreed-upon amount for your complete estate plan rather than being billed by the hour. This approach has become increasingly popular among California estate planning attorneys because it aligns the interests of attorney and client.

With hourly billing, every phone call, email, and question adds to your bill. This creates an uncomfortable dynamic where you might hesitate to ask important questions or request clarification. With flat-fee pricing, you know exactly what you will pay from the start, and you can take all the time you need to understand your estate plan fully.

Most San Diego estate planning firms that offer flat fees structure their services into packages based on complexity. A simple will-based plan costs less than a comprehensive living trust package, which costs less than advanced planning for blended families or high-net-worth estates.

So...How much is estate Planning in San Diego ?

We are not only about the money

Our goal at Opelon LLP is to make Estate Planning financially accessible to everyone.

That is why we came up with two different levels of service.

A traditional, in-office model and a modern, more efficient virtual model.

Additional Services Often Included When Comparing California Estate Planning Fees

Beyond the documents themselves, many flat-fee packages include valuable services that add significant value.

- Initial consultation and estate planning analysis

- Document drafting and revisions

- Signing ceremony with notarization

- Trust funding guidance and assistance

- Recording of the property deed with San Diego County

- Organized binder with all original documents

Why Flat-Fee Pricing Benefits San Diego Families

Transparent flat-fee pricing offers several advantages over traditional hourly billing for estate planning services.

Budget Certainty

You know exactly what your estate plan will cost before you commit. This allows you to plan financially and eliminates the stress of watching a bill grow with every interaction.

Freedom to Ask Questions

When the clock is not running, you can take all the time you need to understand your estate plan. Ask questions. Request explanations. Discuss scenarios. Your fee remains the same.

Aligned Incentives

With flat-fee pricing, your attorney is motivated to work efficiently and get your plan completed properly the first time. There is no financial incentive to drag out the process or create unnecessary complexity.

Easier Comparison Shopping

When firms quote flat fees, you can compare apples to apples. You know exactly what each firm charges for similar services, making it easier to evaluate value.

How to Evaluate Whether an Estate Plan Is Good Value

The lowest price is not always the best value. When comparing estate planning options, consider these factors beyond the quoted fee.

Questions to Ask Before Hiring Any Estate Planning Attorney

- What documents are included? Get a complete list. Some firms advertise low prices but charge extra for essential documents like powers of attorney.

- Is trust funding assistance included? Transferring assets into your trust is critical. Some firms charge separately for funding help.

- What about deed preparation and recording? For California homeowners, transferring the deed to your home into the trust is essential. Confirm whether this is included.

- Are revisions included? Life changes. Find out what happens if you need to make changes during the planning process.

- Who will actually prepare my documents? Understand whether you will work directly with an attorney or primarily with paralegals.

