When a loved one passes away in California, you may assume their estate must go through the lengthy probate process. However, if the estate qualifies as a “small estate,” you may be able to use a small estate affidavit to collect and transfer the deceased person’s assets without ever stepping foot into a courtroom.

This simplified procedure, governed by California Probate Code Sections 13100 through 13106, helps families across San Diego County and throughout California avoid the time and expense of formal probate administration.

In this guide, we explain exactly how the small estate affidavit process works, who qualifies to use it, and the step-by-step process for transferring property.

Whether you are dealing with a bank account, investment holdings, or other personal property left behind by a family member, understanding this streamlined option could save you months of waiting and thousands of dollars in court costs.

Key Takeaways

- A California small estate affidavit allows you to collect a deceased person’s personal property without formal probate when the estate value is $208,850 or less (effective April 1, 2025).

- You must wait at least 40 days after the person’s death before using the affidavit.

- The small estate affidavit cannot be used to transfer real property (land or houses); a separate court petition is required for real estate.

- No court filing is required for the affidavit; you present it directly to the institution holding the deceased person’s property.

- Many San Diego County families use this process successfully to access bank accounts, collect final paychecks, and claim other assets without hiring an attorney.

What Is a California Small Estate Affidavit?

A small estate affidavit is a sworn, written statement that authorizes someone to claim a deceased person’s assets outside of the formal probate process.

Under California Probate Code Section 13100, this affidavit can be used when the total value of the deceased person’s California estate (excluding specific exempt property) does not exceed the statutory threshold.

Think of it as a shortcut. Instead of filing paperwork with the probate court, waiting for a judge to appoint you as executor or administrator, and going through months of formal administration, you prepare the affidavit, attach the required documents, and present it directly to the bank, brokerage, employer, or other entity holding the deceased person’s property.

The recipient of the affidavit is legally required to release the property to you, provided you meet all the requirements. If they refuse without good reason, California law even allows you to recover attorney fees if you have to take them to court.

What Is the Current Small Estate Threshold in California?

As of April 1, 2025, the California small estate affidavit threshold is $208,850.

This means you can use the affidavit procedure if the gross fair market value of all the deceased person’s real and personal property in California (excluding certain exempt assets) does not exceed this amount.

California adjusts this threshold every three years based on the Consumer Price Index to account for inflation. Here is the recent history of threshold changes:

Date of Death | Threshold Amount | Authority |

Before April 1, 2022 | $166,250 | Prob. Code 13100 |

April 1, 2022 to March 31, 2025 | $184,500 | Prob. Code 13100 |

On or after April 1, 2025 | $208,850 | Prob. Code 13100 |

How to Calculate the Estate Value

The estate value for small estate affidavit purposes includes all California real and personal property owned by the deceased person at the time of death, minus certain excluded assets.

Getting this calculation right is essential because using the affidavit when the estate exceeds the threshold could create legal problems.

Assets to Include in Your Calculation for Small Estate Affidavit

- Bank accounts held solely in the deceased person’s name

- Investment and brokerage accounts without transfer-on-death designations

- Retirement accounts and life insurance payable to the estate (not to named beneficiaries)

- Personal property such as furniture, jewelry, and collectibles

- Any real property in California (for calculation purposes only)

- Amounts owed to the deceased (final paychecks, pending refunds, debts owed)

Assets to Exclude From Your Calculation for Small Estate Affidavit

- Vehicles, boats, and mobile homes (these have separate transfer procedures)

- Property held in a living trust

- Property owned as joint tenancy with right of survivorship

- Community property with right of survivorship

- Property that passes directly to the surviving spouse or domestic partner

- Life insurance, retirement accounts, and bank accounts with named beneficiaries

- Real property located outside California

- Multi-party bank accounts where the deceased was one of several owners

Important: Value the property as of the date of death, not the date you complete the affidavit. You do not need to hire a professional appraiser. A good-faith estimate of fair market value is acceptable. For personal property, consider what the items would sell for at a garage sale, not their sentimental value.

