Key Points

- An ILIT is an irrevocable trust used to hold a life insurance policy, providing liquidity to the insured’s estate free of federal estate taxes.

- The parties to an ILIT are 1) the Insured 2) the beneficiary and 3) The Trustee.

- ILITs are a great advanced estate planning tool for anyone who may have a taxable estate

What is a California Irrevocable Life Insurance Trust (ILIT)?

An irrevocable life insurance trust is an advanced estate planning vehicle intended to hold life insurance policies.

The main goal of an ILIT is to provide liquidity to the insured’s estate on the death of the insured and/or to pass death benefit proceeds to the insured’s beneficiaries free of federal estate taxes.

When the insured dies, the policy’s death benefit proceeds are held and/or distributed in accordance with the ILIT’s terms.

The Trustee of the ILIT is responsible for complying with the ILIT’s terms, but customarily is authorized to use the proceeds to lend money to or purchase assets from the insured’s estate.

Because the policy is owned and held by the ILIT’s Trustee, the policy’s death benefit proceeds are not subject to federal estate taxes.

They could, however, depending on how the ILIT is drafted, provide liquidity in the insured’s estate.

The same result can be achieved by making gifts of existing or newly purchased life insurance outright to responsible beneficiaries (e.g., adult children).

With that said, one significant benefit of using an ILIT is that you can appoint a Trustee who understands the importance of having liquidity to pay any taxes, debts, or other estate-related needs.

What if the Life Insurance Requires Regular Payments?

Customarily, the person who establishes the ILIT, usually a person insured by the policy, makes annual gifts to the Trustee of the ILIT to cover the policy’s premiums.

But, to avoid such gifts as counting against the insured’s lifetime gift tax exemption (in 2022, $12,060,000 per US Citizen), the annual gift of money to the Trustee must

- qualify as a “present interest gift” and

- be less than or equal to the annual gift tax exclusion (in 2022, $16,000 per US Citizen).

To qualify as a “present interest gift”, the beneficiaries of the ILIT must have the right (called a “Crummy withdrawal power”) to withdraw the gifted amount within a specified period of time.

Note that a married couple can “split” the gift.

This gives the Trustee of the ILIT twice the annual gift tax exclusion (i.e. $32,000 vs. $16,000) without having to pay gift taxes or have such amount counted against the donor’s lifetime exemption.

