Why O.J. Simpson’s Estate Captivated the Public

The Estate That Sparked Headlines

By focusing on lessons from O.J. Simpson’s case, you can ensure your wishes are carried out and protect your family from financial chaos. Simpson’s 2024 death put his estate, complicated by judgments and legal drama, under national scrutiny.

Imagine a typical couple in their 50s, James and Lisa, who own a house with a mortgage and have education savings for their children. Without an estate plan, unexpected financial liabilities could create confusion and jeopardize their children’s future.

Learning from high-profile cases helps everyday families avoid pitfalls and protect what matters most. Journalists quickly sought Simpson’s assets and debts, raising questions about payments to the victims’ families. This media attention highlights broader lessons beyond celebrity intrigue and sets the stage for practical estate planning takeaways.

This move from public fascination to practical relevance bridges the gap between headline-making estates and everyday planning challenges. It sets up key lessons—such as organizing assets, understanding creditor risks, and planning ahead—to prevent confusion or loss.

Why This Case Matters for Everyday Families (Not Just Celebrities)

Simpson’s experience shows that any estate can face debts, contested ownership, and family tension. For instance, a family facing unexpected bills may struggle to settle their estate without preparation. Listing assets and debts, then meeting with an estate planning attorney, reduces creditor risk and complications. Start by gathering key documents and organizing your finances to create a plan tailored to your family’s needs.

The essential takeaway: thoughtful estate planning and staying organized protect your family from confusion and legal or financial uncertainty.

With those key points in mind, it’s helpful to start by listing all assets and debts. That clear foundation supports the actionable steps below. In the following sections, we build on Simpson’s case and highlight ways to strengthen your own estate plan.

Opelon LLP’s Perspective: Turning High-Profile Chaos Into Practical Lessons

Opelon LLP reviews well-known estate cases like Simpson’s to find real-world lessons for clients. The key takeaway is to follow proven safeguarding steps, such as using privacy tools and naming key fiduciaries, and to avoid pitfalls seen in high-profile cases, such as unpaid debts and ambiguous titles. Our goal is to provide actionable guidance to safeguard your family’s financial future. Throughout this article, we’ll explain Simpson’s estate in plain language, spotlight planning techniques that worked, and call out missteps that invited litigation.

First, let’s set the context by reviewing Simpson’s life and the legal issues that shaped his estate.

Overview of O.J. Simpson’s Life, Legacy, and Legal Entanglements

A Brief Background on His Career and Controversies

Orenthal James “O.J.” Simpson was a national figure long before his estate made news. A standout NFL running back in the 1970s, Simpson later worked in film and television. His public image shifted dramatically after the 1994 murders of Nicole Brown Simpson and Ron Goldman and the subsequent criminal trial; though acquitted criminally in 1995, a civil jury found him liable in 1997 and ordered $33.5 million in damages. That judgment followed him for decades and became central to disputes after his death.

His legal troubles didn’t end there. In 2007, Simpson was convicted in a Las Vegas armed robbery case and spent nearly nine years in prison before his 2017 release. (Simpson convicted of robbery and kidnapping, 2008) By the time he died in April 2024 at age 76, his life was defined as much by courtroom battles as by athletic achievement. That history guaranteed a complex estate administration once probate opened.

Legal Judgments That Followed Him Into Death

Simpson’s largest unresolved issue was the unpaid wrongful-death judgment. The 1997 civil award of $33.5 million to the Brown and Goldman families accrued interest over the years and far exceeded his reported assets. That obligation didn’t vanish at death; it became a creditor claim against his estate. In 2025, the estate accepted a $57.9 million claim from Fred Goldman as valid, underscoring how debts can outlive the individual. (O.J. Simpson’s estate accepts $58M claim from Goldman family, but any payment would be a fraction, 2025)

The estate also faced other claims and tax issues, including reported tax liens and administrative obligations. Under probate rules, government claims and administration costs typically have priority, which meant Simpson’s creditors were first in line before any distributions to heirs. The sheer scale and complexity of these claims made his estate administration unusually difficult.

