Understanding Probate Without a Will

When a person dies without a will in California, their estate doesn’t simply vanish or automatically pass to family members.

Instead, a court-supervised process called probate determines who inherits the deceased person’s assets.

If you’re dealing with this situation in San Diego County or elsewhere in California, knowing how intestate probate operates can assist you in getting ready for what’s to come.

In simple words, probate refers to the court procedure used to collect a deceased person’s assets, settle any debts, and distribute the remaining assets to the heirs.

Put another way, what does probate do? It organizes the probate estate so title and money can be lawfully transferred after death. For those wondering what is probate after someone dies or probate after death, it’s this same legal process under California probate law.

Dying without a will, known legally as dying “intestate,” triggers California’s default inheritance rules. The state essentially writes a will for the deceased person based on family relationships.

This process helps protect heirs and organize asset distribution. However, it can take a long time and requires court oversight, which many families find difficult.

If there is a will, you may hear phrases like “probate of will.” What is the meaning of probate of will? It is the court process to validate the document and carry out its terms, this is also what probate will mean in practice. This article focuses on estates without a will.

Key Takeaways

- California probate is required for estates exceeding $208,850 in assets (effective April 1, 2025), regardless of whether the deceased had a will.

- If someone dies without a will in California, the law decides who gets their stuff. First, a spouse will inherit. Then the children come, followed by other family members.

- The court appoints an “administrator” (not an executor) to manage an intestate estate, typically the surviving spouse or closest relative.

- Probate without a will typically takes 12 to 18 months for straightforward California estates, though complex situations may extend to two years or longer.

- Statutory fees for attorneys and administrators are identical whether there is a will or not, calculated as a percentage of the gross estate value.

When is California Probate Required?

People often ask when is probate required or when is probate necessary in California. The answer depends on what the person owned and how it was titled.

California probate is needed when someone has died, and they owned property just in their name that is worth more than $208,850. This rule starts on April 1, 2025.

This threshold applies whether or not the person left a will.

What matters is not whether there are estate planning documents, but the types of assets the person owned and their value at death.

How Long Does Probate Take Without a Will?

People often ask, “how long does probate take without will in California?”

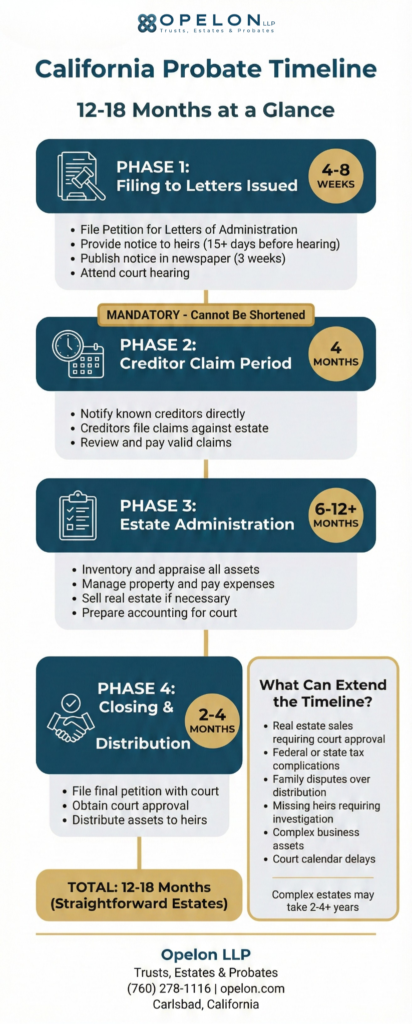

California probate without a will typically takes 12 to 18 months for straightforward estates.

Complex situations involving real estate sales, tax issues, or family disputes may extend the process to two years or longer. The timeline depends on multiple factors, including court scheduling, asset complexity, and whether any disputes arise during administration.

Average Timeframes for Administering Probate Without a Will in California

Understanding the typical probate timeline helps families plan realistically.

The following table breaks down approximate timeframes for each phase of probate administration in California.

