Navigating the intricacies of estate planning can feel like navigating a labyrinth without a map.

Yet, ensuring a smooth transition of your assets and protecting your loved ones’ future is paramount. You might wonder, “Where do I even start?”

Fear not. Whether you’re a young adult, a retiree, or somewhere in between, a well-crafted plan is within your reach.

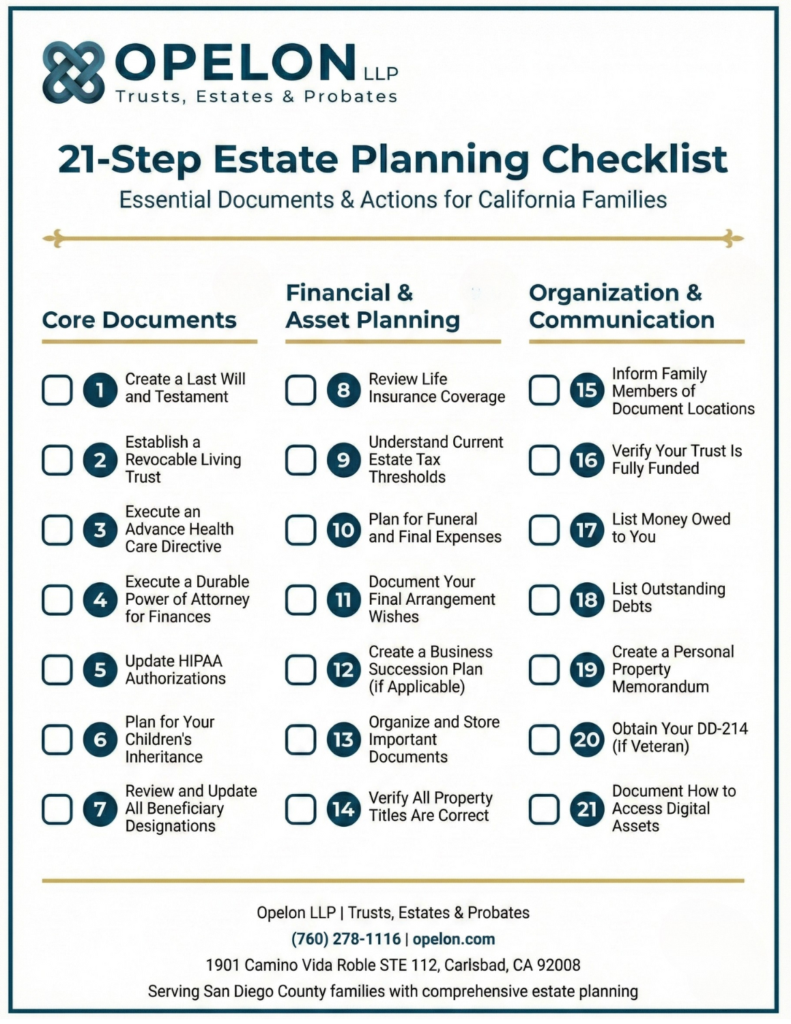

Estate Planning Checklist Key Takeaways

- California homeowners with property over $208,850 should prioritize creating a revocable living trust to help their families avoid the lengthy probate process.

- Every adult needs four core documents: a will, trust (if applicable), advance health care directive, and durable power of attorney for finances.

- Beneficiary designations on retirement accounts and life insurance override your will or trust, so review them annually.

- A funded trust only works if your assets are actually transferred into it. Creating the document is step one; funding it is equally important.

- Digital assets, including cryptocurrency, online accounts, and social media, now require specific planning under California law.

Why Every California Family Needs an Estate Plan

If you own a home in California, have children, or simply want control over what happens to your assets and medical care, estate planning is not optional. It is essential.

Many families assume estate planning is only for the wealthy. The reality is different. In California, if your estate exceeds $208,850 in value (the threshold effective April 1, 2025), your family will face full probate without proper planning. For most San Diego County homeowners, that threshold is easily exceeded by home equity alone.

This checklist walks you through 21 essential steps to protect your family, your assets, and your wishes. Whether you are just starting or updating an existing plan, use this guide as your roadmap.

