AI-generated estate planning documents have become increasingly popular among California residents looking for a quick, inexpensive solution.

Tools like ChatGPT, online form generators, and automated legal document services promise to create wills and trusts in minutes. The appeal is understandable.

Why pay thousands of dollars for an attorney when software can produce similar-looking documents for a fraction of the cost?

Here is the problem with AI-generated estate plans: estate planning documents are not just forms to be filled in. They are legal instruments that must comply with specific California Probate Code requirements.

A document that looks correct on the surface may be legally invalid, create unintended tax consequences, or fail to achieve your actual goals.

In our Carlsbad estate planning practice, we have seen families across San Diego County suffer significant financial harm from AI-generated documents that seemed fine until they were actually needed.

Key Takeaways

- AI tools cannot properly assess whether your California estate plan complies with current Probate Code execution requirements, potentially invalidating your entire document.

- Generic AI-generated trusts may fail to account for California community property rules, creating costly probate complications for surviving spouses.

- AI cannot evaluate your specific family dynamics, asset structure, or tax situation as well as a qualified estate planning attorney can.

- Documents that are not properly funded into a trust, a potential risk when using AI, force families through full probate despite having a trust.

- The money saved using AI for estate planning documents can cost families significantly more when problems surface after death.

- AI tools are only as good as the information you provide, and most people do not know what information is legally relevant to include, creating significant gaps in document coverage.

What Makes California Estate Planning Different from Other States?

California has unique legal requirements that generic AI tools do not adequately address, including community property laws, high probate costs, and specific execution requirements that may render documents invalid if created without proper legal guidance.

California is one of only nine community property states. This designation fundamentally changes how assets pass at death, how trusts must be structured, and what happens if documents are not properly drafted. An AI tool trained on general U.S. estate planning law will miss these critical distinctions.

Consider the probate cost issue alone. Under California Probate Code Section 10810, statutory attorney and executor fees are calculated on the gross value of the estate, not the net value. For a home worth $1,000,000 with a $600,000 mortgage, fees are calculated on the full $1,000,000. This means statutory fees alone would be approximately $46,000, even though equity is only $400,000.

A properly drafted and funded California living trust avoids probate entirely. An AI-generated trust that is not properly funded, or that contains errors, making it legally invalid, can leave your family facing this exact scenario.

How Do AI-Generated Estate Planning Documents Typically Fail?

AI estate planning tools can produce documents with execution errors, missing provisions required under California law, improper beneficiary designations, and failure to coordinate with existing accounts and property titles.

In our experience helping families in Carlsbad and throughout San Diego County, we have identified several patterns in failed AI-generated documents.

Execution Requirement Failures

California Probate Code Section 6110 specifies exact requirements for valid will execution. The document must be in writing, signed by the testator, and witnessed by at least two people who were present at the same time and who understand they are witnessing a will. AI tools provide generic instructions that can lead to improper execution.

We have seen wills where witnesses signed on different days, where witnesses did not actually see the testator sign, or where the testator signed in the wrong location. Any of these errors can invalidate the entire document.

Community Property Oversights

AI tools trained on nationwide data may fail to properly characterize assets as community property or separate property. This distinction affects everything from asset distribution to tax treatment. An incorrectly drafted trust can create unintended disinheritance or unnecessary tax liability.

For married couples in California, community property receives a full step-up in basis at the first spouse’s death. Trusts drafted without understanding this benefit may forfeit significant capital gains tax savings for the surviving spouse.

Missing Trust Funding Guidance

A revocable living trust only avoids probate if assets are actually transferred into it. This process, called funding, requires changing title on real estate, updating beneficiary designations on accounts, and transferring ownership of personal property. AI tools generate trust documents but may provide inadequate guidance on this critical step.

The result is what we call a “drawer trust.” The documents sit in a drawer, never implemented, and the family discovers at death that everything either requires a Heggstad petition or possibly full probate administration. In San Diego County, where the median home price exceeds $900,000, this oversight can cost families tens of thousands of dollars in unnecessary probate fees.