Phase | Timeframe | Key Activities |

Filing to Letters Issued | 4-8 weeks | Petition filed, notice given, hearing held |

Creditor Claim Period | 4 months | Mandatory waiting period (cannot be shortened) |

Estate Administration | 6-12+ months | Gather assets, pay debts, and prepare accounting |

Closing and Distribution | 2-4 months | Final petition, court approval, asset transfer |

Total (Straightforward Estate) | 12-18 months | Minimum realistic timeframe |

Factors Influencing Duration of Probate Without a Will in California

Several factors can extend probate beyond the typical timeline. Real estate sales require additional court hearings and often take months to complete. Tax complications, especially federal estate tax returns or audits, add significant time. Family disagreements about distribution or administrator conduct can delay resolution while the court resolves disputes.

The San Diego County Superior Probate Court‘s calendar also affects timing. Busy court periods may mean longer waits for hearing dates. Working with an experienced probate attorney can help you efficiently navigate procedural requirements and avoid common delays caused by incomplete filings or missed deadlines.

Circumstances Triggering Probate in California

Several situations commonly trigger probate in California. Real estate ownership is the most frequent cause, since most California homes exceed the probate threshold.

Bank accounts in the deceased person’s name, investment accounts without transfer-on-death options, and vehicles owned by a single person all go through probate.

This is a common intersection of probate and property that especially affects probate for property owners.

Assets that typically require probate include:

- Real estate titled solely in the deceased person’s name, including homes, rental properties, and vacant land in California. House in probate meaning: the home cannot be sold or retitled until the court process authorizes it. What does a house in probate mean? It means the court oversees any sale or transfer.

- Bank accounts and certificates of deposit without payable-on-death (POD) beneficiary designations

- Brokerage and investment accounts without transfer-on-death (TOD) registrations

- Business interests, including sole proprietorships, partnership interests, and closely held corporation stock

- Personal property such as vehicles, jewelry, art, and collectibles titled in the deceased person’s name

Common Misconceptions about California Probate Without a Will

Many families believe that having a will allows them to skip probate entirely. This is not accurate.

A will specifies who receives what when someone dies and who will manage their affairs. However, any property owned solely by the deceased still requires court approval to transfer ownership.

The will provides instructions for the probate court to follow; this is the essence of probate of a will.

Another common misconception involves joint bank accounts and beneficiary designations.

These assets usually go straight to the surviving account holder or the named beneficiary. This happens without probate, even if a will states otherwise.

Similarly, life insurance proceeds, retirement accounts with designated beneficiaries, and property held in a living trust avoid probate entirely.

What Happens in the California Probate Court?

California probate courts oversee the process of locating a deceased person’s assets, paying their debts, and distributing the remaining property to their heirs.

For those wondering what happens in probate court, it involves formal filings, notices, appraisals, and court approvals under California probate law.

The San Diego County Superior Court handles probate matters for residents of Carlsbad, Oceanside, Encinitas, and surrounding communities. Court oversight ensures creditors receive notice, assets are correctly valued, and distributions are made in accordance with either the deceased person’s will or California’s intestate succession laws.

The probate process involves filing petitions with the court, attending hearings, publishing legal notices, notifying creditors and heirs, preparing inventories, and submitting accountings.

The court chooses a probate referee. They assess most assets to determine their fair market value. This helps with fee calculations and asset distribution.

How Does Probate Work Without a Will?

When someone dies without a will in California, the probate process follows intestate succession laws found in California Probate Code Sections 6400 through 6414.

These statutes establish a predetermined inheritance hierarchy based on family relationships. The court lacks discretion to deviate from these rules, even if the outcome appears unfair to certain family members. If you want a quick probate overview, the steps below summarize how probate works in intestacy.

Steps in the Probate Process in California

The intestate probate process in California follows a structured sequence of steps, each with specific legal requirements and deadlines.

- File a Petition for Letters of Administration. An interested party, usually a close family member, files a petition with the Superior Court asking to be appointed administrator of the estate. This petition is how you open probate and initiate the case. This petition must identify known heirs and provide basic information about the deceased person’s assets.

- Provide Notice to Heirs and Creditors. California law requires notice to all heirs at least 15 days before the hearing on the petition. Additionally, a notice must be published in a local newspaper for three consecutive weeks to alert potential creditors.