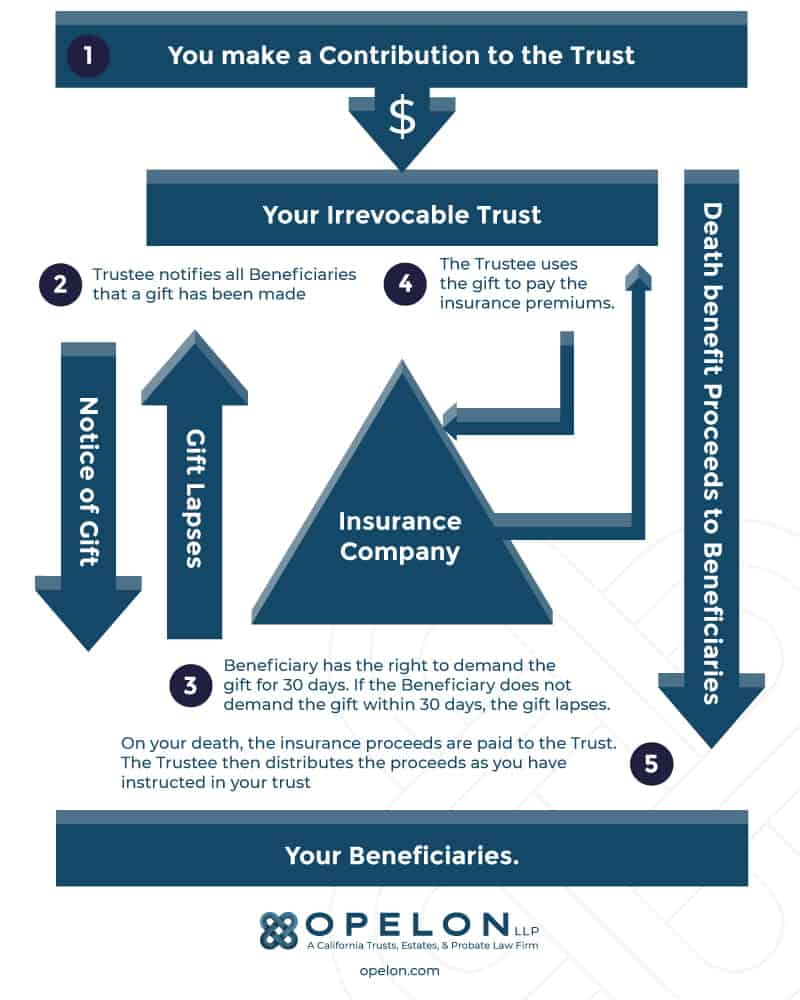

California ILIT Payment Process Chart

California Irrevocable Life Insurance Trust (ILIT) FAQ’S

What is an irrevocable life insurance trust?

The irrevocable life insurance trust is an advanced estate planning vehicle that can be used to hold death benefit proceeds for your beneficiaries.

Two of the significant benefits of an ILIT are

- An ILIT provides liquidity for the estate of the insured and

- is used to pass assets free from federal estate tax and California estate tax upon the insured’s death.

What if the Life Insurance Requires Regular Payments?

When a life insurance policy requires regular payments, the person who established the ILIT will usually make a cash gift to the trustee.

The trustee then uses the funds to pay the insurance policy premiums.

Does an ILIT trigger a Generation-Skipping Transfer Tax (GST)?

Even if the ILIT is not intended to be a generation-skipping trust, an unfortunate series of deaths may cause it to become one.

To prevent that, a portion of the insured’s GST Exemption could be allocated to the Irrevocable Life Insurance Trust by filing a Form 709 Federal Gift and Generation-Skipping Transfer Tax Return with the IRS.

Who are the parties involved in an ILIT?

The Insured:

The insured is generally the person who establishes the ILIT, thereafter called the “Settlor”, “Trustor” or “Grantor”.

Because the insured creates the ILIT, they determine the beneficiaries and the terms under which those beneficiaries receive the trust’s benefits.

Naturally, the insured is the person whose life is covered by any insurance policies owned by the Trust.

The Trustee:

The Trustee is the person designated to administer the ILIT.

The Trustee is tasked with the legal responsibility to

- pay insurance premiums,

- collect the death benefit proceeds when the insured dies, and

- distribute such proceeds to the beneficiaries in accordance with the terms of the ILIT.

The Trustee may be a professional trustee, the family attorney, a CPA, or a family member.

The spouse of the insured may be the Trustee, but it is essential that none of the money contributed to the ILIT belongs to the spouse and that the policy is not a second-to-die policy.

If the spouse owns any of the money contributed to the ILIT, a proportionate share of the insurance proceeds may be included in the spouse’s estate.

The Beneficiary:

Beneficiaries are the persons who ultimately receive the ILIT’s benefits according to the terms of the ILIT. There are usually two occasions when benefits are available to beneficiaries.

The first is during the life of the Grantor, whenever a gift is made to the trust, usually in the form of money, in an amount at least equal to the premium of any life insurance policy held by the trust.

Each beneficiary may withdraw their proportionate share of the contributed amount.

Usually, the power to withdraw must be exercised within a limited specific time frame.

If the beneficiary exercises the demand, the Trustee must distribute the beneficiary’s proportionate amount of the contributed money.

If the beneficiary does not, the Trustee pays the insurance premium after the withdrawal period expires.

This is called a “Crummey Power”, named after the tax case in which this issue was resolved.

The second is when the insured dies.

The life insurance proceeds pay into the trust and are managed and administered for the benefit of the beneficiaries as directed by the trust agreement.

Depending on the trust’s provisions, distributions may be made immediately, may be held for a certain period of time, or may be held for generations.

What Are the Special Requirements of a Generation-Skipping Trust?

Even if the trust is not intended to be a generation-skipping trust, an unfortunate series of deaths may cause it to become one.

As an example, if a child dies and a grandchild becomes the beneficiary of the deceased child’s share, a generation-skipping tax may be due on payments to the grandchild.

