Key Takeaways: California Revocable Living Trust

- A California revocable living trust lets you maintain full control of your assets while alive, then transfers them to your beneficiaries without probate court involvement when you pass away.

- If your California assets exceed $208,850 (the 2025 probate threshold), a living trust can save your family significant time, money, and stress by avoiding the 12 to 18 month probate process.

- Creating the trust document is only half the job. Funding your trust by transferring asset titles into the trust’s name is what actually makes it work.

- A properly funded living trust provides privacy, avoids probate, and allows your successor trustee to manage your affairs immediately if you become incapacitated.

- California community property rules offer unique tax advantages when married couples hold assets in a joint revocable living trust.

If you own a home in California, you’ve probably heard that a revocable living trust can help your family avoid probate. Maybe a friend mentioned their parents had one, or you read about it online. Here’s what most articles don’t tell you: in California specifically, a living trust isn’t just a nice option. For most homeowners in San Diego County and throughout the state, it’s the single most important step you can take to protect your family from a costly, time-consuming legal process.

At Opelon LLP, our estate planning attorneys in Carlsbad have helped hundreds of California families create personalized revocable living trusts. We’ve seen firsthand how the right plan saves time, money, and stress for loved ones during an already difficult time.

This guide explains how California revocable living trusts work, who benefits most from having one, and how to create and maintain your trust properly under current California law.

What Is a California Revocable Living Trust?

A California revocable living trust is a legal document you create while you’re alive to hold and manage your assets.

You transfer ownership of your property, including your home, bank accounts, and investments, into the trust’s name. However, you remain in complete control as the trustee, using and managing everything exactly as you did before.

The term “revocable” means you can change, amend, or completely cancel the trust at any time while you’re mentally capable. This flexibility makes the revocable living trust one of the most popular estate planning tools for California families who value both control and adaptability.

When you pass away, or if you become incapacitated, your chosen successor trustee steps in to manage and distribute your assets according to your written instructions. Because the trust, not you personally, owns the assets, your family avoids the probate court process entirely.

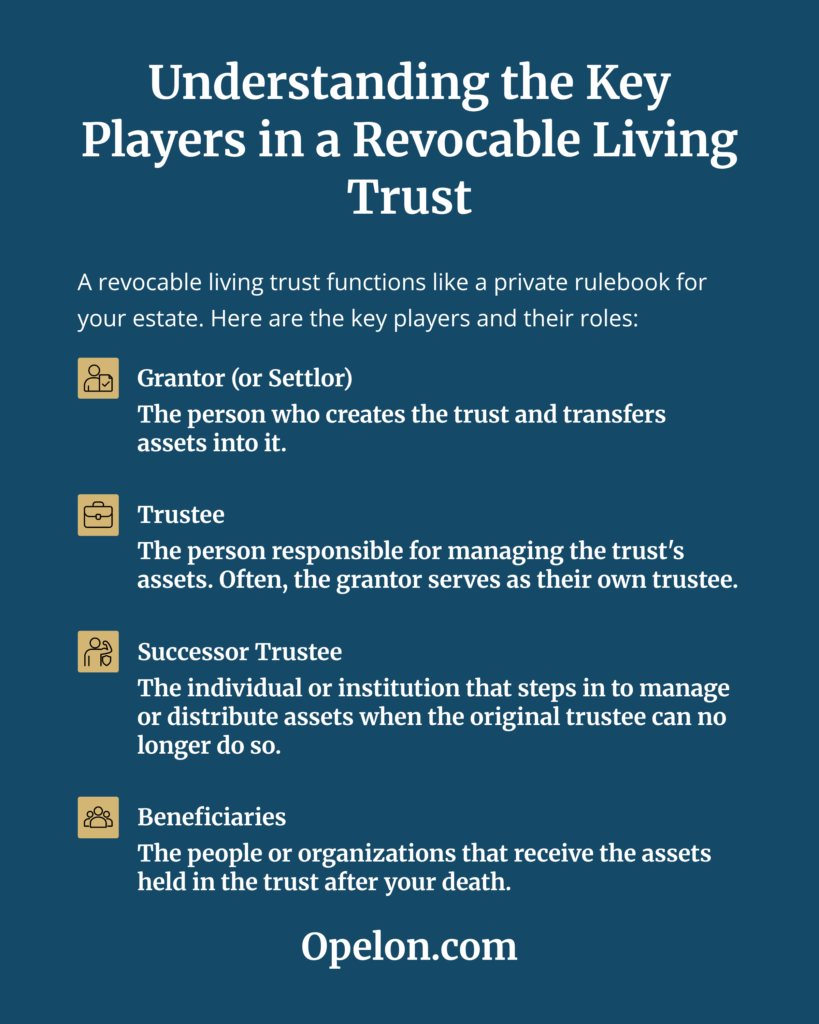

The Key Players in a Living Trust

Understanding the roles involved helps clarify how a living trust operates:

- Grantor (or Settlor): The person who creates the trust and transfers assets into it. In most cases, this is you.

