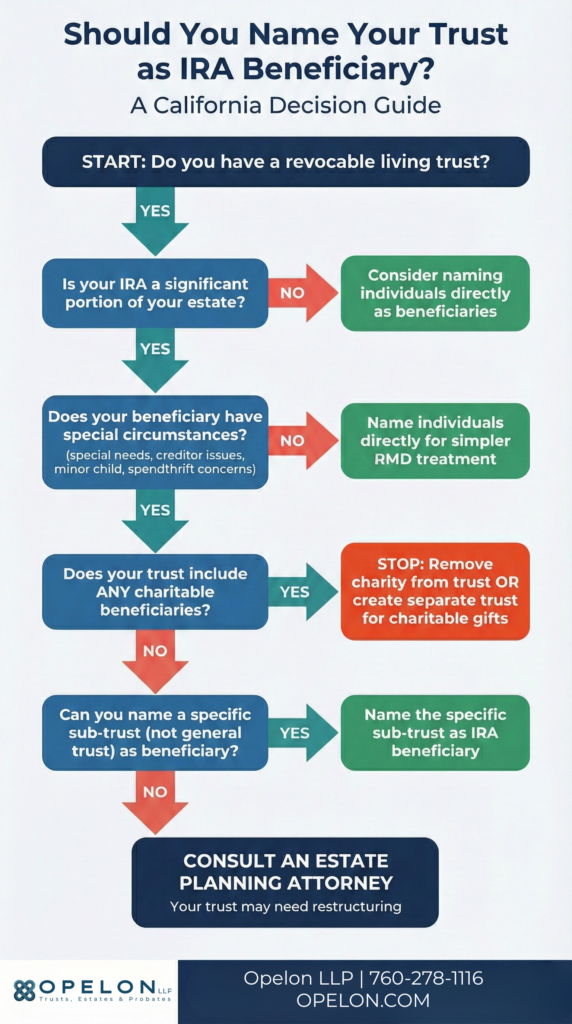

You have a revocable living trust to protect your family and retirement accounts to secure your future. But have you considered how these two pieces of your California estate plan work together?

If you named your trust as the beneficiary of your IRA or 401(k), you may have created problems with Required Minimum Distributions (RMDs). Depending on your facts and the account terms, these issues can increase taxes, accelerate distributions, or create administrative complications.

This is a common coordination issue. With careful planning, you may be able to structure beneficiary designations to better align with your goals, including creditor protection and tax efficiency, depending on your circumstances.

KEY TAKEAWAYS Quick facts before you read on: • Retirement accounts pass by beneficiary designation, not through your trust. • In many cases, the SECURE Act requires non-spouse beneficiaries to distribute inherited IRA assets by the end of the 10th year after death, subject to exceptions and additional rules that can require annual distributions in some situations. • A trust must meet four IRS see-through requirements to keep favorable distribution rules. • July 2024 IRS final regulations (T.D. 10001) addressed separate accounts and certain trust-related distribution rules; whether and how a “sub-trust” approach applies depends on the plan, the trust terms, and timely post-death administration. • Naming individuals directly often produces better tax results than naming your trust. |

Why RMDs and Trust Beneficiary Designations Matter

Retirement accounts like IRAs and 401(k)s pass by beneficiary designation. They do not pass through your trust document. If you name your trust as beneficiary, the IRS applies special rules that affect how quickly your heirs must take distributions.

Many California families assume all assets should flow through their trust. That approach works well for real estate, bank accounts, and brokerage accounts. Retirement accounts are different.

IRAs already avoid probate through beneficiary designations. The main reason to name a trust is to control when your heirs receive the funds. The trade-off is that the IRS may impose faster distribution timelines. This coordination step belongs on every estate planning checklist.

How the SECURE Act Changed Trust RMD Rules

The SECURE Act of 2019 and SECURE 2.0 Act of 2022 changed how inherited IRAs work. Before these laws, beneficiaries could stretch distributions over their lifetime. Now, most non-spouse heirs must empty inherited accounts within 10 years.

Who Can Still Use Lifetime Distributions?

Only “eligible designated beneficiaries” can still stretch distributions. This is a limited group:

- Surviving spouses.

- Minor children of the account owner (until age 21, then the 10-year rule starts).

- Disabled or chronically ill beneficiaries under IRS rules.

- Beneficiaries not more than 10 years younger than the account owner.

For trusts, the IRS looks through the trust to find the underlying beneficiaries. If the trust does not meet specific requirements, stricter rules apply. Including a non-individual beneficiary such as a charity can also trigger less favorable treatment.

How the 10-Year Rule Works for Annual RMDs

For most non-spouse beneficiaries, the distribution rules depend on when the original owner died. Specifically, it matters whether the owner died before or after their required beginning date (RBD).