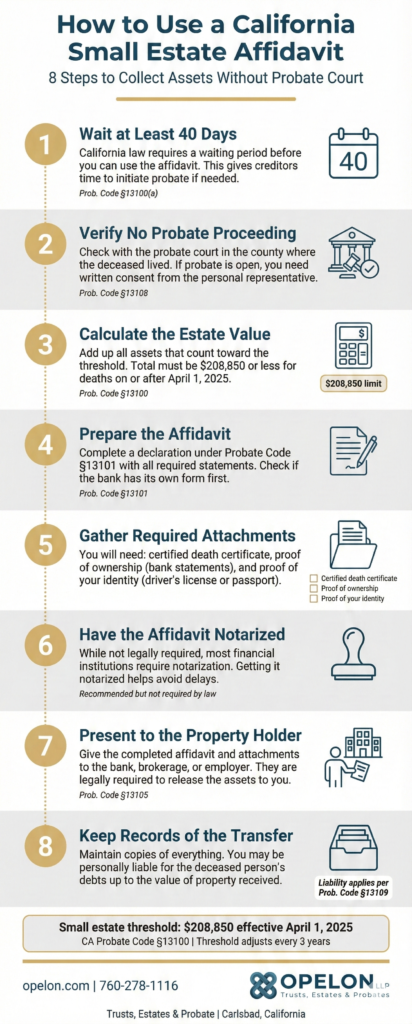

Step-by-Step Process for Using a Small Estate Affidavit

Using a California small estate affidavit involves preparing a sworn declaration, gathering supporting documents, and presenting them to the person or institution holding the deceased person’s property.

Here is precisely how to do it.

- Wait at least 40 days after the death. California law requires a waiting period before you can use the small estate affidavit. This gives any creditors or interested parties time to initiate formal probate if needed.

- Verify no probate proceeding has been filed. Check with the probate court in the county where the deceased person lived. If a probate case is already open, you generally cannot use the small estate affidavit unless the personal representative provides written consent.

- Calculate the estate value. Add up all assets that count toward the threshold using the guidelines above. Make sure the total is $208,850 or less (for deaths on or after April 1, 2025).

- Prepare the small estate affidavit. Complete a declaration under California Probate Code Section 13101 that includes all required statements. Many banks and financial institutions have their own forms, so check with them first.

- Gather required attachments. You will need a certified copy of the death certificate, proof that the deceased owned the property (bank statements, stock certificates), and proof of your identity (driver’s license or passport).

- Have the affidavit notarized. While California law does not strictly require notarization, most financial institutions require it as part of their process. Getting the affidavit notarized helps avoid delays.

- Present the affidavit to the property holder. Give the completed affidavit and all attachments to the bank, brokerage, employer, or other entity holding the property. They are legally required to release the assets to you.

- Keep records of the transfer. Maintain copies of everything for your records. As the person who received assets through the affidavit, you may be personally liable for the deceased person’s debts up to the value of the property you received.

What Must the Affidavit Include?

Under California Probate Code Section 13101, your small estate affidavit must contain specific statements:

- The name of the deceased person and the date of death

- A statement that at least 40 days have passed since the death

- A statement that no probate proceeding is pending or planned (or that the personal representative has consented in writing)

- A statement that the gross value of the estate does not exceed the statutory threshold

- A description of the specific property being claimed

- The names of all successors (heirs or beneficiaries) entitled to the property

- A statement that the affiant is entitled to receive the property as a successor or is authorized to act on behalf of a successor

- A statement that no other person has a superior right to the property

Can You Use a Small Estate Affidavit for Real Property?

No, the small estate affidavit cannot be used to transfer real property such as houses, land, or condominiums. This is one of the most common points of confusion about California’s small estate procedures.

