If you have been appointed as the executor or administrator of an estate in San Diego County, one of your primary responsibilities is completing the inventory and appraisal. This required court filing provides an official accounting of the deceased person’s assets and their fair market values at the date of death.

Many families find this process confusing, particularly when working with a probate referee for the first time.

The good news is that understanding how the inventory and appraisal work can help you meet your legal obligations, avoid costly delays, and move the probate process forward efficiently.

This guide explains everything you need to know about the inventory and appraisal process under California law, including deadlines, costs, and practical tips for San Diego County families.

Key Takeaways

- The inventory and appraisal must be filed within four months of receiving Letters Testamentary or Letters of Administration under California Probate Code Section 8800.

- A court-appointed probate referee values most estate assets, and their fee is approximately 0.1% of the total appraised value.

- Personal representatives can value certain assets themselves, including cash, bank accounts, and publicly traded securities with readily ascertainable values.

- The inventory and appraisal directly affect statutory attorney and executor fees in California probate, which are calculated based on the gross estate value.

- Missing the four-month deadline can result in court intervention, potential removal as personal representative, or other complications in San Diego County probate proceedings.

What Is a Probate Inventory and Appraisal?

The inventory and appraisal is an official court document that lists all assets in a deceased person’s probate estate along with their fair market values as of the date of death.

This document, filed on Judicial Council Form DE-160, serves several critical purposes in California probate proceedings.

First, it creates a complete record of the estate’s assets. This includes real property, bank accounts, investments, vehicles, personal property, business interests, and any other assets that were in the decedent’s name alone at death.

Second, the inventory and appraisal establish the baseline for calculating statutory fees. Under California Probate Code Section 10810, both the attorney and the personal representative are entitled to fees based on the gross value of the estate as determined by this appraisal.

Third, it provides transparency for beneficiaries and creditors. Anyone with an interest in the estate can review the inventory to understand what assets exist and their approximate values.

California Note: Unlike some states where executors can hire any appraiser, California requires the use of a probate referee for most assets. This court-appointed official ensures consistent and impartial valuations across all probate cases.

When Must You File the Inventory and Appraisal?

California Probate Code Section 8800 requires the personal representative to file the inventory and appraisal within four months after receiving Letters Testamentary or Letters of Administration. This deadline runs from the date the court issues your authority to act, not from the date of death or the date you were appointed.

In San Diego County, Letters are typically issued on the same day the court signs the order approving your appointment. You should note this date carefully, as the four-month clock starts immediately.

If you discover additional assets after filing the initial inventory, you must file a supplemental inventory within the same four-month period from discovery. This ensures the court and interested parties have a complete picture of the estate throughout the administration.

What Happens if You Miss the Deadline?

Missing the four-month deadline can create significant problems. The court may require you to appear and explain the delay. Interested parties, including beneficiaries or creditors, may file petitions asking the court to compel you to file or to remove you as personal representative.

In our experience working with San Diego County families, most delays arise from personal representatives underestimating how long it takes to gather information on all assets or coordinate with the probate referee.

Starting the inventory process immediately after receiving Letters helps avoid these issues.

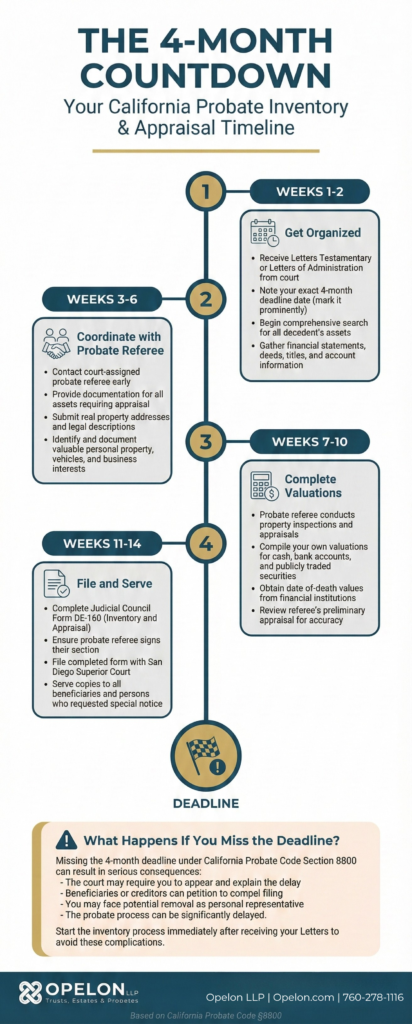

Inventory and Appraisal Infographic

The Role of the Probate Referee in California

A probate referee is a court-appointed official who appraises most assets in a California probate estate. Unlike a traditional real estate appraiser or business valuator, probate referees are appointed by the California State Controller’s Office under Probate Code Section 400 and serve specific counties.