Scenario | Annual RMDs in Years 1-9? | Year 10 Deadline |

Owner died on or after RBD | Yes, based on beneficiary life expectancy | Entire account must be emptied |

Owner died before RBD | No annual RMDs required | Entire account must be emptied |

IMPORTANT The IRS provided penalty relief for certain missed annual RMDs for 2021 through 2024 in limited circumstances (see, e.g., Notice 2024-35 and related guidance). Starting in 2025, missing an RMD may trigger a 25% excise tax on the shortfall. SECURE 2.0 reduced this from 50%. The tax drops to 10% if corrected within the applicable correction window. |

Current RMD Starting Ages Under SECURE 2.0

SECURE 2.0 raised the RMD starting age. Generally, individuals who attain age 72 after 2022 have an RMD age of 73, and the age is scheduled to increase to 75 for individuals who attain age 74 after 2032 (subject to future legislative or regulatory changes).

5 Common Mistakes When Naming a Trust as IRA Beneficiary

Naming your trust as IRA beneficiary is not always wrong. But doing it incorrectly creates real tax consequences. Here are the five mistakes we see most often with California families.

Mistake 1: Naming the General Trust Instead of Specific Sub-Trusts

When you name “The Smith Family Trust” as your IRA beneficiary, the IRS looks at all potential trust beneficiaries. If your trust includes children, grandchildren, and contingent beneficiaries, the full group affects the distribution analysis.

One approach may be to name beneficiary-specific subtrusts (or separate trusts) where appropriate. For example, you might name “Trust for John Smith under the Smith Family Trust” as one IRA’s beneficiary if the plan and trust terms support that structure. An experienced San Diego estate planning attorney can help evaluate and implement beneficiary designations.

2024/2025 REGULATORY UPDATE The July 2024 final IRS regulations (T.D. 10001) address separate accounts and certain trust-related distribution rules; whether a particular “sub-trust” structure is permitted and effective depends on the plan document, the trust terms, and proper administration. Each sub-trust may apply its own distribution schedule if divided immediately upon the owner’s death. The division must happen by December 31 of the year after the year of death. |

Mistake 2: Including Non-Individual Beneficiaries in the Trust

If your trust names a charity as a potential beneficiary, even as a contingent remainder, the trust may lose its “designated beneficiary” status. Under IRS rules, only individuals can be designated beneficiaries.

The result can be less favorable distribution treatment. In some cases, if the owner dies before their RBD and there is no designated beneficiary, the account may be subject to a shorter payout period (often described as a “five-year rule”), which can accelerate taxable income depending on the beneficiary’s situation.

2024/2025 REGULATORY UPDATE The 2024 final regulations allow certain charities to be disregarded in limited situations. This depends on the trust structure and the status of the primary beneficiary. Any charitable language should be reviewed for retirement account planning. |

Mistake 3: Failing to Meet See-Through Trust Requirements

For a trust to qualify as “see-through” (or “look-through”), it must meet four rules under Treasury Regulation 1.401(a)(9)-4(f):

- The trust must be valid under state law.

- The trust must be irrevocable, or become irrevocable at the owner’s death.

- The trust’s beneficiaries must be identifiable from the document.

- Documentation must reach the plan administrator by October 31 of the year after the owner’s death.

If any requirement is missed, the IRS cannot look through the trust. Less favorable distribution rules apply. An attorney should review the trust and beneficiary designation together. Learn more about how trust administration works in California.

Mistake 4: Not Understanding Conduit vs. Accumulation Trusts

Even if your trust qualifies as see-through, the trust type matters. There are two main structures.

A conduit trust requires the trustee to pass all IRA distributions to the beneficiary immediately. An accumulation trust lets the trustee hold distributions inside the trust.

With accumulation trusts, the IRS may consider a wider group of potential beneficiaries. This can result in faster taxation or less flexibility. The choice between conduit and accumulation requires careful analysis. Understanding the role of a trustee helps when making this decision.

Mistake 5: Ignoring the Beneficiary Class Analysis

After the SECURE Act, the “oldest beneficiary” rule still matters in some trust situations. But it no longer works the way many older articles describe. Most non-spouse heirs now face the 10-year rule regardless of age.

The analysis changes when an eligible designated beneficiary is involved. The presence of older or non-qualifying beneficiaries can shorten the distribution period. Splitting accounts and using beneficiary-specific sub-trusts simplifies administration.

2024/2025 REGULATORY UPDATE The July 2024 regulations clarify the use of separate sub-trusts for distribution purposes. Separate accounting must be set up by December 31 of the year after death. The beneficiary designation and trust language must be reviewed together. |

When Naming a Trust as IRA Beneficiary Makes Sense

Despite the complications, there are valid reasons to name a trust. The key is making sure the trust is drafted correctly for retirement assets.

- Special needs beneficiary: A special needs trust can receive IRA distributions without affecting SSI or Medi-Cal eligibility.

- Creditor protection: Inherited IRAs have limited creditor protection in California. A trust can provide stronger security.

- Minor beneficiary: A trust manages distributions until the child reaches a specified age. If you are naming a guardian for your children, coordinate IRA designations with guardianship provisions.

- Substance abuse or spending concerns: A trust can limit access to funds. Read about planning for an estate beneficiary with addiction issues.