Why His Estate Was Always Going To Be Complicated

Given the mismatch between Simpson’s liabilities and his known assets, litigation was almost inevitable. The Goldman and Brown families had pursued collection for decades, and probate provided a formal forum for those claims. Simpson’s affairs also spanned several states (California, Florida, and Nevada), which may require multiple legal actions in the jurisdictions where property is located.

Differences in state law (for example, Nevada’s asset-protection-friendly statutes versus California’s creditor-friendly rules) added legal complexity for administrators trying to sort ownership and priority.

There were also apparent asset-protection moves to unwind. Simpson relied heavily on protected income streams, such as pensions, and reportedly used titling strategies, such as transferring or co-titling property, that creditors challenged. The executor even sought recovery of funds used to buy a Las Vegas home that was placed in a child’s name.

These transfers raise clawback issues in probate, showing how last-minute or incomplete planning fuels post-mortem fights. With this context, here’s what the public record reveals about Simpson’s estate plan.

What We Know About O.J. Simpson’s Estate Plan

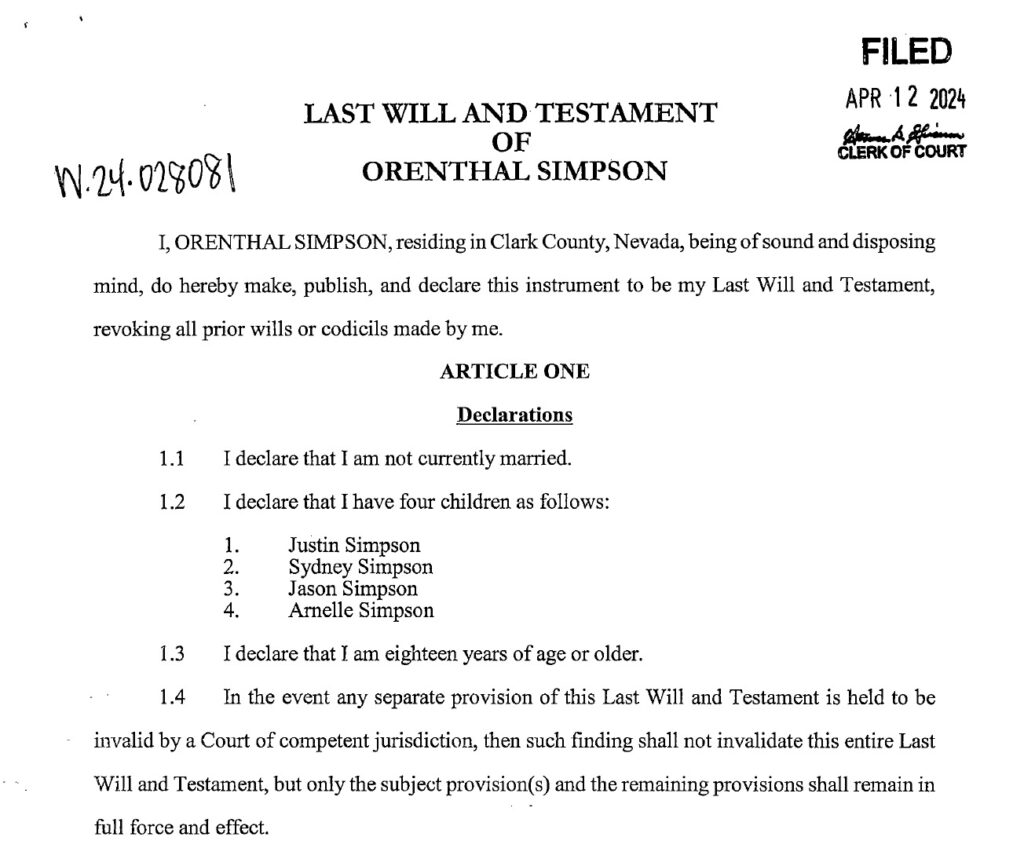

The Revocable Living Trust: The Centerpiece of His Plan

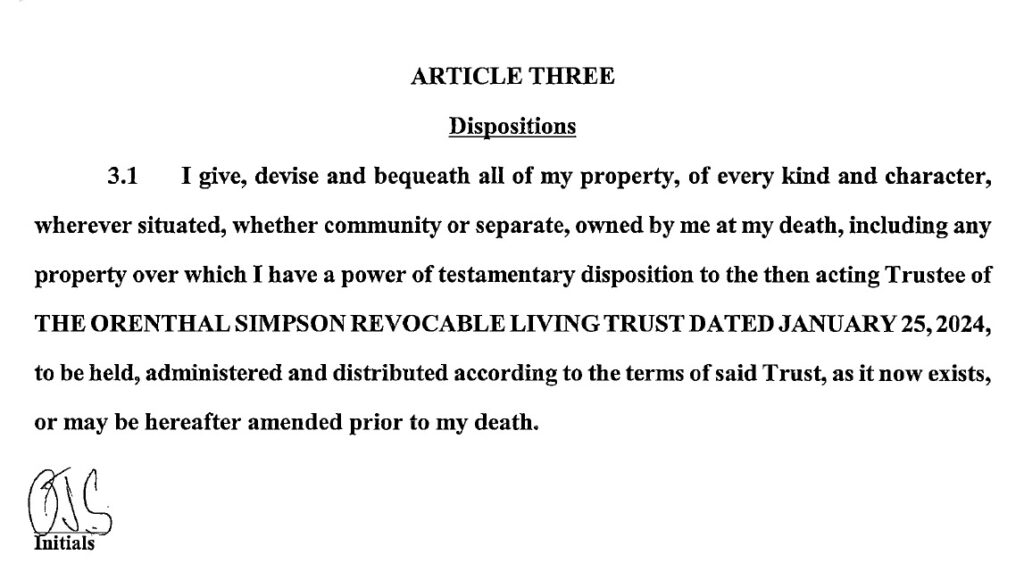

Simpson did create formal estate documents. At the center was a Revocable Living Trust. He executed a will on January 25, 2024, that directed all of his property into “The Orenthal Simpson Revocable Living Trust.” In other words, his will served as a pour‑over will, designed to move any assets not already retitled into the trust at death and to keep certain details out of the public probate record. That structure is a common and sensible choice for privacy and continuity.

Because the trust was revocable during Simpson’s life, he kept control and could change it. At death, the trust likely became irrevocable, and a successor trustee assumed management.

The benefit is privacy. While the will is public, the trust typically is not. Court filings confirmed the trust’s existence and date, but not internal terms. A revocable trust provides privacy and control, but cannot eliminate creditor claims or court involvement if disputes arise.

