If someone you love has passed away, you may be wondering what happens to their property. This is where understanding probate vs non probate assets is critical.

In California, under probate law, some assets must go through probate, while others transfer directly to beneficiaries. If you’re wondering what does probate mean when someone dies or simply what is probate, we explain the basics below.

Understanding the difference between probate vs. non-probate assets can save your family months of waiting and thousands of dollars in court costs.

This article outlines Probate vs Non Probate Assets: Key Differences for California families.

Here in San Diego County, we help families in Carlsbad and throughout Southern California navigate probate after death, and we answer these questions every day.

This guide explains which assets require probate, which ones skip the process entirely, and how thoughtful planning can protect your loved ones. It also helps define probate in plain terms so you can make informed decisions.

Summary & Key Takeaways for Probate vs Non Probate Assets

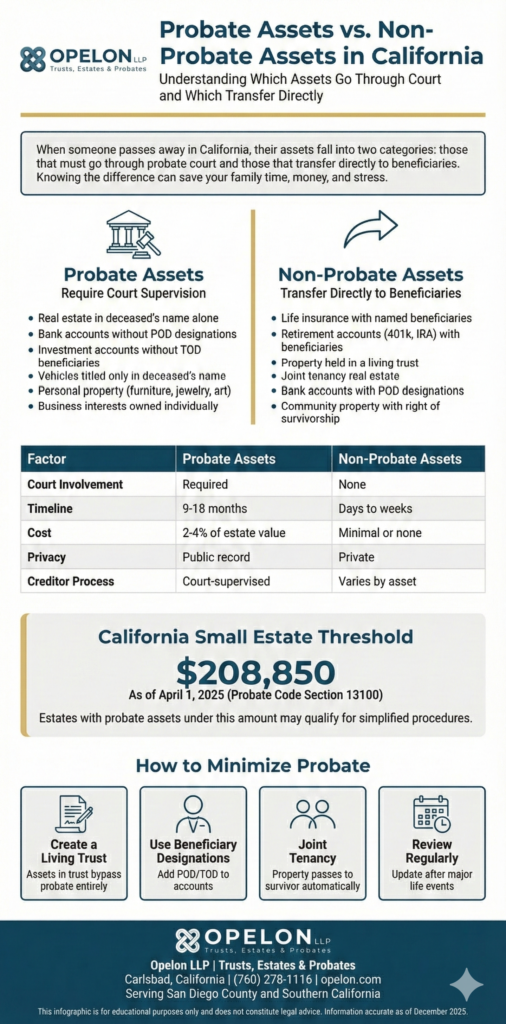

- Probate vs non probate assets determine whether property passes through court supervision or goes directly to beneficiaries, and which assets are subject to probate.

- California estates under $208,850 (as of April 1, 2025) may qualify for simplified small estate procedures under Probate Code Section 13100.

- Non-probate assets, such as life insurance, retirement accounts with beneficiaries, and jointly held property, transfer faster and more privately.

- Strategic estate planning can help most California families minimize or avoid probate entirely.

What Is Probate in California?

Probate is the court-supervised legal process for settling a deceased person’s estate.

If you’ve wondered what is probate or looked for a concise probate definition, you can define probate as the formal procedure by which the court oversees a decedent’s affairs and property.

Under California probate law, the probate court validates any will, appoints a personal representative, oversees payment of debts, and authorizes distribution of remaining assets to heirs or beneficiaries.

If you’re asking how does probate work or what happens in probate court, here’s the typical probate court process in California.

The probate process typically takes 9 to 18 months in California. During this time, the court oversees several important steps:

- Open probate, admit the will to probate (if one exists), and appoint a personal representative

- Inventory and appraisal all probate assets

- Notify creditors and allow four months for claims (per Probate Code Section 9100)

- Pay valid debts and taxes from estate funds

- Distribute remaining assets according to the will or California intestacy laws and obtain a probate order authorizing the final distribution.

In every case, courts admit wills to probate before property is distributed under a final order.

Probate can be expensive. California law sets statutory fees for attorneys and personal representatives based on the estate’s gross value, not the net equity.

For a probate estate worth $500,000, these fees alone can exceed $26,000.

What Are Probate Assets?

Probate assets are property owned solely in the deceased person’s name without a beneficiary designation or survivorship right.

These assets, often referred to as probate property, cannot be transferred to heirs without court authorization.

Common examples of probate assets include:

- Real estate titled in the deceased’s name alone (including probate property)

- Bank accounts without payable-on-death (POD) designations

- Investment accounts without transfer-on-death (TOD) beneficiaries

- Vehicles titled only in the deceased’s name

- Personal property like furniture, jewelry, and artwork

When a house is in probate, it means the real estate title cannot transfer until the court authorizes it (what does it mean when a property is in probate?).

This delay can affect sales, refinancing, and other property decisions for months.

What Are Non-Probate Assets?

Non-probate assets bypass the court process entirely and transfer directly to named beneficiaries.

This happens automatically, typically within days or weeks of death, without court involvement or public record. These assets are usually not part of the probate estate.

Common non-probate assets include:

- Life insurance policies with named beneficiaries

- Retirement accounts (401(k)s, IRAs) with designated beneficiaries

- Property held in a revocable living trust

- Real estate held as joint tenancy with right of survivorship

- Bank accounts with POD designations

- Community property with right of survivorship (for married couples)

The key advantage of non-probate assets is speed and privacy.

