Key Takeaways for the 2026 Federal Estate Tax Exemption

- The 2026 federal estate tax exemption is $15 million per individual ($30 million for married couples), made permanent by the One Big Beautiful Bill Act signed July 4, 2025.

- California does not have a state estate tax or inheritance tax, so only federal estate tax applies to California residents.

- The annual gift tax exclusion remains at $19,000 per recipient in 2026 ($38,000 for married couples using gift splitting).

- Most California families will not owe federal estate tax, but probate avoidance through a living trust remains essential for homeowners.

- High-net-worth families with estates exceeding the exemption face a 40% federal estate tax rate and should consult with an estate planning attorney.

If you have been following the news about estate taxes, you may have heard about major changes taking effect in 2026.

Here is what California families need to know about the new federal estate tax exemption and how it affects your planning.

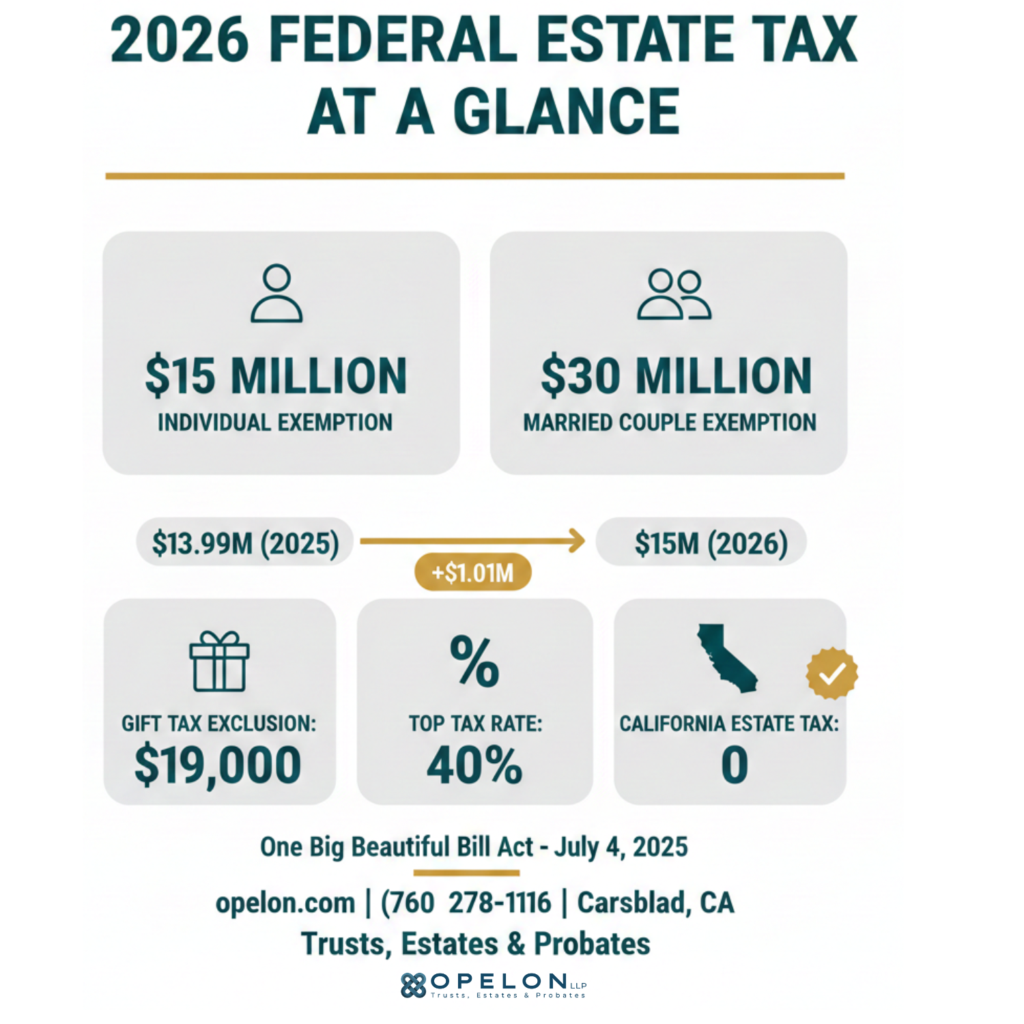

The federal estate tax exemption determines how much you can pass to your heirs without owing federal estate tax. For 2026, this exemption has increased to $15 million per individual, or $30 million for married couples. This represents a significant increase from the 2025 exemption of $13.99 million per individual.

For most San Diego County families, this means the federal estate tax will not be a concern. However, estate planning remains critical for California homeowners who want to help their families avoid the time and expense of probate.

What Is the Federal Estate Tax Exemption in 2026?

The federal estate tax exemption for 2026 is $15 million for an individual or $30 million for a married couple. Estates valued below this threshold do not owe federal estate tax. Estates exceeding this amount are taxed at rates up to 40% on the portion above the exemption.

This exemption was made permanent by the One Big Beautiful Bill Act (also known as OBBBA), which President Trump signed into law on July 4, 2025. Before this legislation, the exemption was scheduled to drop to approximately $7 million per person in 2026 under the sunset provisions of the 2017 Tax Cuts and Jobs Act.