Core Estate Planning Documents

Checklist for Estate Planning in California

(each checkmark below expands)

Step 1. Create a Last Will and Testament

A will is a legal document that specifies how you want your assets distributed after death. In California, a valid will must be in writing, signed by you, and witnessed by two adults who are present at the same time (California Probate Code Section 6110).

Your will also allows you to name a guardian for minor children, an executor to manage your estate, and can specify funeral wishes. Without a will, California’s intestate succession laws determine who inherits your property, which may not align with your wishes.

Wills are relatively inexpensive to set up, however, they only provide for the transfer of assets after death. Additionally, Wills must still undergo probate, a time-consuming and costly process.

Step 2. Establish a Revocable Living Trust

A Revocable living trust is a legal arrangement where you transfer ownership of your assets to the trust during your lifetime. You maintain complete control as the trustee and can change or revoke the trust at any time.

The primary benefit for California families is probate avoidance. Assets held in a properly funded trust pass directly to beneficiaries without court involvement. This saves time (California probate typically takes 12 to 18 months) and reduces costs (statutory probate fees on a $1 million estate exceed $46,000).

Step 3. Execute a Advance Health Care Directive

An Advanced health care directive, combines two important functions: it names someone to make medical decisions if you cannot (health care agent), and it documents your wishes about life-sustaining treatment, pain management, and organ donation.

California law requires this document to be signed and either witnessed by two qualified adults or notarized (California Probate Code Section 4701). Without this document, your family may need to petition the court for a conservatorship just to make medical decisions on your behalf.

Step 4.Execute a Durable Power of Attorney for Finances

A durable power of attorney authorizes someone you trust (your agent) to handle financial matters on your behalf. The word “durable” means the authority continues even if you become incapacitated.

This document allows your agent to pay bills, manage investments, file taxes, and handle real estate transactions. California requires notarization for this document to be effective for real property transactions.

Step 5. Update HIPAA Authorizations

HIPAA (Health Insurance Portability and Accountability Act) protects your medical privacy. A HIPAA authorization allows specific individuals to access your medical records and communicate with your health care providers.

While your advance health care directive may include some HIPAA language, a separate authorization form ensures your family members and agents can obtain medical information when needed, even before you become incapacitated

Step 6. Plan for Your Children's Inheritance

If you have minor children, your estate plan should address who will raise them (guardian nomination) and how their inheritance will be managed until they reach an appropriate age.

Many parents choose to hold children’s inheritances in trust until age 25 or 30, rather than distributing everything at 18. This protects young adults from making impulsive financial decisions while still providing for their education and needs.

Step 7.Review and Update All Beneficiary Designations

Beneficiary designations on retirement accounts (401(k), IRA), life insurance policies, and payable-on-death accounts pass directly to the named beneficiary, regardless of what your will or trust says. This makes reviewing these designations critical.

Common problems include outdated beneficiaries (ex-spouses, deceased relatives), designations that conflict with your trust, or missing contingent beneficiaries. Review these forms annually and after any major life change.

Step 8. Review Life Insurance Coverage

Life insurance provides immediate funds for your family after your death. Common uses include replacing lost income, paying off a mortgage, funding children’s education, and covering estate settlement costs.

Review your coverage amount to ensure it meets your family’s current needs. For larger estates, consider whether an irrevocable life insurance trust (ILIT) makes sense to keep proceeds outside your taxable estate.

Step 9. Understand Current Estate Tax Thresholds

The federal estate tax exemption for 2025 is $13.99 million per person ($27.98 million for married couples using portability). California does not impose a separate state estate or inheritance tax.

The current federal exemption is scheduled to decrease significantly after 2025 when provisions of the Tax Cuts and Jobs Act expire. Families with estates approaching these thresholds should consult with qualified tax professionals about planning strategies.

Step 10. Plan for Funeral and Final Expenses

Funeral and burial costs in San Diego County typically range from $7,000 to $15,000 or more. These expenses are due immediately, often before your family can access other assets.

Consider setting aside funds in a payable-on-death account specifically for final expenses, or discuss prepaid funeral arrangements with your family. Document your preferences for burial versus cremation, service type, and any specific wishes.

