Confused about the new FinCEN Real Estate Reporting Rule?

Beginning March 1, 2026, a new federal reporting requirement from the Financial Crimes Enforcement Network (FinCEN) will apply to certain residential real estate transfers nationwide, including transactions in California.

If you own property through a revocable living trust or hold residential real estate in an LLC, this rule may affect your next transfer or purchase.

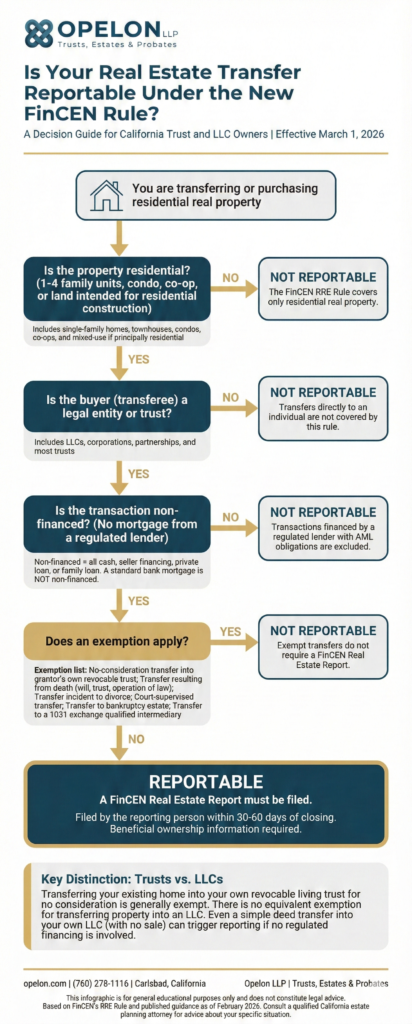

The FinCEN Residential Real Estate Reporting Rule (the “RRE Rule”) requires reporting of certain non-financed transfers of residential real property to legal entities and trusts. Although designed as an anti-money-laundering measure, the rule reaches beyond high-value investment transactions and can affect routine estate planning and asset protection strategies used by California families every day.

Here is what San Diego County homeowners, trust holders, and LLC owners should understand before the rule takes effect.

Key Takeaways

- The FinCEN RRE Rule applies to transfers that close on or after March 1, 2026. Reporting is required only for transactions that close on or after that date.

- It requires reporting of certain non-financed (all-cash or privately financed) transfers of residential real estate to legal entities and trusts.

- Transferring your home into your own revocable living trust for no consideration is generally exempt. The rule provides a specific carve-out for this common estate planning transaction.

- Buying property through a trust using cash or private financing is reportable. The exemption covers only no-consideration transfers into the grantor’s own trust, not purchases.

- LLC transfers do not have the same grantor exemption that revocable trusts have. Deeding residential property into an LLC, even without a sale, can trigger reporting.

- There is no minimum purchase price threshold. A transfer of any value can be reportable if it meets the rule’s criteria.

- Civil and criminal penalties for non-compliance can be significant.

Note: View the FinCEN Facts Sheet Here

What Is the FinCEN Residential Real Estate Reporting Rule?

The FinCEN RRE Rule is a federal anti-money laundering regulation adopted under the Bank Secrecy Act (31 U.S.C. Section 5318). It requires reporting to FinCEN when residential real estate (one-to-four family units) is transferred to a legal entity or trust through a non-financed transaction.

The rule was finalized in 2024. Although it became effective December 1, 2025, Treasury postponed the reporting obligation. Reporting is now required only for transfers that close on or after March 1, 2026.

Before this rule, FinCEN imposed similar reporting only in select high-value markets through Geographic Targeting Orders. The RRE Rule is a significant expansion. It applies nationwide, covers all non-financed transfers to entities or trusts, and has no minimum purchase price.

The rule applies when three conditions are met: (1) residential real property is transferred, (2) the transferee (buyer) is a legal entity or trust, and (3) the transaction is “non-financed” under the rule’s definition.

What Counts as Residential Real Property?

The rule covers a broad range of property types, including single-family homes, townhouses, condominiums, cooperatives, and buildings designed for occupancy by one to four families. It also includes vacant or unimproved land if the transferee intends to build a one-to-four-family residential structure.

Mixed-use property may be included if the structure is designed principally for occupancy by one to four families. Strictly commercial property is not covered.

What Does “Non-Financed” Mean?