2026 Federal Estate and Gift Tax Summary

Category | 2026 Amount |

Federal Estate Tax Exemption (Individual) | $15,000,000 |

Federal Estate Tax Exemption (Married Couple) | $30,000,000 |

Annual Gift Tax Exclusion (Per Recipient) | $19,000 |

Married Couple Gift (Combined) | $38,000 |

Federal Estate Tax Rate (Above Exemption) | Up to 40% |

California Estate Tax | None |

How Does the Federal Estate Tax Exemption Work?

The federal estate tax applies only when the total value of an estate exceeds the exemption amount. If your estate is valued at less than $15 million as an individual (or $30 million as a married couple), your heirs will not owe federal estate tax.

Your estate value is determined by the fair market value of your assets at the time of death. This includes real estate, bank accounts, investment accounts, retirement accounts, life insurance proceeds (if you own the policy), business interests, and personal property.

Certain deductions can reduce your taxable estate, including debts, funeral expenses, charitable gifts, and amounts passing to a surviving spouse (under the unlimited marital deduction for U.S. citizen spouses).

Example: How Federal Estate Tax Is Calculated

Consider a single individual who passes away in 2026 with a total estate valued at $18 million. The federal estate tax calculation would work as follows:

Calculation Step | Amount |

Total Estate Value (Gross Estate) | $18,000,000 |

Less: 2026 Federal Exemption | ($15,000,000) |

Taxable Estate | $3,000,000 |

Federal Estate Tax (at 40%) | $1,200,000 |

In this example, the estate would owe approximately $1.2 million in federal estate tax on the $3 million exceeding the exemption. This illustrates why high-net-worth individuals benefit from advanced estate planning strategies to reduce their taxable estate.

What Is the Gift Tax and How Does It Work?

Gift taxes are federal taxes on transfers of money or property to another person when you receive nothing (or less than fair market value) in return. However, several exclusions protect most gifts from taxation.

Annual Gift Tax Exclusion (2026)

The annual gift tax exclusion for 2026 is $19,000 per recipient. This means you can give up to $19,000 to any number of people during the year without filing a gift tax return or using any of your lifetime exemption. Married couples can combine their exclusions to give up to $38,000 per recipient using a strategy called gift splitting.

For example, if you have three adult children, you and your spouse could give each child $38,000 in 2026 (for a total of $114,000) without any gift tax consequences. These annual exclusion gifts do not reduce your lifetime estate tax exemption.

Lifetime Gift Tax Exemption

The lifetime gift tax exemption is unified with the estate tax exemption. In 2026, this combined exemption is $15 million per individual. Gifts exceeding the annual exclusion amount reduce your lifetime exemption on a dollar-for-dollar basis.

For instance, if you give your daughter $519,000 in 2026, the first $19,000 is covered by the annual exclusion. The remaining $500,000 reduces your lifetime exemption from $15 million to $14.5 million. You would need to file IRS Form 709 (Gift Tax Return) to report this gift, though no tax would be due.

Gifts That Are Not Subject to Gift Tax

Certain transfers are not considered taxable gifts regardless of amount:

- Tuition payments made directly to educational institutions (not to the student)

- Medical expenses paid directly to healthcare providers or insurers

- Gifts to a U.S. citizen spouse (unlimited marital deduction)

- Gifts to qualified charities

- Gifts to political organizations

What Is Portability and How Does It Work?

Portability allows a surviving spouse to use any unused portion of their deceased spouse’s federal estate tax exemption. This effectively allows married couples to combine their exemptions, protecting up to $30 million from federal estate tax in 2026.

To claim portability, the executor of the deceased spouse’s estate must file a federal estate tax return (IRS Form 706) within the deadline, even if no estate tax is owed. The surviving spouse can then apply the transferred exemption amount to offset future gift or estate tax liability.

The deadline for making a late portability election is five years from the date of the first spouse’s death. Making this election is strongly recommended for married couples, especially if the surviving spouse’s estate could exceed the exemption amount in the future.

Does California Have an Estate Tax or Inheritance Tax?

California does not have a state estate tax or inheritance tax. The California estate tax was repealed in 1982, and California has never imposed an inheritance tax. This means California residents are only subject to federal estate tax if their estate exceeds the federal exemption amount.

This is good news for San Diego County families. Unlike residents of states such as Massachusetts (with a $2 million exemption) or New York (with a $7.16 million exemption), Californians do not face an additional layer of state death taxes.

However, California residents who own property in other states should be aware that those states may impose their own estate or inheritance taxes on property located within their borders.

Why Estate Planning Still Matters for California Families

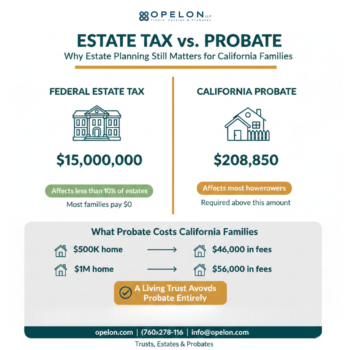

With such a high federal estate tax exemption, you might wonder whether estate planning is still necessary. The answer is yes, especially for California homeowners. While estate tax may not be a concern for most families, probate is a very real issue for anyone who owns real property in California.