- Blended family: A trust ensures a surviving spouse receives income while children from a prior marriage keep the principal. See estate planning for blended families.

- Asset protection: Trust provisions can shield inherited retirement funds from divorce or civil judgments.

How to Coordinate Your IRA Beneficiaries with Your California Trust

The best approach depends on your family’s situation. These steps walk through a complete review of your IRA beneficiary designations.

- Gather your current designation forms. Contact each financial institution and request copies. Many people find outdated forms from decades ago.

- Review your trust document. Identify all beneficiaries, any charitable provisions, and how sub-trusts are created at your death.

- Decide whether a trust is needed for each account. If your heirs have no creditor or spending concerns, naming a beneficiary directly may produce better tax results.

- Name specific sub-trusts when a trust is needed. Work with your attorney to identify the correct sub-trust for each retirement account.

- Split IRAs for multiple beneficiaries. Creating separate accounts during your lifetime simplifies the analysis and avoids class rule problems.

- Update designations in writing. Complete new forms with each institution. Keep copies with your estate planning documents. See our guide on where to store estate planning documents.

- Review every three to five years. Also review after any major life event such as marriage, divorce, or the birth of a child.

Frequently Asked Questions: RMDs and Trust Beneficiaries

The IRA may be treated as having no designated beneficiary. Depending on whether death occurs before or after the required beginning date and on the type of account and beneficiary, the applicable payout rule may be accelerated (often described as a “five-year rule” in certain cases) or based on the decedent’s remaining life expectancy. Either outcome can accelerate distributions and increase taxes compared to other beneficiary structures, depending on the facts.

Generally no. The spousal rollover is available only when a spouse is the direct IRA beneficiary. If a trust is named, the surviving spouse typically cannot roll the IRA into their own account. If rollover flexibility matters, name the spouse directly.

Roth IRAs have no RMDs during the original owner’s lifetime. However, inherited Roth IRAs follow the same post-death rules as traditional IRAs. Non-spouse heirs must empty an inherited Roth IRA within 10 years. The distributions are tax-free, but the timeline still applies.

Converting a traditional IRA to a Roth removes the income tax burden from your heirs. You pay the tax now at your current rate. This may help if your beneficiaries will be in higher brackets. Consult a tax advisor about whether this fits your situation. Learn about the current federal estate tax exemption amount and how it may affect your planning.

SECURE 2.0 reduced the excise tax from 50% to 25% of the missed amount, and it may be reduced to 10% if corrected within the applicable correction window and other requirements are met. For example, a missed $50,000 RMD could result in a $12,500 excise tax at 25%, or $5,000 at 10% if timely corrected and eligible. Trustees should track RMD deadlines carefully and consult a tax advisor regarding correction procedures.

Review designations when you update your estate plan, after major life events, and every three to five years at minimum. Beneficiary designations override your will and trust. Many people create a comprehensive California estate plan but never update their retirement account forms.

SECURE 2.0 section 327 (effective 2024) lets a surviving spouse elect to be treated as the deceased employee for RMD purposes. This election allows delayed RMDs, use of the more favorable Uniform Lifetime Table, and avoidance of the 10% early withdrawal penalty. The spouse can still do a spousal rollover later.

Next Steps: Protecting Your California Family

Coordinating retirement accounts with your California estate plan takes attention to IRS rules, beneficiary forms, and your family’s specific goals. The mistakes in this article are common, but they are preventable.

If you have a revocable trust and significant retirement accounts, a beneficiary review is often advisable. An experienced attorney can help identify coordination issues before they become costly. Depending on your situation, updates may reduce taxes or administrative burdens, but outcomes are not guaranteed.

Opelon LLP helps families throughout San Diego County, including Carlsbad, Oceanside, Encinitas, and surrounding North County communities. Call (760) 278-1116 or visit opelon.com to schedule a consultation.

Legal Disclaimer

This article provides general information about IRS RMD rules and California estate planning. It is for educational purposes only. It does not constitute legal or tax advice and does not create an attorney-client relationship. This communication may be considered attorney advertising. No outcome is guaranteed; results depend on the facts of each matter, and any prior results are not a guarantee of a similar outcome.

RMD rules change frequently. This article is intended to reflect generally applicable federal rules and guidance as of March 2026, including the July 2024 final IRS regulations (T.D. 10001), but it may not reflect later developments or your specific plan terms. Consult a qualified attorney and tax advisor before making decisions based on this information.

About the Author

Matt Odgers, Esq. is a Founding Partner at Opelon LLP, a trust, estate, and probate law firm in Carlsbad, California. A San Diego County native who grew up in Ramona, Matt earned his J.D. from Thomas Jefferson School of Law.

His recognitions include Best Lawyers: Ones to Watch in America (2026) and the Carlsbad Chamber of Commerce 40 Under 40 (2023). He was also named a Super Lawyers Rising Star in 2017, 2018, and 2019. California State Bar No. 290722.

Last Updated: March 2026