Reported Beneficiaries and Fiduciaries

Who would benefit, and who managed the estate? Public filings provide some clarity. Simpson names his four adult children (Arnelle, Jason, Sydney, and Justin Simpson) in the introductory section, suggesting they are the primary beneficiaries of the trust, though the trust details remain private.

The will also includes a no‑contest clause that reduces a challenger’s share to a nominal $1, a common tool designed to discourage litigation among heirs.

On the fiduciary side, Simpson named longtime attorney Malcolm LaVergne as executor (personal representative), with son Justin named as successor representative if LaVergne could not serve. The identity of the successor trustee for the trust itself is not public.

Typically, the grantor serves as initial trustee during life, with a named successor stepping in at death; that arrangement likely applied here. The important point is that Simpson designated key fiduciaries in advance rather than leaving those decisions to a court.

Asset Types: Real Estate, Pensions, Media Royalties & More

Simpson’s estate contained a mix of asset classes, each with different estate and creditor implications. Here’s a concise overview:

O.J. Simpson’s Real Estate

Simpson’s final residence was a home in Las Vegas, reportedly in the Rhodes Ranch community. Reports indicate the home was co-owned with his son, Justin, and that the estate is seeking to recover about $159,000 Simpson paid toward the purchase, plus appreciation. If the home wasn’t properly titled into the trust, it would be a probate asset, which is one reason Nevada courts became involved. Simpson previously owned property in Florida that was reportedly lost to foreclosure.

Pensions and Retirement Accounts

His primary income streams were defined‑benefit pensions: the NFL pension and Screen Actors Guild benefits. These retirement incomes are often protected from creditors while the beneficiary is living, and their post‑death treatment depends on the plan’s beneficiary designations. Pensions typically pay according to plan rules rather than by will or trust, so properly naming beneficiaries is critical to determine who receives survivor benefits outside probate.