California Probate Affects Most Homeowners

California requires full probate administration for estates with assets exceeding $208,850 (effective April 1, 2025). Since the median home price in San Diego County well exceeds this threshold, most homeowners’ estates will require probate without proper planning.

California probate typically takes 12 to 18 months for straightforward estates and can take two years or longer for complex situations. During this time, your family cannot sell or refinance the home, and assets are tied up in court proceedings.

Probate Costs Are Significant

California has statutory probate fees based on the gross value of the estate (not equity). Both the attorney and the executor are entitled to these fees under California Probate Code Section 10810:

Gross Estate Value | Total Statutory Fees |

$500,000 | $26,000 |

$750,000 | $36,000 |

$1,000,000 | $46,000 |

$1,500,000 | $56,000 |

$2,000,000 | $66,000 |

These fees are based on the gross value of the estate before deducting mortgages or other debts. A home worth $1.2 million with a $600,000 mortgage still results in probate fees calculated on the full $1.2 million value.

A Living Trust Avoids Probate

A properly funded revocable living trust allows your assets to pass directly to your beneficiaries without court involvement. The trust administration process is private, typically takes weeks instead of months, and avoids statutory probate fees. For most California homeowners, the cost of establishing a living trust is a fraction of potential probate fees.

Estate Tax Planning for Business Owners

If you own a business or professional practice, the value of your business is included in your estate for federal estate tax purposes. For successful business owners, this can push the total estate value above the $15 million exemption.

Proper planning can help reduce the taxable value of your estate through strategies such as family limited partnerships, intentionally defective grantor trusts, or structured gifting programs. Business succession planning can also ensure a smooth transition while minimizing tax liability.

If your estate may exceed the federal exemption amount, consulting with an experienced estate planning attorney is essential. The cost of proper planning is minimal compared to a potential 40% estate tax on assets above the exemption.

Frequently Asked Questions about the 2026 federal estate tax exemption

The federal estate tax exemption for 2026 is $15 million per individual and $30 million for married couples. This exemption was made permanent by the One Big Beautiful Bill Act, signed into law on July 4, 2025. Estates below this threshold do not owe federal estate tax.

Yes. The exemption increased from $13.99 million per individual in 2025 to $15 million per individual in 2026. This increase was part of the One Big Beautiful Bill Act, which also made the higher exemption permanent rather than allowing it to sunset to approximately $7 million in 2026 as originally scheduled.

No. California does not have a state estate tax or inheritance tax. The California estate tax was repealed in 1982. California residents are only subject to federal estate tax if their estate exceeds the federal exemption amount of $15 million in 2026.

The annual gift tax exclusion for 2026 is $19,000 per recipient, unchanged from 2025. Married couples can combine their exclusions to give $38,000 per recipient through gift splitting. Gifts within this exclusion do not require filing a gift tax return and do not reduce your lifetime exemption.

Your estate may owe federal estate tax if your total assets exceed $15 million as an individual or $30 million as a married couple (using portability). Assets include real estate, investments, retirement accounts, life insurance proceeds, business interests, and personal property. Most California families fall well below this threshold.

Yes. Estate planning is not only about estate taxes. California homeowners need a living trust to avoid probate, which applies to estates over $208,850 regardless of estate tax exemption. A comprehensive estate plan also addresses incapacity planning, guardianship for minor children, and ensuring your wishes are carried out.

Portability allows a surviving spouse to inherit their deceased spouse’s unused estate tax exemption. To claim portability, the executor must file a federal estate tax return (Form 706) within the deadline, even if no tax is owed. This is recommended for most married couples to preserve maximum flexibility for the surviving spouse.

The $15 million exemption is now permanent under the One Big Beautiful Bill Act, though it will continue to be adjusted annually for inflation. Unlike the previous temporary increase under the 2017 Tax Cuts and Jobs Act, there is no scheduled sunset or reduction. However, future legislation could always modify estate tax rules.

How Opelon LLP Can Help

If you are concerned about estate taxes, probate costs, or simply want to ensure your family is protected, the estate planning attorneys at Opelon LLP can help you develop a comprehensive plan tailored to your situation.

Whether you need a basic living trust to avoid California probate or advanced planning strategies for a larger estate, we offer personalized guidance for San Diego County families and California residents throughout the state.

Schedule a consultation to discuss your estate planning needs:

- Call our Carlsbad office: (760) 278-1116

- Visit us online: opelon.com

- Office location: 1901 Camino Vida Roble STE 112, Carlsbad, CA 92008

Disclaimer

This article provides general information about federal estate and gift taxes and California estate planning law. It is for educational purposes only and does not constitute legal or tax advice. Tax laws are complex and change frequently. The information in this article was accurate as of December 2025. For advice about your specific situation, please consult with a qualified California estate planning attorney and tax professional.