A transfer is considered non-financed if it does not involve credit secured by the property from a financial institution that is subject to federal anti-money-laundering (AML) program requirements and Suspicious Activity Report (SAR) requirements. A standard mortgage from a bank, credit union, or similarly regulated lender is excluded from reporting.

In practical terms, reportable non-financed transactions include all-cash purchases, seller-financed transactions, private loans, family loans, and any credit extended by a lender not subject to Bank Secrecy Act AML obligations.

Who Is Responsible for Filing the FinCEN Report?

FinCEN assigns filing responsibility through a reporting cascade. Only one person per transaction is responsible. The person listed as the closing or settlement agent on the settlement statement is generally first in line. The parties may also use a written designation agreement to assign responsibility to another eligible participant.

The reporting cascade assigns responsibility in the following order:

- The closing or settlement agent listed on the settlement statement.

- The preparer of the closing statement.

- The person recording the deed.

- The title insurance underwriter issuing the owner’s policy.

- If none of the above apply, the person who disburses the greatest amount of funds.

- As a last resort, the person who prepares the deed or transfer instrument.

The parties may enter into a written, transaction-specific designation agreement assigning reporting responsibility to another eligible participant. These agreements must be retained for five years.

California Note:

In estate planning transfers involving LLCs where no title company or settlement agent is involved, the attorney preparing the deed could become the reporting person depending on who performs which closing functions.

Estate planning attorneys in Carlsbad, San Diego County, and throughout California should carefully evaluate their role in each transaction and consider whether a designation agreement is appropriate.

How the FinCEN Real Estate Reporting Rule Affects Revocable Living Trusts in California

For most California families, the routine estate planning transfer of a home into a revocable living trust is exempt from FinCEN reporting. The rule provides a specific carve-out for no-consideration transfers by an individual (or individual and spouse) to a trust of which they are the grantor or settlor.

Scenario 1: Transferring Your Home Into Your Own Revocable Trust (No Sale)

This is the most common estate planning transaction for California homeowners. You already own the property and you deed it into your revocable living trust to avoid probate. No money changes hands.

The result: No FinCEN real estate reporting required. The RRE Rule specifically exempts a transfer for no consideration made by an individual, either alone or with their spouse, to a trust of which that individual, their spouse, or both are the settlors or grantors.

This exemption covers the standard estate planning transaction where you deed your Carlsbad home, San Diego condo, or Oceanside townhouse into your own revocable living trust for probate avoidance.

FinCEN’s FAQs confirm this with a clear example: if a married couple jointly owns residential real property and transfers it to a trust for which they are the grantors, with no payment from the trust, the transfer is not reportable.

Scenario 2: Your Revocable Trust Buys a New Property

If your revocable trust is the buyer in a residential real estate purchase, reporting depends on how the purchase is financed.

How the Trust Buys | Reportable? | Reason |

Traditional mortgage from a regulated lender | No | Financed transaction. The lender already has AML obligations. |

All cash (no financing) | Yes | Non-financed transfer to a trust. No exemption applies because this is a purchase, not a no-consideration transfer. |

Seller financing | Yes | The lender is not subject to AML obligations. |

Private or family loan | Yes | The lender is not a regulated financial institution. |

If the transaction is reportable, the Real Estate Report must identify relevant beneficial owners of the trust, which may include the grantor, trustee, and others as defined by FinCEN’s rule.

How the FinCEN Rule Affects LLCs Holding Residential Property in California

LLCs generally face broader reporting exposure than revocable trusts under the RRE Rule. There is no equivalent exemption for no-consideration transfers into an LLC. Most privately held LLCs fall within the rule’s definition of a “transferee entity,” subject to specific regulatory exceptions for certain highly regulated entities.

Scenario 3: Deeding Property Into Your Own LLC (No Sale)

Some California homeowners transfer residential property into an LLC for asset protection, liability management, or as part of a broader estate plan. Unlike the revocable trust exemption, the RRE Rule provides no parallel carve-out for transfers to LLCs.

The result: Typically reportable. If you deed residential property into your own single-member LLC and there is no institutional financing involved in the transfer, FinCEN treats this as a non-financed transfer to a legal entity. The no-consideration exemption that protects grantor trust transfers does not extend to LLC transfers.

This is a meaningful change for California property owners. If you were planning to retitle a San Diego County rental property or vacation home into an LLC, any transfer closing on or after March 1, 2026 may require a FinCEN Real Estate Report.