To prevent that, a portion of the insured’s Generation-Skipping Tax Exemption could be allocated to the ILIT by filing a Form 709 Federal Gift and Generation-Skipping Transfer Tax Return with the IRS.

If the non-gifting spouse has agreed to a gift split, that spouse must allocate his/her GST to the Irrevocable Life Insurance Trust.

In either case, the allocation equals the premiums. The child may also be given a general power of appointment and GST Exemption does not need to be allocated.

What is the Cash Flow Arrangement in a California Irrevocable Life Insurance Trust-ILIT?

As noted above, the insured typically contributes at least the premium to the ILIT each year.

The Trustee holds the funds during the withdrawal period and then makes the premium payments.

It is important that the insured contribute the funds to the ILIT to ensure the ILIT’s formalities are followed.

If the ILIT terms are not followed, the IRS may attempt to disregard the ILIT and include the insurance proceeds in the insured’s estate.

The IRS can also disallow the premiums from qualifying for the annual gift tax exclusion.

If the insurance policy has cash value, it may be available to a spouse beneficiary for his or her health, education, maintenance, or support (if the trust so provides).

When the insured dies, the trustee collects the proceeds, administers them, and distributes them in accordance with the ILIT’s terms.

Are the Premium Contributions to the ILIT a Taxable Gift by the Insured?

Yes. However, certain taxpayers may make annual gifts of “present interests” in an amount granted under IRC Sect. 2503(b) to other persons, and the gift is excluded from taxable gifts.

– presently $17,000 per year, per donee (2023).

That means US citizen (and domiciliary) spouses may contribute double the applicable amount per beneficiary.

If only one spouse is making the gift/insurance premium contributions, the other spouse can agree to a “gift split.”

Gift splitting means that the other spouse enables the gifting spouse to contribute up to double the relevant amount to the Trust for non-spouse beneficiaries and use the other spouse’s exclusion.

So, does that work for gifts to a trust?

In general, no. However, as discussed below, a Crummey demand right qualifies the contributed gift for treatment as a “present interest gift” for purposes of the annual exclusion.

What is an ILIT Crummy Withdrawal Power?

A Crummy withdrawal power provides that each time a contribution is made to the trust, the beneficiary has a temporary, but unconditional, right to demand a withdrawal of a specified amount from the trust.

This is referred to as the “Demand Right“.

If the Demand Right is not exercised within the withdrawal period, the annual transfer for that year remains in the trust for management by the trustee or can be used to pay the life insurance premiums.

If demanded, the trustee must deliver the funds to the beneficiary.

That said, the beneficiary should understand the rationale for an Irrevocable Life Insurance Trust (ILIT) and the benefits of not exercising the Demand Right.

Most beneficiaries recognize that such a withdrawal may affect the grantor’s decision to make future transfers to that trust.

In other words, if a beneficiary exercises their Demand Right, they will receive that year’s insurance premium…

However, if the beneficiary does not pay the premium, the policy will lapse and the Grantor will likely not make any future payments to the beneficiary.

Once the withdrawal right lapses, the trustee may use the funds contributed to pay premiums on the trust’s life insurance policies.

What is a Crummy Demand Right and How Does It Work?

Let’s assume the insured’s spouse and two children are the beneficiaries of the ILIT, and that the annual insurance premiums are $25,000.

In the Crummey case, the Irrevocable Life Insurance Trust gave the beneficiaries the right to demand from the trustee of the trust an amount equal to the respective beneficiary’s share of the annual contribution.

For technical reasons, the spouse should typically not have a demand right (i.e., the right to request a portion of the contribution) exceeding $5,000.

Therefore, under our assumed facts, the spouse has a right to demand from the trustee $5,000, and each child has the right to demand up to $10,000 (their share in the contributed amount).

Because beneficiaries have the right to demand that the trustee distribute their share of the contributions, the tax court has held that the contributions constitute a present interest gift.

Definition of Present Interest Gift: A gift that the recipient is free to use, enjoy, and benefit from immediately with no strings attached.

If the insured contributes to an existing policy, the demand right enables the beneficiaries to demand an interest in the policy.

Thus, it is necessary to coordinate the demands with the current year’s annual exclusion amount.

When Should You Use a California ILIT?