While you must include real property in your calculation to determine whether the estate meets the threshold, the affidavit itself can only transfer personal property. For real estate transfers in small estates, California provides a separate procedure called the Petition to Determine Succession to Real Property under Probate Code Sections 13150 through 13158.

This petition requires a court filing and a six-month waiting period after death, but it is still considerably simpler than full probate administration. If the deceased person owned real property in San Diego County or elsewhere in California, consult with a probate attorney to understand your options.

What If a Bank or Institution Rejects Your Affidavit?

It happens more often than it should. You prepare everything correctly, present your affidavit to the bank, and they tell you they need “Letters” or that you need to go through probate. Here is what to do:

First, ask to speak with a supervisor. Many frontline bank employees are not familiar with California’s small estate affidavit procedure. A supervisor or manager may be more knowledgeable.

Second, request that they consult their legal department. Reference California Probate Code Sections 13100 through 13106 and explain that the law requires them to release the property when you present a proper affidavit with all the necessary documentation.

Third, put your request in writing. Send a formal letter citing the specific code sections and explaining why your affidavit complies with the law. Keep copies of all correspondence.

Under California Probate Code Section 13105, if a property holder unreasonably refuses to release property after receiving a proper affidavit, you can bring a court action to compel the transfer. The court may award you attorney fees if it finds the refusal was unreasonable.

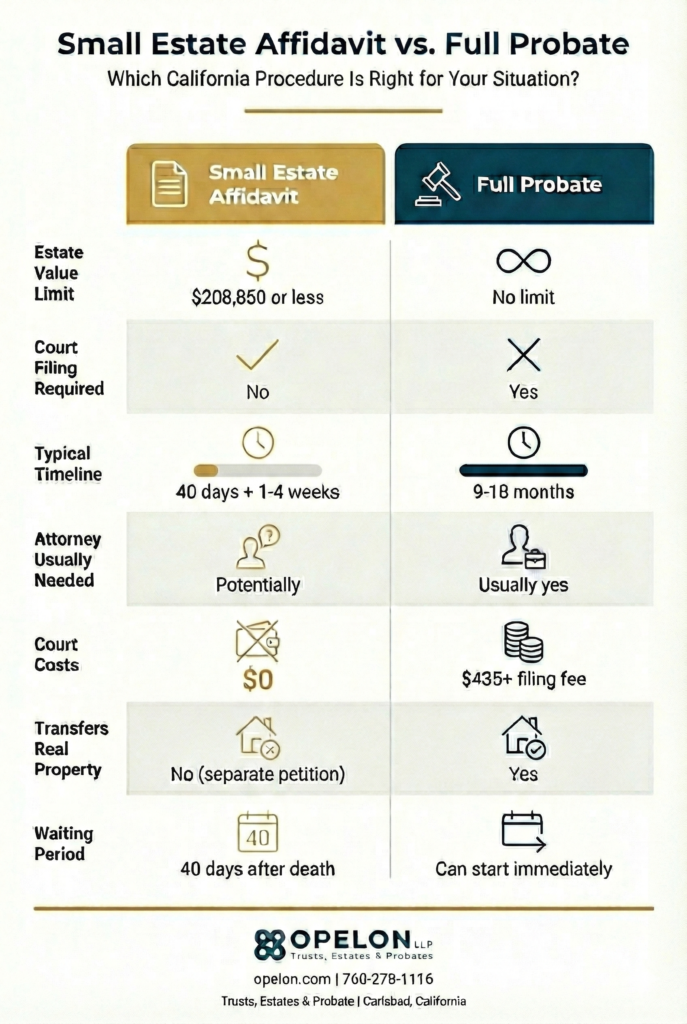

Small Estate Affidavit vs. Full Probate: A Comparison

Factor | Small Estate Affidavit | Full Probate |

Estate Value Limit | $208,850 or less | No limit |

Court Filing Required | No | Yes |

Typical Timeline | 40 days plus 1 to 4 weeks | 9 to 18 months |

Attorney Usually Needed | Often not | Usually yes |

Court Costs | None | $435+ filing fee |

Real Property Transfer | No (separate petition) | Yes |

Waiting Period | 40 days after death | Can start immediately |

When Full Probate May Be the Better Option

While the small estate affidavit offers significant advantages, there are situations where full probate might actually serve your family better:

- The estate includes real property. If the deceased person owned a home or land, you will eventually need court involvement anyway. Full probate might be more efficient than using multiple simplified procedures.