- Trustee: The person responsible for managing the trust assets. While you’re alive and capable, you typically serve as your own trustee.

- Successor Trustee: The person or institution who steps in to manage the trust if you become incapacitated or when you pass away.

- Beneficiaries: The people or organizations who receive the trust assets according to your instructions.

Why Do California Families Create Living Trusts?

California’s probate process is known for being lengthy, expensive, and public. A properly funded living trust addresses all three concerns.

Avoiding California Probate

When someone passes away owning assets in their individual name that exceed California’s probate threshold, those assets must go through probate court.

The current threshold is $208,850 (effective April 1, 2025). For most California homeowners, this means probate is virtually guaranteed without proper planning.

California probate typically takes 12 to 18 months for straightforward estates. More complex situations can stretch to two years or longer. During this time, your family must navigate court hearings, legal filings, and mandatory waiting periods before accessing inherited property.

A living trust bypasses probate completely because the trust, not you individually, owns the assets. Your successor trustee can begin managing and distributing assets immediately, without court involvement.

Maintaining Privacy

Probate is a public proceeding. Once a will is filed with the court, it becomes a public record. Anyone can look up the details of your estate, including what assets you owned, their values, and who received them.

A living trust remains entirely private. Your trust document is never filed with any court or government agency. Only your trustee and beneficiaries need to know its contents.

Planning for Incapacity

A living trust isn’t just about what happens after death. It also protects you during your lifetime.

If you become unable to manage your affairs due to illness, injury, or cognitive decline, your successor trustee can step in immediately. They can pay your bills, manage your investments, and handle financial matters without petitioning a court for a conservatorship.

Without a trust, your family would need to go through a court process to gain authority over your finances. This process is expensive, time-consuming, and public.

How Much Does California Probate Cost?

California sets probate attorney and executor fees by statute, based on a percentage of the estate’s gross value.

Both the attorney and the personal representative (executor) are entitled to the same fees, effectively doubling the statutory cost.

Here’s how the California Probate Code Section 10810 fee schedule works:

|

Estate Value |

Attorney Fee |

Executor Fee |

|

First $100,000 |

4% ($4,000) |

4% ($4,000) |

|

Next $100,000 |

3% ($3,000) |

3% ($3,000) |

|

Next $800,000 |

2% ($16,000) |

2% ($16,000) |

|

Next $9,000,000 |

1% |

1% |

|

Next $15,000,000 |

0.5% |

0.5% |

Important: These fees are calculated on the gross value of the estate, not the net value after debts. If you own a $900,000 home with a $400,000 mortgage, probate fees are calculated on the full $900,000.

What California Probate Actually Costs: Real Examples

|

Estate Value |

Attorney Fee |

Executor Fee |

Total Fees |

|

$500,000 |

$13,000 |

$13,000 |

$26,000 |

|

$750,000 |

$18,000 |

$18,000 |

$36,000 |

|

$1,000,000 |

$23,000 |

$23,000 |

$46,000 |

|

$1,500,000 |

$28,000 |

$28,000 |

$56,000 |

|

$2,000,000 |

$33,000 |

$33,000 |

$66,000 |

These statutory fees don’t include court filing fees (starting at $435), publication costs ($200 to $500), probate referee fees (approximately 0.1% of appraised assets), or potential extraordinary fees for complex matters.

Who Needs a California Revocable Living Trust?

Almost anyone who owns real property or significant assets in California can benefit from a living trust. A trust is particularly valuable if you:

- Own a home or other real estate in California worth more than $208,850

- Own real property in multiple states (a trust avoids probate in each state)

- Have minor children or dependents who need protection

- Value privacy and want to keep your estate matters out of public record

- Want to plan for potential incapacity without court involvement

- Own a business, LLC, or professional practice

- Want to reduce potential for family conflict after your death

- Have a blended family with children from different relationships

At Opelon LLP, we’ve seen living trusts simplify even the most complex estates. From growing families looking to avoid probate in San Diego County to high-net-worth professionals seeking privacy and structure, the right trust can make a significant difference.

