California Trust Administration Process: Your Complete 8 Step Guide

The trust administration process can seem daunting when you’ve just lost a loved one and suddenly find yourself responsible for managing their trust. The good news is that unlike probate, trust administration in California typically happens outside of court, making it faster, more private, and significantly less costly. This guide walks you through each step so you know exactly what to do and when.

Lessons From the Juice: What OJ Simpson’s Estate Teaches Us in 2025

When OJ Simpson died in 2024, the drama didn’t end; it simply moved from the courtroom to the probate court. Overnight, his estate became a national spectacle: massive debts, a decades-old wrongful death judgment, missing assets, and a trust that raised more questions than answers. But behind all the headlines lies something far more important than celebrity intrigue. Simpson’s estate is a real-world reminder of what can go wrong when lawsuits, creditors, and complicated family dynamics collide and why everyday families need to plan ahead long before chaos hits.

Beneficiary Designations in California Estate Planning: A Complete Guide (2026)

Your beneficiary designations can override your will, your trust, and your wishes. One outdated form could send your retirement savings to an ex-spouse instead of your children. Here is how to get them right under California law.

Navigating a Heggstad Petition in San Diego: Understanding Probate Code § 850 for Trust Asset Transfers

Gain insights into Heggstad petitions in San Diego. This key guide explains the probate code § 850 and offers trustees and beneficiaries a streamlined way to confirm that assets left out of a trust were still intended to be included. This process avoids the delays of full probate while ensuring a decedent’s intent is honored. Learn how this petition works and why it is a vital tool in California trust administration.

Selling a House in San Diego Probate: Step-by-Step California Guide (2026)

Selling a house in probate can be challenging. This expert guide outlines crucial steps when selling a house in San Diego probate, clarifying legal processes and options for personal representatives.

Opelon LLP’s Lawyer Matt Odgers Named to 2026 Best Lawyers: Ones to Watch® in America

San Diego, August 21, 2025 — Opelon LLP is pleased to announce that partner Matt Odgers lawyer has been included in the 2026 edition of Best Lawyers: Ones to Watch® in America.

Estate Planning for Bitcoin in 2025 | A Simple Guide to Fund a Trust with Bitcoin

If you are a holder of Bitcoin, this article will help you to understand how to fund a trust with Bitcoin as well as the benefits of estate planning for Bitcoin.

California Revocable Living Trust: The Complete 2026 Guide

A California Revocable Living Trust helps protect your assets, avoid probate, and keep your estate private. Learn how it works under California law and how Opelon LLP, a trusted Carlsbad estate planning firm, can help you plan with confidence.

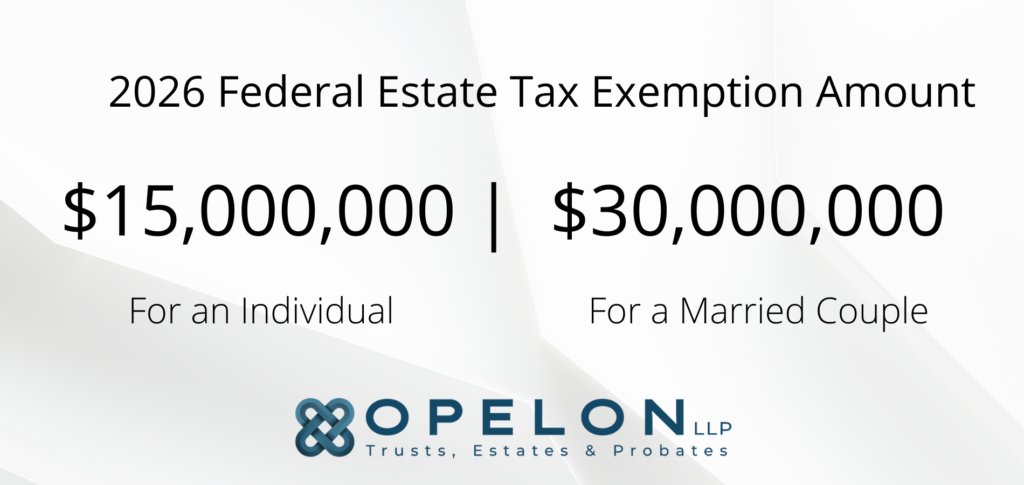

2026 Federal Estate Tax Exemption: What California Families Need to Know

Big changes are here for estate planning in 2026. The federal estate tax exemption has increased to $15,000,000 for an individual and $30,000,000 for a married couple, a significant jump from the 2025 exemption of $13.99 million.

So how does this affect you? Put simply, you will only owe federal estate tax if the total value of your estate exceeds these thresholds