- There are significant debts or potential creditors. Probate provides a formal creditor claims period that limits how long creditors can come after the estate. Without probate, creditors may have longer to pursue claims.

- Family disputes exist. If there is any chance that heirs will disagree about who gets what, the court supervision in probate can help protect everyone involved.

- The estate is complex. Multiple types of assets, business interests, or unusual circumstances may warrant the probate process.

Frequently Asked Questions About California Small Estate Affidavits

After waiting the required 40 days following the death, most families complete the process within a few days to a few weeks. The timeline depends largely on how quickly you can gather documents and how responsive the institutions holding the property are. Compared to formal probate, which typically takes 9 to 18 months in California, this is significantly faster.

If multiple people are entitled to inherit, all successors must either sign the affidavit or authorize one person to sign on their behalf. The affidavit should list all successors and their respective relationships to the deceased. Once you receive the property, you are responsible for distributing it equitably among all rightful heirs.

Yes, to a limited extent. Under California Probate Code Section 13109, if you receive property through the small estate affidavit, you are personally liable for the deceased person’s unsecured debts up to the fair market value of the property you received. This liability may be enforced for the same period during which creditors could have enforced the debt against the deceased person.

The California small estate affidavit only applies to property located in California. If the deceased person owned property in other states, you would need to follow that state’s procedures for transferring small estate assets. Many states have similar simplified procedures, but the thresholds and requirements vary.

Letters Testamentary (or Letters of Administration) are court documents that prove a person has been officially appointed by the probate court to manage a deceased person’s estate. These require opening a formal probate case. A small estate affidavit is a sworn declaration you prepare yourself, without court involvement, to collect assets from estates that qualify for simplified procedures.

Vehicles, boats, and mobile homes are excluded from the small estate affidavit calculation and cannot be transferred using this procedure. California has a separate process through the DMV for transferring vehicle titles when someone dies. You will need to complete the appropriate DMV forms and may need to show proof of your relationship to the deceased person.

Need Help With a Small Estate in San Diego County?

Navigating the aftermath of a loved one’s death is never easy, even when the estate qualifies for simplified procedures. If you are dealing with a small estate in Carlsbad, San Diego County, or anywhere in California and have questions about whether the small estate affidavit is right for your situation, Opelon LLP is here to help.

Our team guides families through probate alternatives and trust administration throughout North County San Diego. We can review your situation, help you understand your options, and ensure you take the right approach for your family’s circumstances.

Contact Opelon LLP at (760) 278-1116 to schedule a consultation, or visit our Carlsbad office at 1901 Camino Vida Roble STE 112, Carlsbad, CA 92008.

Author: Matt Odgers, Esq. is a Founding Partner at Opelon LLP in Carlsbad, California, where he oversees marketing and operations. A San Diego County native who grew up in Ramona, Matt earned his J.D. from Thomas Jefferson School of Law and holds a B.A. in Political Science from Purdue University. He has been recognized by Best Lawyers: Ones to Watch in America (2026) and Super Lawyers Rising Stars.

Legal Disclaimer This article provides general information about California estate planning law and is for educational purposes only. It does not constitute legal advice and does not create an attorney-client relationship. Estate planning laws are complex and change frequently. The information in this article was accurate as of December 2025. For advice about your specific situation, please consult with a qualified California estate planning attorney or California probate lawyer.