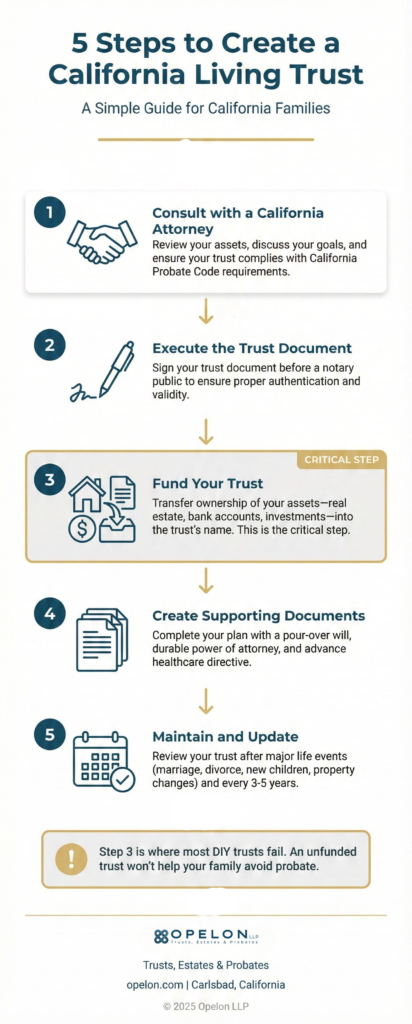

How to Create a California Revocable Living Trust

Creating a California revocable living trust involves several important steps. While the process is straightforward with professional guidance, each step requires careful attention to detail.

Step 1: Work with a California Estate Planning Attorney

Your attorney will review your assets, understand your goals, and draft a trust document tailored to your family’s needs. A California-licensed estate planning attorney ensures your trust complies with California Probate Code requirements and addresses state-specific issues like community property rules.

Step 2: Execute the Trust Document

You’ll sign the trust document, typically before a notary public. While California law doesn’t require notarization for a trust to be valid, notarization helps with real estate transfers and provides additional authentication.

Step 3: Fund the Trust

This is the most critical step. Funding means transferring ownership of your assets from your individual name into the trust’s name. Without proper funding, your trust is essentially an empty container that won’t help your family avoid probate.

Step 4: Create Supporting Documents

A complete estate plan includes more than just a trust. You’ll also need a pour-over will to catch any assets not transferred to the trust, a durable power of attorney for financial matters, an advance healthcare directive, and potentially a HIPAA authorization.

Step 5: Maintain and Update Your Trust

Review your trust after major life events such as marriage, divorce, the birth of a child, or significant asset changes. California laws also change periodically, so periodic reviews with your attorney help ensure your plan remains current.

How to Fund a California Revocable Living Trust

Funding your trust is what makes it actually work.

Many people create a trust but never complete the funding process, leaving their families to face probate anyway. In our experience, about one-third of the trusts we review when families come to us were never fully funded.

Here’s how to properly fund different types of assets:

|

Asset Type |

How to Transfer |

|

Real Estate |

Record a new deed (typically a grant deed or quitclaim deed) transferring the property to the trust’s name with the county recorder |

|

Bank Accounts |

Open new accounts in the trust’s name or change title on existing accounts at your financial institution |

|

Brokerage Accounts |

Retitle accounts to the trust’s name through your brokerage firm |

|

Business Interests |

Assign ownership shares or membership interests to the trust and update operating agreements |

|

Personal Property |

Use a general assignment document to transfer valuables like jewelry, art, or collections |

|

Life Insurance |

Name the trust as contingent beneficiary (primary beneficiary is typically your spouse) |

|

Retirement Accounts |

Generally NOT transferred into the trust; instead, update beneficiary designations (consult your attorney for specific guidance) |

Review your trust funding annually and whenever you acquire new assets. At Opelon LLP, we help clients not only create their trusts but also properly fund and maintain them over time.

What Is the Difference Between a Will and a Trust in California?