Step 11. Document Your Final Arrangement Wishes

Beyond financial planning, your family needs to know your preferences for funeral services, burial or cremation, religious or cultural customs, and any specific requests. These instructions should be kept separate from your will (which may not be located immediately).

Step 12. Create a Business Succession Plan (If Applicable)

If you own a business, your estate plan must address what happens to the business upon your death or incapacity. Questions to consider include: Who will run the business? Will it be sold? How will ownership transfer to family members or business partners?

A buy-sell agreement, proper entity structuring, and coordination with your personal estate plan are essential for business owners.

Step 13. Organize and Store Important Documents

Gather all important documents in one secure location. This includes your estate planning documents, deeds, titles, insurance policies, tax returns, financial account statements, and identification documents.

Consider a fireproof safe at home for original documents and a secure digital backup. Your successor trustee and executor should know where to find these materials.

Step 14. Verify All Property Titles Are Correct

Review how each asset is titled. Common issues include property still held in individual names (not the trust), incorrect ownership between spouses, and outdated deed records.

For real property, check your deed at the San Diego County Recorder’s Office or online. The title should reflect your trust ownership if you want to avoid probate on that property.

Step 15. Inform Family Members of Document Locations

Your estate plan only works if your family can find it when needed. Tell your successor trustee, executor, and health care agent where you store your documents. Consider providing them with copies of key documents now.

Step 16. Verify Your Trust Is Fully Funded

A revocable living trust only avoids probate for assets actually transferred into the trust. This step, called “trust funding,” requires changing title on real estate, updating ownership on financial accounts, and assigning personal property to the trust.

An unfunded trust provides no probate benefit. Review your trust funding annually, especially after purchasing new property or opening new accounts.

Step 17. List Money Owed to You

Document any loans you have made to family members, friends, or others. Include promissory notes, repayment terms, and current balances. This ensures your executor or trustee can collect these amounts for your estate.

Step 18. List Outstanding Debts

Create a list of all debts including mortgages, car loans, credit cards, and any other obligations. Include account numbers, creditor contact information, and approximate balances. This helps your family manage your financial affairs efficiently.

Quick Tip: Requesting a free credit report can give you a handy list of creditors.

Step 19. Create a Personal Property Memorandum

A personal property memorandum is a separate document that specifies who should receive specific items of tangible personal property (jewelry, artwork, furniture, collectibles). California law allows this memorandum to be changed without amending your trust.

This document can prevent family disputes over sentimental items and ensures cherished possessions go to the people you intend.

It is important to work with an attorney to verify that your written wishes will be upheld.

Step 20. If You Are a Veteran, Obtain DD-214 and keep a copy with your Estate Planning Documents

If you are a military veteran, your DD-214 discharge document is essential for your family to access veterans’ benefits, burial in a national cemetery, and other services. Keep a certified copy with your estate planning documents.

Replacement copies can be obtained from the National Personnel Records Center, but this process takes time. Having the document readily available helps your family during an already difficult period.

Step 21. Document How to Access Digital Assets

Digital assets include email accounts, social media profiles, online banking, cryptocurrency, digital photos, and any online accounts with financial or sentimental value. California’s Revised Uniform Fiduciary Access to Digital Assets Act governs how fiduciaries can access these assets.

Create a secure list of accounts, usernames, and access instructions. Consider using a password manager and providing your successor trustee with access information. Specify in your estate plan how you want digital assets handled after death.

Estate Planning Checklist Infographic

Estate Planning Checklist Conclusion

Thank you for taking the time to read through our 21-step estate planning checklist as part of our estate planning 101 series. We hope that it has been beneficial and will help you organize and plan for the future.

If you have any questions about our estate planning checklist, please feel free to reach out to one of our firm’s estate planning attorneys in San Diego.

Your Next Step in Using this Estate Planning Checklist

Completing this checklist is a significant step toward protecting your family and legacy. If you have questions about your specific situation or would like help implementing your estate plan, Opelon LLP offers consultations for San Diego County families.

Our Carlsbad estate planning office serves families throughout North County San Diego, including Oceanside, Encinitas, San Marcos, Escondido, Vista, and the surrounding communities.