Your beneficiaries receive their inheritance without waiting for court approval, and the transfer remains off public record.

Probate vs Non Probate Assets: Key Differences

Understanding the differences helps you make informed estate planning decisions.

Factor | Probate Assets | Non-Probate Assets |

Court Involvement | Required | None |

Timeline | 9-18 months typical | Days to weeks |

Cost | Statutory fees (2-4% of estate) | Minimal or none |

Privacy | Public record | Private |

Creditor Protection | Court-supervised claims process | Varies by asset type |

Frequently Asked Questions about Probate vs Non Probate Assets

What does it mean when a house is in probate?

When a house is in probate, the title to the property is frozen until the court authorizes the transfer. The personal representative cannot sell, refinance, or transfer the property without court approval. In California, this process typically takes 9 to 18 months.

Do all estates have to go through probate in California?

No. Estates with probate assets valued at less than $208,850 (as of April 2025) may qualify for simplified procedures. Estates where all assets have beneficiary designations, are held in trust, or pass by survivorship rights, may avoid probate entirely regardless of total value.

What is the difference between probate and non-probate assets?

Probate assets are owned solely in the deceased’s name and require court supervision to transfer. Non-probate assets have a built-in transfer mechanism (beneficiary designation, joint ownership, or trust) that allows them to pass directly to recipients without court involvement.

How long does probate take in San Diego County?

Most probates in San Diego County take 9 to 18 months from filing to final distribution. Complex estates with real property sales, tax issues, or creditor disputes can take longer. The mandatory creditor claim period alone is four months.

Can a revocable living trust help avoid probate?

Yes. A properly funded revocable living trust is the most effective way to avoid probate in California. Assets held in the trust pass to beneficiaries in accordance with the trust terms, without court supervision, thereby saving time and money and maintaining privacy.

What happens if someone dies without a will in California?

When someone dies without a will (intestate), California law determines who inherits their probate assets. Typically, assets go first to a surviving spouse, then to children, then to other relatives. The probate court continues to supervise distribution pursuant to these intestacy laws.

When Is Probate Required in California?

Probate is generally required when someone dies, and their assets exceed California’s small estate threshold.

People often ask when is probate necessary; as of April 1, 2025, that threshold is $208,850 (this amount adjusts periodically for inflation under Probate Code Section 890).

However, probate may be required even for smaller estates in certain situations. These include contested wills, unclear ownership, or real property that doesn’t qualify for the small estate real property petition.

For estates under the threshold, California offers simplified procedures. The small estate affidavit (Probate Code Section 13100) allows heirs to collect personal property 40 days after death without court involvement. A separate petition exists for real property of small value (Probate Code Section 13200).

Worth knowing: assets with beneficiary designations, joint tenancy property, and trust assets don’t count toward the probate threshold. Your total estate might be worth millions, but if everything is structured correctly, none of it may require probate.

If you’re wondering what is the meaning of probate of will, it refers to the court’s acceptance of a will and supervision of the estate.

How to Minimize Probate Exposure

Strategic planning can help California families avoid probate in most cases, especially for property owners.

- Create a revocable living trust: Assets transferred to a properly funded revocable living trust bypass probate completely. This is the most comprehensive solution for California homeowners and is especially helpful for property owners navigating probate.

- Use beneficiary designations: Add POD designations to bank accounts and TOD designations to investment accounts. Ensure retirement accounts and life insurance have current beneficiaries.

- Consider joint tenancy: Property held as joint tenants with right of survivorship passes automatically to the surviving owner.

- Review your estate plan regularly: Beneficiary designations and property titles should be reviewed after significant life events like marriage, divorce, or the birth of children.

You may wonder why do you need probate, or why do you have to have probate, at all.

In some cases, it’s necessary to establish a clear title, resolve creditor claims under probate law, and ensure lawful distribution.

Planning Protects Your Family

Understanding the difference between probate vs non probate assets is the first step toward protecting your family from unnecessary delays and expenses.

With proper planning, most California families can ensure their assets transfer smoothly to loved ones.

Whether you’re creating an estate plan for the first time or helping settle a loved one’s estate, knowing how different assets are treated can make all the difference.

If you have questions about probate or estate planning in California, we’re here to help. Our Carlsbad office serves families throughout San Diego County and Southern California with estate planning, trust administration, and non-contested probate matters.

About the Author: Matt Odgers is a partner and Director of Operations at Opelon LLP in Carlsbad, California. With 13 years of experience, he focuses on estate planning, probate, and trust administration for families in San Diego County.

Matt earned his J.D. from Thomas Jefferson School of Law (2012) and his B.A. in Political Science from Purdue University (2003). He is admitted to the State Bar of California (Bar # 290722) and was named to Best Lawyers: Ones to Watch in America (2026).

Matt is committed to helping families protect their legacies through thoughtful estate planning.

Disclaimer: This article provides general information about San Diego estate planning law and is for educational purposes only. It does not constitute legal advice and does not create an attorney-client relationship. If you have questions about probate vs non probate assets in California please give us a call.

Estate planning laws are complex and change frequently. The information in this article was accurate as of December 2025. For advice about your specific situation, please consult with a qualified California estate planning attorney.