A common question we hear at Opelon LLP is whether a will is sufficient or whether a trust is necessary. The short answer: in California, if you own a home, a trust almost always makes more sense. Here’s why.

|

Feature |

Will |

Living Trust |

|

When Effective |

Only after death |

Immediately upon creation |

|

Probate Required |

Yes, if over $208,850 |

No |

|

Privacy |

Public record |

Completely private |

|

Incapacity Protection |

None |

Yes |

|

Court Oversight |

Required throughout |

None |

|

Timeline |

12-18+ months |

Weeks to months |

|

Names Guardian for Minor Children |

Yes |

No (requires will) |

Most California families benefit from having both: a living trust for asset management and probate avoidance, plus a “pour-over will” that captures any assets accidentally left outside the trust. The will also names guardians for minor children, which a trust cannot do.

California Community Property and Living Trusts

California is one of nine community property states, which affects how married couples structure their living trusts.

Under California law, most assets acquired during marriage belong equally to both spouses, regardless of who earned the income or whose name is on the title.

When married couples place community property into a joint revocable living trust, both spouses maintain equal ownership. This arrangement offers a significant tax advantage.

The Double Step-Up in Basis

When the first spouse dies, community property in a trust receives a full “stepped-up basis” for capital gains tax purposes. This means both the surviving spouse’s half and the deceased spouse’s half step up to the current fair market value.

Consider this example: A couple purchased their home 30 years ago for $200,000. Today, it’s worth $1,200,000. If held as community property and one spouse passes away, the entire property’s basis steps up to $1,200,000. The surviving spouse could sell the home immediately with little or no capital gains tax.

This double step-up is unique to community property states and represents a significant tax advantage over joint tenancy or tenancy in common ownership in non-community property states.

How Is a California Revocable Living Trust Taxed?

A revocable living trust is “tax neutral” during your lifetime.

Because you retain full control over the trust and can revoke it at any time, the IRS treats you as the owner of all trust assets. The trust uses your Social Security number, and all income is reported on your personal tax return.

A living trust does not by itself reduce income taxes or estate taxes. However, it can work alongside other strategies, such as irrevocable trusts, charitable planning, or lifetime gifting, to minimize taxes for high-net-worth families.

California Estate Tax

California does not have a state estate tax or inheritance tax.

Only the federal estate tax applies if your estate exceeds the federal exemption.

Federal Estate Tax Exemption (2026)

The current federal estate tax exemption is $13.99 million per individual, or $27.98 million for married couples. Estates exceeding these amounts face a 40% federal estate tax on the excess.

Under the One Big Beautiful Bill Act, this exemption will increase to $15 million per individual ($30 million for married couples) beginning January 1, 2026. The exemption will continue to be indexed for inflation going forward.

For most California families, the federal estate tax isn’t a concern. However, if your estate approaches these thresholds, advanced planning strategies may be appropriate. Your estate planning attorney can coordinate with your CPA or financial advisor to evaluate your specific situation.

When Does a Revocable Living Trust Become Irrevocable?

A California revocable living trust becomes irrevocable when the grantor passes away or permanently loses the mental capacity to make changes.

At that point, the trust terms are locked in, and no one, including the successor trustee or beneficiaries, can alter the distribution instructions.

During your lifetime, the trust remains fully revocable as long as you’re mentally competent. You can amend, modify, or completely revoke it at any time.

If you become incapacitated but haven’t passed away, the trust effectively becomes “frozen.” Your successor trustee can manage assets under the existing terms but cannot modify the trust itself. This protection ensures your intentions are honored even when you can no longer advocate for yourself.

How to Choose a Successor Trustee

Selecting the right successor trustee is one of the most important decisions in creating your living trust. This person will manage your assets, pay bills, file taxes, and distribute your estate according to your instructions.

Qualities to look for in a successor trustee include:

- Trustworthiness and integrity

- Organizational skills and attention to detail

- Financial responsibility

- Availability and willingness to serve

- Ability to work with professionals when needed

Many clients choose a trusted family member as their primary successor trustee and name a professional fiduciary or trust company as a backup. The key is selecting someone who will follow your wishes faithfully and seek expert help when needed.

How Much Does a California Revocable Living Trust Cost?

The cost of creating a California revocable living trust depends on the complexity of your estate and the attorney’s approach. Most complete estate plans, including a trust, pour-over will, durable power of attorney, and advance healthcare directive, range from $2,500 to $5,000.

While DIY kits and online forms may seem tempting at $100 to $500, they often fail to meet California’s strict legal standards or address state-specific issues like community property. An improperly drafted or unfunded trust can cause the very problems it was meant to prevent, ultimately costing your family far more in probate fees and delays.