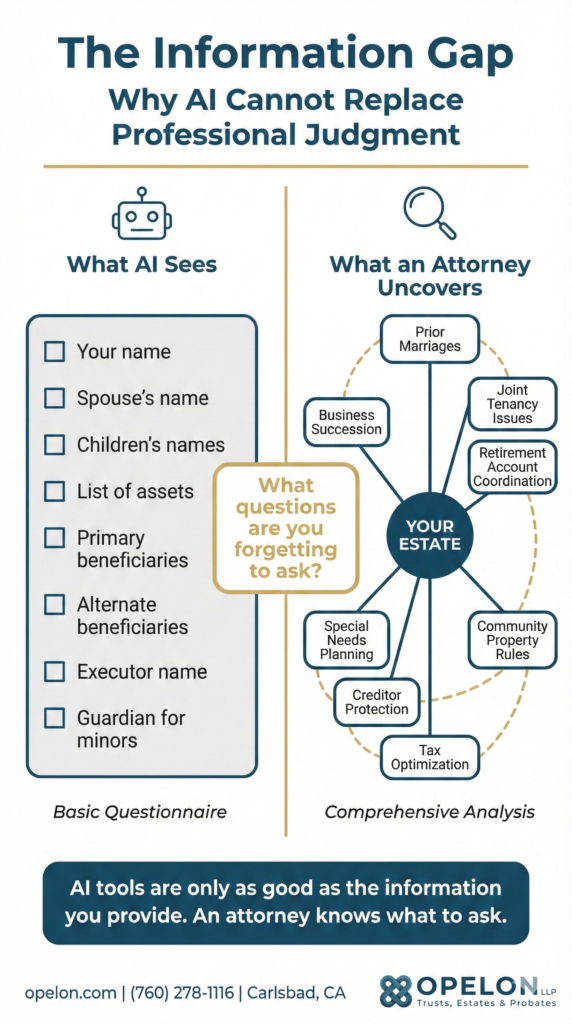

AI Is Only as Good as the Information You Provide

One of the most significant risks of using AI for estate planning is a fundamental limitation: AI tools can only work with the information you give them. Unlike an experienced attorney who asks probing questions to uncover potential issues, AI relies entirely on what you think to include. The problem is that most people do not know what they do not know.

For example, you might not realize that a rental property you own with a family member creates joint tenancy issues that affect your trust. You might not think to mention that your spouse was married before, which could impact community property characterization. You might not know that certain retirement account beneficiary designations override your trust provisions entirely. An AI tool will not ask about these scenarios because it does not know to look for them.

This creates a dangerous gap. The AI produces a document that appears complete and professional, but it may be missing critical provisions because you simply did not know what information was relevant. By the time these gaps are discovered, often after death, it is too late to fix them.

AI-Generated vs. Attorney-Prepared Estate Plans: A Comparison

Factor | AI-Generated Documents | Attorney-Prepared Plan |

Upfront Cost | $0 to $500 | $2,500 to $5,000 typical |

California-Specific Knowledge | Generic nationwide templates may miss community property rules | Tailored to California Probate Code and community property requirements |

Execution Guidance | Generic instructions; no supervision of signing | Supervised signing ceremony; ensures Probate Code compliance |

Trust Funding | Minimal or no guidance; may result in unfunded trusts | Comprehensive funding assistance; deeds prepared; accounts retitled |

Personal Situation Analysis | Generic questionnaire; may not identify unique issues | Detailed consultation; identifies tax, family, and asset issues |

Ongoing Support | None; no relationship after document generation | Available for questions, periodic reviews, and updates as laws change |

Cost If Documents Fail | $46,000+ in probate fees for $1M estate; 12-18 month delay | Probate avoided; private administration in weeks or months |

Information Gathering | Limited to questions you know to ask; gaps in coverage likely | Comprehensive intake process; attorney asks probing questions to uncover all relevant issues |

Professional Accountability | No accountability; AI has no professional license or liability | Attorney bound by professional responsibility rules; accountable for work product |

What You Are Really Paying an Estate Planning Attorney For

When you invest in professional estate planning, you are not simply paying for document generation. You are paying for peace of mind that comes from three essential protections that AI cannot provide.

First, you are paying for comprehensive information gathering. An experienced California estate planning attorney knows the right questions to ask, many of which you would never think to raise yourself. They will inquire about your entire financial picture, family dynamics, potential creditor issues, business interests, prior marriages, and dozens of other factors that affect how your estate plan should be structured.