An ILIT is an excellent estate-planning tool for individuals (or couples) facing estate or death taxes and seeking to provide liquidity to pay those taxes through a life insurance policy.

All while avoiding estate or death taxes on the life insurance proceeds and compounding estate tax problems.

An ILIT also allows the insured to “leverage” annual exclusion gifts, lifetime credit against the gift tax, and the insured’s generation-skipping transfer (GST) tax exemption.

This happens when the insured makes gifts of policies that have a low current gift value in relation to their value at the insured’s death.

So who should use an ILIT?

If the donor does not have confidence that the recipients of the gifts will cooperate in retaining the policies (or their proceeds) and making them available to the donor’s estate for payment of taxes.

This would be an excellent time to consider setting one up.

Lastly, an ILIT is beneficial when the gifts are made to minor beneficiaries or beneficiaries who do not have the capacity or judgment to manage the policies/proceeds.

Can an ILIT be amended?

Irrevocable Trusts are permanent once they are created.

Unlike a standard Revocable Living Trust, an irrevocable trust may protect your assets from creditors and lawsuits.

In addition, when you transfer property into the irrevocable trust, that property is not added to the value of your estate for estate tax purposes.

Keep in mind, however, that the value of the transfer may decrease your annual lifetime gift exemption.

That said, California permits an irrevocable trust to be amended in certain circumstances.

What if I Already Have a Life Insurance Policy That I want to Put into an ILIT?

If the insured has a preexisting policy, that policy may be contributed to the ILIT. However, there are a few added wrinkles.

First, a value must be determined to determine how much of the lifetime gift tax exemption is used in the year the existing policy is contributed.

Also, if you transfer an existing policy, you must survive three years from the date of the transfer to be able to exclude the insurance proceeds from your estate.

If you don’t, then the full value of the death proceeds may be included in your taxable estate.

Does an ILIT have to file an income tax return?

Not usually. A trust does not have to file an income tax return unless it has gross income in excess of $600 or any taxable income.

If the premium contributions are not placed in an interest-bearing account, most ILITs will not have any income. If this is the case, then no income tax return is needed.

If, on the other hand, income is being earned by the ILIT (e.g., interest is being earned on cash in the bank), the ILIT may be able to pay for the trustee’s administration to offset any taxable income.

The ILIT will need to obtain a taxpayer identification number in case a return is required.

The IRS may send the trustee a request for a tax return, but it may be sufficient to write to the IRS and state there was no gross income.

What Happens If The Beneficiary Demands The Money to be Paid to Them?

If the beneficiaries demand payment, the Trustee must pay it to them. This can trigger a number of unexpected and undesirable events.

The insurance policy may lapse if there are not sufficient funds to pay the premiums. With the life insurance policy lapsed, the beneficiaries would receive no future benefit.

Depending on your health at the time, you may be uninsurable, and your demanding beneficiaries have just removed an essential and valuable element of your estate plan.

Beneficiaries must understand that, although their right to withdraw is real, they should ignore that right and allow it to lapse.

What Should be Included in The Notice to the Beneficiaries Letter?

Generally, the notice needs to include the amount of the contribution and a statement that the beneficiary has a right to the lesser of:

- the beneficiary’s pro-rata share of the contribution or

- The amount of the annual gift tax exclusion available to the insured for that year for that beneficiary.

For example, let’s assume a married Grantor with two children makes a $40,000 contribution. The spouse limit is $5,000, so the remaining $35,000 is $17,500 per child.

However, because the demand right is limited as described above, each child can withdraw only $17,000.

The amount of the contribution in excess of the annual gift exclusion must be charged against the Grantor’s lifetime gift exclusion (presently $12.92 million in 2023).

Finally, the notice must include a description of when the demand right lapses.

We have provided a sample Demand Right Notification below for your reference.

Sample ILIT “Notice of Demand Right” Letter

ILITs are a Great Estate Planning Tool When Done Right.

If you are concerned that your estate may exceed the death tax or federal exemption amount, give us a call to discuss and take a look at our estate planning checklist.

Opelon LLP works with estate planning clients throughout California on wills, trusts, power of attorneys, and advanced planning.

We are happy to sit down with clients to discuss the benefits of advanced estate planning.