When you compare the one-time cost of a professionally drafted trust to the potential $26,000 to $66,000 in statutory probate fees for a typical California home, the math strongly favors proper planning.

Advantages and Disadvantages of a California Revocable Living Trust

Advantages of the Revocable Living Trust

- Avoids Probate: A funded trust bypasses the 12 to 18 month probate process entirely, saving time, money, and stress.

- Maintains Privacy: Unlike a will, a trust remains private. Your family’s financial details never become public record.

- Protects During Incapacity: Your successor trustee can manage your finances immediately if you become unable to do so.

- Offers Flexibility and Control: You can modify or revoke your trust at any time, and you control how and when beneficiaries receive assets.

- Simplifies Multi-State Property: If you own property in multiple states, your trust prevents separate probate proceedings in each jurisdiction.

- Reduces Family Conflict: Clear, legally binding instructions minimize disputes among beneficiaries.

Disadvantages of the Revocable Living Trust

- No Creditor Protection: Because you maintain control, assets in a revocable trust are not protected from creditors during your lifetime.

- No Tax Savings by Itself: A revocable living trust doesn’t reduce income or estate taxes on its own.

- Upfront Cost: The initial investment is higher than a simple will, though typically far less than eventual probate costs.

- Requires Ongoing Maintenance: You must properly fund the trust and keep it updated as your life circumstances change.

How Often Should You Update Your California Revocable Living Trust?

Estate planning is not a one-time event. Your trust should be reviewed after major life events such as:

- Marriage, divorce, or remarriage

- Birth or adoption of a child or grandchild

- Death of a spouse, beneficiary, or trustee

- Purchase or sale of real property

- Significant changes in asset values

- Moving to or from California

- Changes in California law that affect your plan

Even without major life changes, we recommend reviewing your estate plan every three to five years. California laws evolve regularly, and periodic reviews ensure your plan remains current and effective.

California Revocable Living Trust FAQ

What is a California Revocable Living Trust?

A California revocable living trust is a legal document that holds your assets during your lifetime and transfers them to your beneficiaries after death without probate court involvement. You maintain full control as trustee and can change or revoke the trust at any time while mentally competent.

Why should I consider a revocable living trust in California?

The primary benefits are avoiding probate, keeping your estate private, ensuring a smooth transfer of assets, and providing for management of your assets if you become incapacitated.

Who needs a revocable living trust in California?

A living trust is beneficial for California residents who own real estate, have significant assets, want to avoid probate, or simply want to streamline their estate planning while maintaining flexibility and control.

Does a revocable living trust protect assets from creditors in California?

No. A revocable living trust does not provide asset protection. Since you retain control, your assets are still subject to creditors’ claims. Other types of trusts may be better suited for asset protection.

How do I fund a revocable living trust in California?

Funding means transferring ownership of your assets—such as real estate, bank accounts, or investments—into the trust’s name. This step is crucial; without proper funding, your trust will not serve its intended purpose.

How is a revocable living trust taxed?

For tax purposes, the IRS treats the grantor as the owner of the assets. All income is reported on your personal tax return, and the assets remain part of your taxable estate. A revocable trust provides no income or estate tax advantages.

What is the difference between a will and a revocable living trust in California?

A will must go through probate, which can be costly and time-consuming. A revocable living trust allows assets to pass directly to beneficiaries without probate, while also providing for asset management during your lifetime if you become incapacitated.

How much does it cost to set up a revocable living trust in California?

The cost varies depending on the complexity of your estate and whether you use an attorney. In California, fees typically range from $1,500 to several thousand dollars for a revocable living trust. While more expensive upfront than a will, a trust usually saves money in the long run by avoiding probate. See Opelon’s cost to set up an estate plan here.

When does a revocable living trust become irrevocable?

A revocable living trust becomes irrevocable when the grantor dies or if the grantor voluntarily gives up the right to revoke it. After that point, the trust’s terms cannot be changed.

Do I still need a will if I have a revocable living trust?

Yes. Most estate plans include a “pour-over will” to catch any assets not transferred into the trust. This ensures that all of your property is distributed according to your wishes, even if something is accidentally left outside of the trust.

What is the estate tax exemption?

The estate tax exemption grants an individual a certain amount of leeway in transferring their wealth without being burdened by the accompanying taxes. Depending on prevailing conditions, this threshold can be altered and have major implications for how much money is subject to taxation under the estate tax.