They have seen countless situations where seemingly minor details created major problems, and they know how to identify and address those issues proactively.

Second, you are paying for the security of knowing your documents will work when the time comes. An attorney takes responsibility for ensuring documents comply with California Probate Code requirements, that execution is properly supervised, and that your trust is actually funded.

This professional accountability provides assurance that your family will not face unexpected legal battles or costly probate proceedings because of a technical defect.

Third, you are paying for expert judgment that cannot be replicated by artificial intelligence. Estate planning involves nuanced decisions about tax optimization, asset protection, family harmony, and long-term planning.

An attorney can evaluate tradeoffs, anticipate problems, and craft solutions tailored to your unique circumstances. AI generates documents based on patterns in data; it cannot exercise professional judgment about what is best for your specific situation.

What Is the Real Cost of Using AI for Estate Planning?

While AI estate planning tools cost between $0 and $500, the actual cost of errors can exceed $50,000 when document failures require probate, create tax problems, or lead to family disputes that could have been prevented.

The math seems simple at first. A comprehensive estate plan from a qualified California estate planning attorney typically costs $2,500 to $5,000. An AI-generated document might cost $200 or less. That is a savings of $2,000 or more.

But consider what happens when problems arise. For a California estate with $1,000,000 in gross assets (a common situation in San Diego County, given property values), statutory probate fees under Probate Code Section 10810 total approximately $46,000 for both attorney and executor. Additional costs for appraisals, court fees, and administration can add another $5,000 to $15,000.

The savings from using AI documents evaporates entirely if those documents fail. Worse, the estate pays far more than it would have paid for proper planning. Families also lose 12 to 18 months or longer while the probate process is completed.

Additionally, if you use AI to generate documents and then ask an attorney to review them, expect to pay more than you would for original drafting. Reviewing AI-generated documents requires the attorney to carefully analyze what the AI produced, identify errors or omissions, assess whether the document can be salvaged, and determine what corrections are needed.

This process typically takes longer than starting fresh with a comprehensive intake and drafting documents specifically designed for your situation.

Many attorneys find that the time required to review, correct, and validate AI-generated documents exceeds the time they would spend creating proper documents from scratch, resulting in higher overall costs for clients who attempted the DIY approach first.

Are There Any Situations Where AI Estate Planning Tools Are Appropriate?

AI tools may help with basic estate planning education and identifying what questions to ask, but should not be used as a substitute for professional legal advice. Particularly in California where stakes are high and legal requirements are complex.

AI can be genuinely useful for learning basic concepts before meeting with an attorney. Understanding terms like “revocable trust,” “pour-over will,” or “power of attorney” helps you ask better questions and make more informed decisions. Some people use AI to draft initial thoughts about asset distribution before refining those wishes with professional guidance.

However, using AI to generate final legal documents that will govern your family’s financial future is a different matter entirely. Even if you have a seemingly simple situation, California’s unique laws mean that professional review is essential.

If your estate is valued below the California small estate threshold of $208,850 (effective April 1, 2025), you have no minor children, and you have no real property, the consequences of document errors are lower. But even then, an improperly drafted healthcare directive or power of attorney can create significant problems during incapacity.

What Should California Residents Look for in Professional Estate Planning?

When choosing estate planning assistance, California residents should work with attorneys who demonstrate specific knowledge of California Probate Code, community property rules, and local court procedures, and who take time to understand your individual circumstances.

Professional estate planning involves much more than generating documents. A qualified California estate planning attorney will conduct a thorough review of your assets, family situation, and goals.

They will identify potential issues like blended family complications, special needs beneficiaries, proper use of the rule against perpetuities, or business succession concerns that generic AI tools cannot recognize.

Look for an attorney who explains not just what documents you need, but why you need them and how they work together. Your estate plan should include a trust funding process to ensure assets are properly titled. The attorney should also provide guidance on beneficiary designations for retirement accounts and life insurance, which pass outside of your trust or will.

Most importantly, choose someone who will be available when questions arise. Estate planning is not a one-time event. Life changes, laws change, and your plan needs periodic review to remain effective.