When you open a probate case in San Diego County, the court will assign a probate referee to your case. You can also select a specific probate referee from the list of those appointed to serve San Diego County, though most personal representatives accept the court’s assignment.

What Does the Probate Referee Value?

The probate referee appraises most tangible and intangible property, including:

- Real property, such as homes, vacant land, and rental properties, in California

- Business interests, including closely held corporations, partnerships, and limited liability companies

- Valuable personal property such as artwork, antiques, jewelry, and collectibles

- Vehicles, boats, and recreational vehicles

- Non-publicly traded securities and promissory notes

- Intellectual property and royalty interests

For complex assets such as businesses or unusual real property, the probate referee may consult independent appraisers, but remains responsible for the final valuation submitted to the court.

Assets the Personal Representative Can Value

California law allows the personal representative to value certain assets directly, without involving the probate referee. These include:

- Cash on hand and in bank accounts

- Publicly traded stocks, bonds, and mutual funds with readily ascertainable values

- U.S. savings bonds

- Amounts due from insurance policies with fixed values

For publicly traded securities, you should obtain the closing price on the date of death or, if markets were closed, the average of the high and low prices from the trading days immediately before and after death.

How Much Does the Probate Referee Charge?

The probate referee’s fee is set by law at approximately 0.1% (one-tenth of one percent) of the total value of assets they appraise. This fee is paid from estate funds and is considered a reasonable cost of administration.

Here is what you might expect to pay based on typical estate values:

Value of Assets Appraised | Approximate Referee Fee | Notes |

$500,000 | $500 | Typical single-home estate |

$1,000,000 | $1,000 | Average San Diego estate |

$2,000,000 | $2,000 | Larger real property holdings |

Note: There is no separate court filing fee for the inventory and appraisal in San Diego County.

How to Complete the Inventory and Appraisal: Step by Step

Completing the inventory and appraisal involves several coordinated steps. Here is the process we recommend to San Diego County families:

- Gather Information About All Assets. Review the decedent’s financial records, tax returns, mail, and any estate planning documents to identify all assets. Check for bank statements, brokerage statements, deeds, vehicle titles, and business records.

- Determine Which Assets Require Probate. Not all assets go through probate. Assets in a trust, those with beneficiary designations, and jointly held property with survivorship rights typically pass outside probate and are not included in the inventory.

- Contact the Probate Referee. Provide the assigned probate referee with documentation for all assets requiring appraisal. For real property, this includes the property address and legal description. For personal property, provide detailed descriptions and, when available, supporting documentation.

- Prepare Your Portion of the Inventory. Compile values for assets you can appraise yourself, such as cash and publicly traded securities. Obtain date-of-death values from financial institutions or reliable financial databases.

- Receive the Referee’s Appraisal. The probate referee will complete their appraisal and return it to you. Review the values carefully and discuss any concerns with the referee before finalizing the document.

- Complete Form DE-160. Transfer all asset information onto the Judicial Council Inventory and Appraisal form and separate assets into those appraised by the referee and those appraised by the personal representative.

- File with the Court. Submit the completed inventory and appraisal to the San Diego Superior Court Probate Division. The form becomes part of the public court record.

- Serve Interested Parties. Provide copies to beneficiaries and any other persons who have requested special notice of probate proceedings.

How the Inventory Affects Probate Costs

The inventory and appraisal directly determine the statutory fees for both the attorney and the personal representative in California probate. Under Probate Code Section 10810, these fees are calculated based on the gross value of the estate, not the net value after debts.

This means that a home worth $1,000,000 with a $600,000 mortgage generates fees based on the full $1,000,000 value. The mortgage is not subtracted when calculating statutory compensation.

The statutory fee schedule is as follows:

Estate Value Tier | Fee Percentage |

First $100,000 | 4% |

Next $100,000 | 3% |

Next $800,000 | 2% |

Next $9,000,000 | 1% |

Both the attorney and the personal representative are entitled to this fee, meaning a $1,000,000 estate generates $23,000 for the attorney and $23,000 for the personal representative, for a combined total of $46,000 in statutory fees.

4 Common Challenges in the Inventory Process

Several issues commonly arise during the inventory and appraisal process in San Diego County probate cases:

1. Locating All Assets

The decedent may not have kept organized records, or family members may be unaware of certain accounts or property. Reviewing tax returns from the past three to five years often reveals interest, dividend, or rental income that points to previously unknown assets.