- Attend the Court Hearing. A probate judge reviews the petition and, if everything is in order, issues Letters of Administration. These letters grant the administrator legal authority to act on behalf of the estate.

- Inventory and Appraise Assets. Within four months of receiving letters, the administrator must file an inventory and appraisal with the court. A court-appointed probate referee values most assets.

- Manage the Estate During Administration. The administrator collects assets, manages property, pays ongoing expenses, and handles any necessary sales of real or personal property.

- Pay Creditor Claims. Known creditors must be notified directly. All creditors have four months from the issuance of letters (or 60 days from actual notice, whichever is later) to file claims. The administrator reviews and pays valid claims.

- File Final Petition and Distribute Assets. After paying off debts and expenses, the administrator requests court approval of the final account. They also request permission to distribute the remaining assets to the heirs under intestate succession laws.

- Obtain Probate Orders. The court will issue a probate order approving the accounting and authorizing distributions.

Appointing an Administrator

When someone dies with a will, that document typically names an executor to manage the estate. Without a will, the court appoints an “administrator” to serve the same function. California Probate Code Section 8461 establishes priority for who may serve as administrator:

- Surviving spouse or registered domestic partner

- Children of the deceased

- Grandchildren of the deceased

- Parents of the deceased

- Siblings of the deceased

- Other next of kin

If multiple people share the same priority level, the court may require them to agree on who will serve or may appoint co-administrators. In some cases, the court may require the administrator to obtain a surety bond to protect the estate from potential mismanagement.

Handling the Probate Estate When There is No Will

The administrator has fiduciary duties to the estate and its beneficiaries. This means acting in good faith, avoiding conflicts of interest, and managing assets prudently. In our experience working with families throughout San Diego County, the administrative burden often surprises people who expected a more straightforward process.

Every day, administrator responsibilities include securing real property, canceling credit cards, redirecting mail, filing final tax returns, maintaining insurance coverage, and communicating regularly with heirs. The administrator must also keep detailed records of all transactions and be prepared to account for every dollar that passes through the estate.

Estate Assets and Debts

Before any distributions to heirs, the estate must pay valid debts and expenses. California law establishes a priority order for payment of claims. Funeral expenses, administration costs, and secured debts typically come first. Unsecured creditors follow, and heirs receive only what remains after all legitimate claims are satisfied.

If the estate lacks sufficient assets to pay all debts, it is considered “insolvent.” In that case, heirs may receive nothing. Creditors cannot pursue heirs personally for the deceased person’s debts unless the heir co-signed for the obligation or is otherwise legally responsible.

Comparing Probate without a Will to Probate With a Will in California

Surprisingly, probate with a will and probate without a will take roughly the same amount of time. The mandatory creditor claim period applies regardless of whether a will exists. Court oversight, required notices, and administrative steps remain identical.

If you’re wondering what probate will mean in this context, it simply means the court validates the will and supervises the same steps described above.

The key differences involve who inherits and who manages the estate. With a will, the deceased person chose their beneficiaries and executor.

Without a will, California law makes those decisions through intestate succession rules. Statutory fees for attorneys and administrators are calculated the same way in both situations.

California Statutory Probate Fees (Attorney and Administrator Each)

Gross Estate Value | Attorney Fee | Administrator Fee | Combined Total |

$500,000 | $13,000 | $13,000 | $26,000 |

$750,000 | $18,000 | $18,000 | $36,000 |

$1,000,000 | $23,000 | $23,000 | $46,000 |

$1,500,000 | $28,000 | $28,000 | $56,000 |

Note: Fees calculated on gross estate value per California Probate Code Section 10810. Mortgage balances are not deducted.

California Probate Without a Will: FAQ's

If no probate case is opened, the deceased person’s assets remain titled in their name indefinitely. Real property cannot be sold or transferred, bank accounts may be frozen, and creditors may pursue claims against the estate. Eventually, the state may intervene to resolve the situation, but families lose control over the process and timeline.