Scenario 4: An LLC Buys Residential Property

The same financing analysis applies to LLC purchases as it does to trust purchases.

How the LLC Buys | Reportable? | Reason |

Traditional mortgage from a regulated lender | No | The lender’s AML program covers the transaction. |

All-cash purchase | Yes | Non-financed transfer to a legal entity. |

Seller or private financing | Yes | Lender not subject to BSA/AML requirements. |

Deed transfer from owner into LLC (no sale) | Yes | Non-financed transfer to an entity. No LLC exemption exists. |

When an LLC is the transferee, the report must identify individuals who exercise substantial control over the entity, or who own or control at least 25% of its ownership interests. These requirements are consistent with the beneficial ownership definitions FinCEN developed for the Corporate Transparency Act.

Trust vs. LLC: Side-by-Side Comparison Under the FinCEN Rule

The key difference between trusts and LLCs under the RRE Rule is the exemption for grantor trust transfers. Revocable trusts benefit from a specific carve-out for routine estate planning transfers. LLCs do not.

Transaction Type | Revocable Trust | LLC |

Transfer existing home in (no sale) | Exempt (no-consideration transfer to grantor’s own trust) | Reportable (no equivalent exemption) |

Buy property with bank mortgage | Not reportable (financed) | Not reportable (financed) |

Buy property all-cash | Reportable | Reportable |

Buy with seller or private financing | Reportable | Reportable |

Beneficial owners reported | Grantor/settlor of revocable trust; trustee; others per rule | Individual with 25%+ ownership or substantial control |

What Information Must Be Reported to FinCEN?

The FinCEN Real Estate Report is a detailed electronic filing containing up to 111 numbered data fields. It includes information about the property, the seller, the buyer entity or trust, beneficial owners, representatives acting for the buyer, and the purchase price and payment method.

Reports must be filed by the later of two deadlines: the last day of the month following the month of closing, or 30 calendar days after closing. In practical terms, this gives the reporting person between 30 and 60 days.

Reporting persons must retain certain related records, including any designation agreements and written beneficial ownership certifications, for five years.

Other Transfers That Are Exempt from FinCEN Real Estate Reporting

Beyond the revocable trust exemption, the RRE Rule exempts several categories of lower-risk transfers that commonly arise in estate planning and family property transitions in California.

The following types of transfers are not reportable:

- Transfers resulting from death (by will, trust, operation of law, or beneficiary designation).

- Transfers incident to divorce or dissolution of a marriage or civil union.

- Transfers to a bankruptcy estate.

- Court-supervised transfers.

- Grants, transfers, or revocations of easements.

- Transfers to a qualified intermediary in a Section 1031 like-kind exchange.

- No-consideration transfers by an individual (or with their spouse) into their own grantor trust.

For California families going through trust administration or probate, the exemption for transfers resulting from death is particularly important.

Distributions from a trust to beneficiaries after the grantor’s death, transfers by operation of law (such as joint tenancy survivorship), and transfers by beneficiary designation are all exempt.

Key Point:

There is no minimum dollar threshold. A non-financed transfer of residential real estate to an entity or trust is reportable regardless of property value. A $200,000 condo and a $5 million home are treated the same under this rule.

Penalties for Non-Compliance

FinCEN penalties for failing to comply with the RRE Rule can be significant. Penalties are imposed on the reporting person, not necessarily the property buyer.

As of 2025 (with amounts subject to periodic inflation adjustments), FinCEN indicates the following penalty structure:

- Negligent violations: Up to approximately $1,430 per violation, with higher penalties for patterns of violations.

- Willful violations (civil): Up to the greater of approximately $71,545 or the amount involved in the transaction, subject to statutory caps.

- Criminal penalties: Fines up to $250,000 and up to five years imprisonment.

Penalty amounts are adjusted periodically for inflation. Settlement agents, title professionals, and attorneys who fall within the reporting cascade should take compliance seriously.

What California Property Owners Should Do Before March 2026

California families who own property through trusts or LLCs, or who plan to acquire residential real estate through these vehicles, should review their approach before March 1, 2026. A few practical steps can help you prepare.

- Review how your property is currently titled. If you have been planning to transfer residential property into an LLC but have not yet done so, understand that completing that transfer after March 1, 2026 may trigger FinCEN reporting.