Media Rights and Royalties:

Any residuals or publicity rights carry special rules and sometimes limited value, especially given the legal claims already asserted against Simpson’s earnings.

Notably, the rights to his controversial book If I Did It were seized in part by the Goldman family. In general, media income can be an asset, but much of it has already been claimed or restricted by court orders.

Cash, Investments, and Personal Property

Simpson reported little in investments or liquid savings later in life. High‑value collectibles and memorabilia were previously seized to satisfy judgments. After his death, the estate pursued missing items, such as a Rolex and a Hall of Fame ring, which could be sold to benefit creditors if recovered.

Any life insurance proceeds (if they existed) would pass to named beneficiaries and may be protected depending on state law; public confirmation of such policies has not been disclosed. Life insurance plays a crucial role in estate planning by providing immediate liquidity to pay off debts, thereby relieving heirs from financial burdens. This can be particularly beneficial in covering estate taxes, final expenses, or any outstanding liabilities, allowing beneficiaries to retain more of the estate’s assets. Life insurance policies can also be used strategically to equalize inheritance among heirs or to fulfill specific bequests that might otherwise be impossible.

The estate was dominated by a house with contested ownership, limited liquid assets, and pensions that largely operated outside probate. That variety shows why each asset class needs separate planning attention in a comprehensive estate plan.

The Confidentiality Factor: What Trust Planning Can (and Can’t) Hide

Privacy was a clear motivation for Simpson’s trust. Unlike a will, which becomes a public court record, a living trust generally keeps distribution details private. After his death, the trust itself remained sealed; we know it existed only because the will and court filings referenced it. That confidentiality shields beneficiaries and family matters from media scrutiny, a meaningful benefit in a case as notorious as this one.

But trusts have limits.

A revocable trust does not shield assets from the grantor’s creditors at death, and in many states, creditors may bring claims against trust assets. In Simpson’s case, the trust didn’t prevent Fred Goldman from pursuing the estate, and the executor ultimately accepted the Goldman claim in probate court so trust assets could be used to pay.

Also, a trust won’t always prevent court involvement: Nevada law and the size of Simpson’s estate made some probate filings necessary to give creditors a formal claims forum. The bottom line: trusts enhance privacy and can simplify administration, but they don’t erase debts or remove the need to properly title and fund assets into the trust.

The Battle Over Creditors and Claims

The Goldman Civil Judgment: A Debt That Outlived Him

The 1997 civil judgment against Simpson for $33.5 million is the central creditor issue for his estate. That judgment accrued interest over decades and remained largely unpaid. At death, the Goldmans filed a creditor’s claim in Nevada probate, asserting their right to payment plus interest. By one estimate, under California’s 10% statutory interest, it had ballooned significantly by 2024.

Recognizing the practical limits of the estate, the executor accepted a creditor claim of roughly $58 million in late 2025. Accepting a claim acknowledges its validity and moves administration forward, but it does not guarantee full payment, especially when the estate’s recoverable assets were estimated to be only a fraction of that amount.

Even a modest recovery after many years can be meaningful to claimants and shows how persistent enforcement is often required to collect long‑standing judgments. For families and planners, the lesson is clear: large liabilities can follow you into death and reduce what heirs receive.

Simpson’s estate is a practical example of creditor‑claim procedure. When probate opens, states set a limited window for creditors to present claims. In Nevada, opening probate triggers a claims period during which creditors must file to preserve their rights; Fred Goldman’s formal claim in July 2024 followed that timetable. If a creditor misses the deadline, they may lose the right to collect through probate.

The executor then reviews claims and decides whether to accept or contest them. By accepting the Goldman claim, Malcolm LaVergne avoided costly litigation over its validity. Accepted claims are paid from estate assets according to statutory priority: administration expenses and taxes first, then secured claims and judgments, followed by unsecured creditors. Only after those are satisfied can any remainder be distributed to beneficiaries. In Simpson’s case, administration costs and government liens had to be addressed before any payment to the Goldman/Brown judgment, making it unlikely that heirs would see distributions.

Another critical point: if family members delay opening probate, creditors can force the process. Nevada law permits a creditor to petition the court to open an estate if no one else files the will or starts probate. Living without an executor or a timely administration invites creditors to step in. Families should name an executor and have a plan so that creditor claims are handled in an orderly fashion rather than by outside parties.