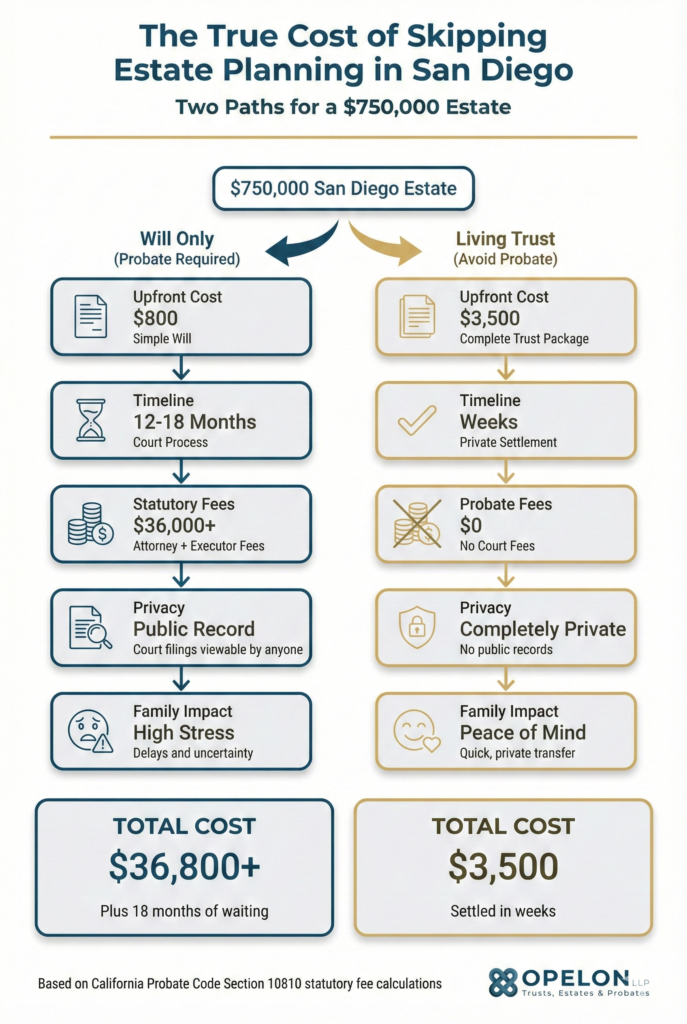

(Flat-Fee Estate Planning vs. Probate Costs: The Math

Many families hesitate at the upfront cost of estate planning without understanding what they are actually avoiding. California has some of the highest probate fees in the nation, and they are calculated on gross asset value, not equity.

Under California Probate Code Section 10810, statutory fees for both the attorney and executor are set by law based on the gross value of the probate estate.

| Estate Value | Combined Statutory Fees | Potential Savings with Trust |

| $500,000 | $26,000 | $21,000 – $23,000 |

| $750,000 | $36,000 | $31,000 – $33,000 |

| $1,000,000 | $46,000 | $41,000 – $43,000 |

| $1,500,000 | $56,000 | $51,000 – $53,000 |

Important: These fees are based on gross value. A home worth $1 million with a $600,000 mortgage still generates fees based on the full $1 million. This is why estate planning is particularly valuable for San Diego County homeowners, where median home values often exceed $900,000.

How Opelon LLP Approaches Flat-Fee Estate Planning

At our Carlsbad office, we designed our flat-fee pricing structure with one goal: making estate planning financially accessible while providing comprehensive legal protection for San Diego County families.

Our Pricing Philosophy

- Clear quotes upfront: You receive a specific price during your free consultation, not a vague range.

- No hidden fees: The price quoted is the price you pay. If additional work is needed beyond the original scope, we discuss it with you first.

- Comprehensive packages: Our estate plans include all essential documents, not stripped-down versions that require costly add-ons.

- Direct attorney access: You work directly with an experienced estate planning attorney, not primarily with support staff.

San Diego Probate Fees

In California Probate Fees are Set By The Court As Follows

Protection Through Planning

What is the average cost of estate planning in San Diego?

Estate planning in San Diego typically costs between $1,500 and $7,000, depending on the complexity of your estate and the services needed.

What factors influence the cost of estate planning in San Diego?

The cost is influenced by factors such as the size and complexity of your estate, the type of estate planning documents required (wills, trusts, etc.), and whether you need ongoing legal services.

What are the basic components of an estate plan?

A basic estate plan includes a will, a living trust, durable power of attorney, and healthcare directives. Costs vary depending on which documents are included in your plan.

Do I need a lawyer for estate planning in San Diego?

While it’s possible to create an estate plan without an attorney, working with a lawyer ensures that your documents are legally sound and tailored to your specific needs, which could affect the cost.

What is the cost of creating a living trust in San Diego?

Creating a living trust can cost anywhere from $1,000 to $3,500, depending on the complexity and the attorney’s fees. Keep in mind that a revocable living trust is only one component to an effective estate plan.

Are there any hidden costs in estate planning?