- Understand how future purchases will be financed. If you or your trust plan to buy residential property with cash, seller financing, or a private loan, the transaction will likely be reportable. Traditional bank financing keeps the transaction outside this rule.

- Be prepared to provide beneficial ownership information. If your transaction is reportable, the reporting person will need names, addresses, and identification details of beneficial owners. Having this ready will help the closing go smoothly.

- Coordinate early with your attorney and closing professionals. Whether you are setting up a revocable living trust, forming an LLC, or buying investment property in San Diego County, an estate planning attorney can help you understand how this rule applies to your specific situation.

- Stay informed. FinCEN may issue additional guidance, and regulatory interpretations can evolve. The rule could be modified after March 1, 2026.

Frequently Asked Questions About the FinCEN Real Estate Rule and California Estate Planning

Does the FinCEN RRE Rule apply to transfers into my revocable living trust?

It depends on the type of transfer. If you are deeding your existing home into your own revocable living trust for estate planning purposes with no payment involved, this transfer is generally exempt. If your trust is purchasing a new property without traditional bank financing, the transfer is reportable.

Does this rule apply if I use an LLC to buy a rental property in California?

Yes, if the purchase is non-financed (all-cash, seller-financed, or privately funded). There is no exemption for LLC purchases regardless of whether the LLC is used for investment, asset protection, or estate planning purposes.

Is there a minimum property value that triggers reporting?

No. There is no minimum purchase price or property value threshold. Any non-financed transfer of residential real estate (one-to-four units) to a legal entity or trust can be reportable, regardless of the amount.

Who files the FinCEN Real Estate Report?

The “reporting person” files the report. This is determined by a cascade that generally begins with the closing or settlement agent. If no settlement agent is involved, responsibility moves down the cascade. The parties can also designate a specific person through a written agreement.

What if the property transfer results from someone passing away?

Transfers resulting from death, whether through a will, trust, operation of law (such as joint tenancy survivorship), or beneficiary designation, are exempt from reporting. This includes distributions from a trust to beneficiaries as part of trust administration.

Do I need to report if I buy a home with a regular bank mortgage in the name of my trust?

No. A purchase financed by a traditional mortgage from a bank, credit union, or other regulated financial institution is not considered a non-financed transfer. These transactions are already subject to the lender’s anti-money-laundering program and are excluded from this rule.

Are commercial properties covered by this rule?

No. The RRE Rule applies only to residential real property, defined as structures designed for occupancy by one to four families (including condos and co-ops), and land intended for residential construction. Strictly commercial property is not covered.

Can I still deed my home into an LLC before the rule takes effect?

Reporting persons are exempt from the requirement to file reports for transfers that close before March 1, 2026. After that date, the reporting obligation applies. Consult with a California estate planning attorney to evaluate timing and your specific situation.

How Opelon LLP Can Help With Trust and LLC Planning in California

At Opelon LLP, we help California families plan for their estate and theirr the future, and stay current with the laws that affect property ownership. Whether you are creating a revocable living trust, forming a real estate LLC, or evaluating how to title your next property purchase, we can walk you through how the FinCEN reporting rules apply to your situation.

Based in Carlsbad and serving clients throughout San Diego County, our estate planning practice is built on clear communication, flat-fee transparency, and getting things done right. If you have questions about trusts, LLCs, or real estate ownership planning, we are here to help.

Schedule a consultation with Opelon LLP: Call (760) 278-1116 or visit opelon.com to learn more about our estate planning services in Carlsbad, California.

About the Author

Matt Odgers, Esq. is a Founding Partner at Opelon LLP, a trust, estate, and probate law firm based in Carlsbad, California. A San Diego County native who grew up in Ramona, Matt oversees the firm’s marketing and operations and is passionate about helping local families protect their legacies through thoughtful estate planning. He earned his J.D. from Thomas Jefferson School of Law in San Diego and holds a B.A. in Political Science from Purdue University. Matt’s commitment to client service has earned him recognition including Best Lawyers: Ones to Watch in America (2026), the Carlsbad Chamber of Commerce 40 Under 40 (2023), and four-time selection as a Super Lawyers Rising Star. He is admitted to the State Bar of California.

This article provides general information regarding FinCEN’s Residential Real Estate Reporting Rule as of February 2026. It is for educational purposes only and does not constitute legal advice. It does not create an attorney-client relationship. Laws and regulations may change, and regulatory interpretations can evolve. For advice about your specific circumstances, consult a qualified California estate planning attorney.