Strategies High-Profile Individuals Use to Protect Assets (Legally)

High‑profile individuals with significant liability exposure often deploy legal strategies to protect assets, some of which Simpson used or attempted to use. Below are common techniques and their purposes:

These tools are legally available but have limits. They must be implemented before a creditor threat materializes and used with proper legal counsel to avoid fraudulent-transfer claims. Importantly, Opelon LLP emphasizes the lawful and ethical use of these strategies and provides clients with thorough explanations of the associated risks. This approach ensures compliance with legal standards and fosters trust with clients who may be wary of potential pitfalls.

For most people, prudent use of retirement accounts, correct titling, trusts, and adequate insurance provides meaningful protection without crossing legal lines. The Simpson story shows what can work, and how strong creditor claims can still reach into seemingly protected corners.

What This Means for Normal Families With Debts or Litigation Risk

Most families won’t face Simpson‑level drama, but scaled‑down versions of these problems are common. Key takeaways:

- Estate debts reduce inheritances: Unpaid obligations are paid from the estate before heirs inherit. If you want to leave a home or other asset, factor in mortgages or judgments and consider life insurance or other funding to preserve inheritances.

- Joint debts and co‑signers: Co‑signers may become personally responsible if a co‑borrower dies. Account for that possibility in your plan (for example, by providing funds to pay off joint obligations).

- Communicate and plan for creditor issues: If you know of potential claims or lawsuits, work with an estate planner and consider negotiating settlements while you’re alive. A proactive approach can reduce chaos later.

- Protect against lawsuits and liability: Those in high‑risk professions should consider liability insurance, business entity structures, and asset protection planning well in advance.

Debt and litigation risk are valid estate‑planning factors. Address them early through insurance, proper titling, and tailored legal tools, so your heirs are not left scrambling. Opelon LLP helps clients design plans that account for these risks and prioritize family protection.

How Probate Works When There’s Already a Trust

Why Some Assets Still End Up in Probate

Many people assume a living trust means no probate at all. That’s not always the case. A trust only avoids probate for assets that are properly funded into it before death. Any property still titled in the decedent’s name typically goes through probate and is “poured over” into the trust via a pour-over will. In fact, statistics show that an unfunded trust can delay estate settlement by an average of 18 months, resulting in significant legal expenses and emotional stress for the family.

In Simpson’s case, some assets remained outside the trust or were subject to creditor action, which required probate filings. Nevada law also creates thresholds: if a decedent leaves real estate or assets exceeding a certain amount, probate may be required to provide creditors with a forum. That’s why the executor filed the will shortly after Simpson’s death: to comply with statutory notice requirements and start the creditor clock.

While a trust reduces probate exposure, it doesn’t guarantee zero court interaction when there are unfunded assets or large creditor claims. Assets like pensions and certain retirement benefits typically follow beneficiary designations and plan rules, not a trust. That’s why coordinating beneficiary forms and account titling with your trust is essential to achieve the intended outcome.

The Role of the Successor Trustee vs. Executor

A trust and a will often create two complementary roles: the successor trustee (who manages trust assets) and the executor or personal representative (who handles probate assets). Their duties overlap in administration but differ in how they operate.

The executor, appointed by the court, deals with probate matters: inventorying assets in the decedent’s name, notifying creditors, paying taxes and administration costs, and distributing assets according to the will or applicable law. In Simpson’s estate, Malcolm LaVergne served in this role and had to obtain court authority to act.

The successor trustee steps into the trust role privately and manages the trust’s assets already titled in the trust’s name without court approval. If all assets are in the trust, the trustee largely handles administration and distribution; the executor’s work can be minimal. In mixed situations like Simpson’s, the executor and trustee must coordinate. For example, the executor may transfer probate assets into the trust once creditor issues are resolved, and the trustee manages trust property throughout.

The practical lesson: choose fiduciaries who can work together, and document their roles clearly. Naming the same person as executor and trustee simplifies administration, but separate appointments can work if they’re aligned and communicative. Simpson’s documents appear well drafted in that respect, even though external creditor pressure created friction beyond the documents themselves.