Frequently Asked Questions About AI and Estate Planning

AI tools can generate estate planning documents, but cannot ensure proper execution under California Probate Code Section 6110, and cannot guarantee they will cover the client’s specific needs. The document must be properly signed and witnessed according to specific requirements. AI cannot supervise this process or verify compliance, and execution errors can invalidate the entire document.

Typically not until after your death, which is precisely the problem. Document defects may only become apparent when someone tries to use them. By then, you are not available to clarify your intentions or execute corrected documents. Your family must then navigate probate court to resolve issues you could have prevented.

Not necessarily. A defective trust can create problems worse than having no plan at all. It may create false confidence that everything is handled, leading families to skip proper planning. It can also create confusion about asset ownership and distribution that complicates probate rather than avoiding it.

California community property rules require proper characterization of marital assets, specific provisions for disposition at death, and coordination with tax planning opportunities. AI tools trained on general U.S. law may miss these requirements entirely, potentially creating unintended disinheritance or forfeiting valuable tax benefits.

Assets not transferred into the trust before death must pass through probate, completely defeating the purpose of creating a trust. In California, probate for a $1,000,000 estate costs approximately $46,000 in statutory fees alone. This is a frequent failure we encounter with AI-generated estate plans.

Potentially yes (depending on when you talk to the attorney), but it typically costs more than starting fresh with properly drafted documents. Reviewing AI-generated documents requires identifying errors, assessing what can be salvaged, and creating amendments or entirely new documents. Many attorneys find it more efficient to start over with a comprehensive plan tailored to your situation.

Online document services use questionnaires and templates rather than generative AI, but face similar limitations. They cannot evaluate your specific situation, cannot ensure proper execution, and may not provide adequate guidance on trust funding. California residents face the same risks of invalid documents and unexpected probate.

Comprehensive estate planning in the San Diego County area typically ranges from $2,500 to $5,000 for a complete plan including a revocable living trust, pour-over will, powers of attorney, healthcare directives, and trust funding assistance. More complex situations involving business interests, blended families, or tax planning may cost more.

When an attorney reviews AI-generated documents, they must carefully examine every provision to identify errors, omissions, and potential problems. This detailed analysis takes more time than the structured process of gathering your information and drafting documents designed specifically for your situation. The attorney cannot assume anything in the AI document is correct and must verify compliance with California law throughout. Additionally, correcting errors often requires significant restructuring rather than simple edits, adding further time and cost.

Protecting Your California Family the Right Way

The appeal of AI estate planning tools is understandable. They promise to save money and time on a task nobody enjoys thinking about. But estate planning is fundamentally different from other document creation tasks. The consequences of errors do not appear until the document creator is gone and cannot fix them.

For California residents, with our unique community property laws, high real estate values, and expensive probate system, the stakes are simply too high. An investment of a few thousand dollars in proper planning protects your family from potential costs of $50,000 or more, plus months or years of delay and uncertainty.

The peace of mind that comes from knowing an experienced professional has asked all the right questions, anticipated potential problems, and created documents that will work when your family needs them is invaluable. AI cannot provide that assurance because it does not know what it does not know, and it has no accountability for errors. When you invest in professional estate planning, you are investing in security for your family’s future.

If you have questions about whether your existing estate plan (AI-generated or otherwise) adequately protects your family, speaking with a qualified California estate planning attorney can provide clarity and peace of mind.

Ready to protect your family with a properly drafted California estate plan? Contact Opelon LLP at (760) 278-1116 to schedule a consultation. We serve families throughout Carlsbad, San Diego County, and the surrounding communities of Oceanside, Encinitas, San Marcos, Escondido, Vista, Del Mar, La Jolla, and Poway.

Legal Disclaimer

This article provides general information about California estate planning law and is for educational purposes only. It does not constitute legal advice and does not create an attorney-client relationship. Estate planning laws are complex and change frequently. The information in this article was accurate as of January 2026. For advice about your specific situation, please consult with a qualified California estate planning attorney.

About the Author

Matt Odgers, Esq. is Co-Founding Partner at Opelon LLP in Carlsbad, California, where he oversees marketing and operations. A San Diego County native who grew up in Ramona, Matt earned his J.D. from Thomas Jefferson School of Law and holds a B.A. in Political Science from Purdue University. He has been recognized by Best Lawyers: Ones to Watch in America (2026) and Super Lawyers Rising Stars.