If you are under the probate threshold, then the small estate affidavit procedure under California Probate Code Section 13100 applies regardless of whether the deceased person had a will. If the estate’s California assets total $208,850 or less (effective April 1, 2025), heirs may use the affidavit process 40 days after death to collect personal property without formal probate.

If no living relatives can be identified after a diligent search, the estate “escheats” to the State of California. This is rare, as California’s intestate succession laws extend to distant relatives, including grandparents, aunts, uncles, and their descendants. The state only inherits when absolutely no blood relatives exist.

Stepchildren do not inherit under California’s intestate succession laws unless they were legally adopted by the deceased person. Without adoption, stepchildren have no inheritance rights regardless of how long they lived with or were supported by the stepparent. Only biological and legally adopted children qualify as heirs.

Yes, the court may remove an administrator for cause, including mismanagement, failure to perform duties, or conflict of interest. Interested parties can petition the court for removal. If removed, the court appoints a successor administrator from the next eligible person in the statutory priority list.

Probate defined: it is the court process that identifies assets, pays valid debts, and transfers remaining property to the proper heirs. This is the purpose of probate under California probate law.

It means the court supervises any sale or transfer of the property during administration. Until the judge authorizes it, often through a probate order, the deed cannot be retitled. This is a practical example of probate and property.

Probate starts when a petition is filed with the Superior Court and a case number is assigned. After notice and a hearing, the court issues Letters of Administration so the administrator can act.

File a petition for Letters of Administration in the county where the decedent lived, give required notice to heirs and creditors, and attend the hearing. An attorney can provide a step-by-step probate guide and help you open probate efficiently.

Conclusion

Summary of Key Points

Probate without a will in California follows a structured legal process governed by intestate succession laws.

The court appoints an administrator to manage the estate, notify creditors, inventory assets, pay debts, and distribute the remaining property to heirs under Probate Code Sections 6400-6414. The process takes 12 to 18 months for most estates, with statutory fees calculated on gross asset values.

California’s intestate succession rules prioritize close family members. Surviving spouses receive all community property and a portion of separate property. Children, parents, siblings, and more distant relatives inherit according to a defined hierarchy when no spouse survives.

These rules apply uniformly, regardless of the deceased person’s actual wishes or family circumstances.

Why do you need probate, or why do you have to have probate?

The purpose is to ensure clear title transfers, orderly payment of debts, and protection of heirs and creditors under the court’s supervision.

Next Steps for Heirs When Faced with Probate Without a Will in California

If you are facing probate without a will in San Diego County or elsewhere in California, consider taking these initial steps:

- Gather information about the deceased person’s assets, including real estate deeds, bank statements, investment accounts, and vehicle titles. This helps determine whether probate is necessary and provides documentation for the court.

- Identify all potential heirs under California’s intestate succession laws. The court will require this information when petitioning for letters of administration.

- Secure the deceased person’s property, especially real estate. Change locks if necessary, maintain insurance coverage, and protect valuable personal property from loss or theft.

- Consult with a California probate attorney to understand your specific situation. Every estate is different, and professional guidance helps avoid costly mistakes during administration.

If you are wondering “how do I get probate started”, your attorney can help you prepare and file the petition to open probate and guide you through the required notices, inventories, and court appearances.

Opelon LLP assists families throughout San Diego County with non-contested probate matters, including intestate estates. Contact us at (760) 278-1116 to discuss your probate questions.

Legal Disclaimer

This article provides general information about California probate law and is for educational purposes only. It does not constitute legal advice and does not create an attorney-client relationship. Estate planning and probate laws are complex and subject to change. The information in this article was accurate as of December 2025. For advice about your specific situation, please consult with a qualified California estate planning and probate attorney.

The $208,850 probate threshold referenced in this article is effective April 1, 2025, and adjusts periodically for inflation. Verify the current threshold before making decisions based on this figure.

About the Author

Matt Odgers, Esq. is a Partner at Opelon LLP, a trust, estate, and probate law firm based in Carlsbad, California. He holds a J.D. from Thomas Jefferson School of Law and a B.A. in Political Science from Purdue University. Matt has been recognized by Best Lawyers: Ones to Watch in America (2026) for his work in trusts and estates. California State Bar No. 290722.