When the Court Must Step In: Public Filings and Legal Challenges

Even with a trust, courts get involved when disputes or statutory requirements arise. Typical triggers include:

- Creditor disputes: Large creditor claims often push matters into probate court, so claims can be vetted and paid in the correct priority.

- Assets outside the trust: If property needs to be recovered or re‑titled into the estate or trust, the executor may petition the court for relief (for example, to claw back transfers to relatives).

- Beneficiary challenges: Will or trust contests can bring disputed documents into public court hearings, delaying administration and exposing private details.

- Public filings: Probate often requires inventories and accountings that become part of the public record, allowing creditors and others to inspect the estate administration.

Trust planning reduces but does not eliminate court involvement when extraordinary circumstances arise. The more you anticipate and address issues in advance, build trust, update titles and beneficiaries, and communicate your wishes, the less likely the court will be called on to resolve disputes.

Lessons for Anyone With a Trust-Based Plan

If you have a living trust or are considering one, Simpson’s story offers practical reminders. Below are proven strategies to maintain your trust’s effectiveness and keep your estate plan operational.

Strategy | Description |

Fund Your Trust During Life | Retitle your home, bank and investment accounts, and other assets into the trust and keep beneficiary forms consistent so assets avoid probate where intended. |

Still Have a Will (Pour-Over Will) | Keep a simple pour‑over will to catch any assets unintentionally left out of the trust and ensure nothing becomes “orphaned.” |

Expect Some Interaction With Probate | Understand state rules and be prepared for the executor or trustee to deal with limited probate matters, especially when creditors or unfunded assets exist. |

Use No-Contest Clauses Wisely | No‑contest clauses can deter challenges, but use them thoughtfully and alongside communication to reduce family conflict. |

These steps help make a trust practical and durable. A well‑funded trust, combined with updated beneficiary designations and clear communication, goes a long way toward avoiding surprises and court involvement.

A trust is one of the best tools for privacy and probate avoidance, but it requires upkeep.

Review your documents periodically, confirm asset titles, and plan for known risks, such as creditor claims. If a trust held up through Simpson’s tumultuous affairs and preserved some privacy and control, imagine how effectively it can protect a well‑maintained family plan.

What O.J. Simpson’s Estate Got Right

Privacy Through Trust-Based Planning

One clear success was Simpson’s use of a revocable living trust to protect family privacy. Because the trust’s terms remained private, the public learned only limited details about distribution. For a family that valued avoiding further media intrusion, that confidentiality mattered.

Even minor choices, like filing the will without exposing the trust document, helped keep certain family matters out of headlines and allowed the family to grieve with some dignity.

Avoiding Probate on Major Assets

Another positive was directing assets into a trust so that, where possible, probate was minimized. Retirement accounts and life insurance, if designated properly, bypassed probate and went directly to named beneficiaries. Where the will had to be filed, it largely served to move residual assets into the trust rather than to govern every distribution, a common and efficient design.

Given Nevada law and the outstanding creditor claims, probate couldn’t be avoided entirely. Still, the trust structure reduced the scope of public administration and likely saved time and expense compared to a fully probate‑based estate.

Prior Structuring for Media & Intellectual Property Income

Simpson’s handling of media deals and residuals shows a degree of sophistication. Some rights were already controlled or subject to court orders (for example, the treatment of If I Did It), and separating intellectual property or business income into entities can be an effective planning tool when done properly. While strong creditor claims can limit the practical value of such structures, sensible prior planning of IP and media rights can preserve value for heirs in less extreme scenarios.

Having Fiduciaries in Place Before Death

Finally, Simpson appointed fiduciaries and updated his documents shortly before he died. Naming an executor, successor representative, and presumably a successor trustee avoided the uncertainty and delay that often follow an intestate death.

He even waived a bond for the personal representative, a detail that can save the estate money and speed administration. Creating clear documents and naming people you trust are core components of an effective plan, and Simpson did both.