2. Valuing Unique Personal Property

Items such as artwork, antiques, and collections can be challenging to value. The probate referee may need to consult specialists, which can add time to the process. Providing the referee with any documentation about the items, such as purchase receipts or prior appraisals, helps expedite this step.

3. Real Property in Multiple Counties

If the estate includes California real property outside San Diego County, you may need to work with probate referees in each county where property is located. This requires coordination to ensure all appraisals are completed within the four-month deadline.

4. Disputed Valuations

Beneficiaries sometimes disagree with the probate referee’s valuation, particularly for real property or business interests. While you can discuss concerns with the referee, formal challenges to valuations can complicate and delay the probate process.

Practical Tips for San Diego County Families

Based on our experience helping families through probate in Carlsbad and throughout San Diego County, here are some practical suggestions:

- Start immediately. Four months may seem like plenty of time, but gathering documentation and coordinating with the probate referee often takes longer than most people expect.

- Create a master list. Maintain a spreadsheet of all assets, their approximate values, and whether they require probate. This helps you stay organized and ensures nothing is overlooked.

- Communicate with the probate referee early. Reach out as soon as you receive your Letters. Probate referees handle many cases simultaneously, and early communication helps ensure your case stays on schedule.

- Keep beneficiaries informed. Beneficiaries often have questions about estate values. Providing regular updates helps manage expectations and reduces potential conflicts.

- Work with an experienced probate attorney. A knowledgeable probate attorney can help you navigate the inventory process efficiently, ensure compliance with all legal requirements, and address any complications that arise.

Frequently Asked Questions About Probate Inventory and Appraisal

California Probate Code Section 8800 requires the personal representative to file the inventory and appraisal within four months from the date of receiving Letters Testamentary or Letters of Administration. This deadline applies in San Diego County and throughout California. Missing this deadline may result in court intervention or removal as personal representative.

The probate referee fee in California is set by statute at approximately 0.1% of the value of assets appraised. For a typical San Diego estate with $1,000,000 in assets requiring referee appraisal, the fee would be approximately $1,000. This fee is paid from estate funds as a cost of administration.

Yes. California law allows personal representatives to value certain assets directly, including cash, bank accounts, publicly traded stocks and bonds with readily ascertainable values, and U.S. savings bonds. All other assets, including real property, business interests, and valuable personal property, must be appraised by the probate referee.

The inventory and appraisal is filed using Judicial Council Form DE-160, titled “Inventory and Appraisal.” This standardized form is used throughout California, including in San Diego Superior Court. The form separates assets into those valued by the personal representative and those appraised by the probate referee.

No. Assets held in a properly funded trust are not part of the probate estate and should not be included in the inventory and appraisal. Only assets that were in the decedent’s name alone at death, without a beneficiary designation or survivorship provision, are included in the probate inventory.

If you discover assets after filing the initial inventory, you must file a supplemental inventory and appraisal. The same four-month deadline applies from the date you discover or reasonably should have discovered the additional assets. The probate referee will appraise any newly discovered assets requiring their valuation.

Yes. California statutory probate fees for both attorneys and personal representatives are calculated based on the gross value of the estate as determined by the inventory and appraisal. This is the gross value, not the net value after subtracting debts and mortgages. Understanding this helps families anticipate the total cost of probate administration.

Moving Forward with Confidence in Navigating the Inventory and Appraisal

Inventory and appraisal are critical milestones in California probate administration. Understanding the process, deadlines, and requirements helps you fulfill your duties as a personal representative while avoiding unnecessary delays or complications.

If you are serving as executor or administrator of an estate in San Diego County and have questions about the inventory and appraisal process, we are here to help. Our team at Opelon LLP guides families through every step of probate administration, ensuring compliance with California law while making the process as straightforward as possible.

Need help with probate administration in San Diego County?

Contact Opelon LLP at (760) 278-1116 or visit opelon.com to schedule a consultation. We serve families throughout Carlsbad, Oceanside, Encinitas, San Marcos, Escondido, Vista, and all of San Diego County.

Legal Disclaimer

This information is provided for general educational purposes only and does not constitute legal advice. Every estate is unique, and the information presented here may not apply to your specific situation. California law changes, and the legislature or courts may modify the thresholds, fees, and procedures described. For advice about your particular circumstances, please consult with a qualified California probate attorney. No attorney-client relationship is created by reading this content.