Can a successor trustee change a revocable living trust?

Generally, no. Once the grantor becomes incapacitated or passes away, a revocable living trust becomes irrevocable, and the successor trustee cannot change, add to, or revoke its terms. The trustee’s role is to follow the grantor’s written instructions exactly as stated in the trust. However, in rare cases, the trust document itself may grant limited powers—such as correcting errors or updating administrative provisions—or a court may authorize changes under specific circumstances allowed by California law.

Can a revocable living trust be contested in California?

Yes, although trust contests are generally more difficult than will contests. Under California Probate Code Section 16061.8, beneficiaries have 120 days from receiving notice of the trust to file a contest. A trust may be challenged on grounds of lack of mental capacity, undue influence, fraud, or improper execution. Working with an experienced attorney helps ensure your trust is properly drafted to minimize contest risk.

Who controls a revocable living trust after the grantor’s death?

After the grantor’s death, control passes to the successor trustee named in the trust document. The successor trustee is responsible for collecting trust assets, paying valid debts and taxes, and distributing property to beneficiaries according to the trust’s terms. They act in a fiduciary capacity—meaning they must manage the trust with honesty, loyalty, and full transparency under Probate Code § 16002. Beneficiaries have the right to receive accountings and request information about trust administration.

Can a successor trustee sell property held in a living trust?

Yes—if the trust grants that authority. A successor trustee can sell real estate or other trust assets when doing so is necessary to pay expenses, settle debts, or distribute proceeds to beneficiaries. The trustee must act in the best interest of all beneficiaries and comply with the trust’s terms and California law. Unless restricted by the document, most modern living trusts give trustees broad powers to manage and liquidate assets under Probate Code § 16226. Proper record-keeping and fair-market-value sales are essential to fulfill fiduciary duties.

What happens if a living trust isn’t properly funded?

If a revocable living trust isn’t funded—that is, if property wasn’t retitled into the trust’s name—those assets may still need to go through probate. California allows a simplified process called a Heggstad petition (under Probate Code § 850) if the trust or supporting documents show clear intent to include the asset. However, this remedy isn’t guaranteed. To ensure the trust works as intended, each asset should be correctly titled or assigned to the trust while the grantor is alive.

How often should I update my California revocable living trust?

Review your living trust every few years or whenever major life events occur—such as marriage, divorce, the birth of a child, buying or selling real estate, or significant changes in finances. You should also revisit your plan if any trustee or beneficiary passes away or if California or federal tax laws change. Keeping your trust current ensures that it remains legally enforceable and continues to reflect your wishes. At Opelon LLP, we recommend a formal trust review at least every three to five years.

Does a revocable living trust protect assets from creditors?

No. A revocable living trust does not provide asset protection from creditors during your lifetime. Because you retain full control and can revoke the trust at any time, creditors can reach trust assets just as they could reach assets held in your individual name. Certain irrevocable trusts may offer creditor protection, but this requires giving up control over the assets.

Do I still need a will if I have a living trust?

Yes. Most people with a living trust also need a “pour-over will” that transfers any assets accidentally left outside the trust into the trust at death. The will also serves an important function that a trust cannot: naming guardians for minor children.

What is the California probate threshold for 2025?

The California probate threshold is $208,850 (effective April 1, 2025). Estates exceeding this value in assets subject to probate generally must go through the formal probate process unless proper planning, such as a living trust, is in place.

Take the Next Step Toward Protecting Your Family

A California Revocable Living Trust provides control, privacy, and flexibility while helping your family avoid the delays and costs of probate. It doesn’t automatically save taxes or protect assets from creditors, but it forms the foundation for a strong, adaptable estate plan.

The key to success is professional drafting, thorough funding, and periodic review. With proper guidance, your trust can grow and evolve with you, ensuring your wishes are honored exactly as you intend.

At Opelon LLP, our Carlsbad estate planning attorneys have extensive experience helping California families create clear, enforceable trusts tailored to their goals. We believe estate planning isn’t just about documents. It’s about peace of mind for you and protection for the people you love.

Ready to take the next step? Contact our Carlsbad office to schedule a consultation.

Together, we’ll build a plan that protects what matters most.

Legal Disclaimer

This article provides general information about California estate planning law and is for educational purposes only. It does not constitute legal advice and does not create an attorney-client relationship. Estate planning laws are complex and change frequently. The information in this article was accurate as of December 2025. For advice about your specific situation, please consult with a qualified.