There are no hidden fees after our attorneys have quoted you the flat rate in your consultation. Additional costs that may arise, and will be quoted ahead of any work performed, are additional deed recordings, advanced estate planning, and advanced funding assistance, among others.

Can I get an estimate for my estate planning needs in San Diego?

Yes, at Opelon LLP we offer free consultations or can provide an estimate based on your specific needs and the complexity of your estate.

Does the cost of estate planning include probate avoidance strategies?

Many estate plans include strategies to avoid probate, such as setting up a living trust. While this adds to upfront costs, it can save significant time and money for your heirs later.

Are there tax planning costs included in estate planning?

Estate planning for high-net-worth individuals often involves tax planning to minimize estate, gift, and inheritance taxes. These services typically increase the overall cost of your estate plan and will be quoted in your consultation.

Is estate planning more expensive for families with minor children?

At Opelon, Estate planning for families with minor children does not increase the cost of your estate plan. Our family estate planning packing includes creating guardianship designations and establishing trusts to manage assets for the children’s future.

Can I get a free estate planning consultation in San Diego?

Yes. Many San Diego estate planning attorneys, including Opelon LLP, offer free initial consultations. During this meeting, you can discuss your situation, learn about your options, and receive a clear price quote with no obligation. This allows you to make an informed decision about whether to proceed.

What should I bring to an estate planning consultation?

Bring a general understanding of your assets, including real estate, retirement accounts, and life insurance. Also consider who you want to name as beneficiaries, trustees, guardians for minor children, and agents for your powers of attorney. You do not need exact account balances, but a general picture helps the attorney recommend the right plan.

Why is estate planning cheaper online than with an attorney?

Online services use automated forms rather than personalized legal advice. They cannot identify issues specific to your situation, ensure your documents comply with California law, or help you properly fund your trust. An unfunded trust does not avoid probate. The low upfront cost of online documents often leads to expensive problems later.

What is the difference between flat-fee and hourly billing for estate planning?

Flat-fee billing means you pay one agreed-upon price for your complete estate plan regardless of how many hours the attorney works. Hourly billing charges you for every minute of attorney time, which can result in unpredictable total costs. Flat fees provide budget certainty and encourage thorough communication without financial anxiety.

Is flat-fee estate planning worth the cost?

For most California homeowners, flat-fee estate planning provides substantial value. The upfront investment of $3,000 to $5,000 can save your family $30,000 to $50,000 or more in probate fees, plus 12 to 18 months of court delays. The peace of mind and protection for your family typically far outweigh the initial cost.

Get Your Free Estate Planning Consultation

Understanding your estate planning options should not cost you anything. At Opelon LLP, we offer complimentary consultations where you can discuss your situation, learn about your options, and receive a clear, flat-fee price quote with absolutely no obligation.

Our Carlsbad office serves families throughout San Diego County, including Oceanside, Encinitas, San Marcos, Escondido, Vista, Del Mar, La Jolla, and Poway. We also offer convenient virtual consultations for busy families.

Schedule your free consultation today by calling (760) 278-1116 or completing our online contact form. Let us show you how transparent, flat-fee estate planning can protect your family without the stress of unpredictable legal bills.

Disclaimer

This page provides general information about estate planning costs and is not legal advice. Every family’s situation is unique, and the information provided here may not apply to your specific circumstances. The cost ranges mentioned are typical for the San Diego County area as of the publication date and may vary based on individual needs and market conditions. For personalized guidance regarding your estate plan, please schedule a consultation with a qualified California estate planning attorney.

About the Author:

Matt Odgers is a Partner and Co-Founder of Opelon LLP, a probate and estate planning law firm in Carlsbad, California. He earned his B.A. in Political Science from Purdue University and his J.D. from Thomas Jefferson School of Law. opelon Matt has been recognized as one of the Carlsbad Chamber of Commerce’s “40 Under 40” and named to Best Lawyers: Ones to Watch in America