What Could Have Been Done Better in O.J. Simpson’s Estate Plan

Planning for Large Judgments or High-Risk Liability

Simpson’s plan fell short in confronting the known, large judgment head‑on. The 1997 civil verdict was not a surprise, and more proactive legal and financial steps earlier in his life might have changed the outcome. Options could have included negotiating a settlement years earlier, exploring lawful asset‑protection structures implemented before a claim arose, or reviewing whether bankruptcy was an appropriate tool at a particular time, recognizing that intentional‑tort judgments often aren’t dischargeable.

The general lesson: if you face significant liability risk, address it early. Asset protection and settlement strategies work best when planned before claims appear; last‑minute transfers are often reversed as fraudulent conveyances.

Clearer Structuring for Potential Disputes

Unclear ownership of the Las Vegas home and questions about missing personal items, such as a ring and a watch, created avoidable conflicts. Clear titling, documented gifts or loans, and inventories of valuable personal property reduce the chance of post‑death disputes.

If a decedent intends to transfer property to a family member, documenting the nature of the transfer—gift, sale, or loan—prevents confusion and litigation later. Similarly, while a no‑contest clause deters litigation, an interpersonal approach (letters of explanation, family meetings, or mediated settlements) can further reduce the likelihood of conflict. Appointing a co‑fiduciary from the family can also enhance transparency and trust when sensitive decisions must be made.

Managing Public Perception and Media Sensitivity

Public comments by fiduciaries can inflame disputes and prolong litigation. Early media statements that are combative or dismissive tend to harden opposition; conversely, a measured, law‑focused tone can open the door to practical resolutions.

For high‑profile estates, coordinating legal strategy with prudent communications planning is a wise move. Sometimes saying less and letting legal processes proceed avoids escalating conflicts that cost time and money.

Ensuring Trust Assets Are Properly Funded

A recurring problem with trust plans is failing to actually fund them. Simpson created his trust shortly before his death, and some assets likely remained titled outside it.

Fully funding a trust by retitling real estate, accounts, and documents that transfer on death is the necessary follow‑through to realize the trust’s benefits. Regular reviews and checklists help ensure newly acquired assets are properly aligned with the trust over time.

Key Legal Lessons From O.J. Simpson’s Estate for the Average Person

Why Everyone Should Have a Trust (Not Just Celebrities)

Simpson’s case demonstrates the core advantages of a trust beyond celebrity concerns. Trusts provide meaningful privacy, reduce probate costs and delays, and offer continuity if you become incapacitated. For most people who own a home, have savings, or want to control distributions to heirs, a trust is a practical tool.

Benefit | Description |

Avoiding Probate Hassles | Properly funded trusts let families bypass lengthy probate, giving faster access to funds and property. |

Privacy | Trusts keep estate details confidential, limiting public and media scrutiny. |

Incapacity Planning | A living trust designates a successor trustee to manage affairs if you’re unable to do so, avoiding court guardianship. |

Customization and Control | Trusts let you tailor distributions and protections for beneficiaries, such as staged distributions or spendthrift terms. |

Estate Tax Planning | For some families, trust structures help with tax planning and can avoid multiple probates across states. |

Trusts cost more upfront than a simple will, but they often save money and stress later. For many families, the long‑term benefits outweigh the initial expense.

Simpson’s plan shows both the value and the limits of trusts; used properly, they protect privacy and provide control, but they must be maintained and integrated with beneficiary designations and asset titles.

The Importance of Maintaining & Updating Your Plan

Estate planning is not a one‑time event. Simpson updated his documents shortly before his death, and that timely update likely prevented additional confusion. Major life events, such as marriage, divorce, births, deaths, moving to another state, or acquiring significant assets, should trigger a plan review.

We recommend checking your documents periodically and after any major change. Also, ensure beneficiary forms and account titles align with your current intentions; mismatches are a common source of unintended outcomes.

Communicate with the chosen fiduciaries to ensure they understand their roles and are willing to serve. Store documents where they can be found quickly. Good maintenance and clear communication turn legal documents into practical protections rather than files that sit unused when they’re needed most.

Protect Your Family from Creditors, Lawsuits, & Chaos

You don’t need a celebrity’s resources to protect your family. Helpful, lawful steps include:

- Asset protection in your plan: Use spendthrift trusts to shield inheritances from beneficiaries’ creditors, and consider irrevocable trusts, where appropriate and lawful, to protect assets from future claims.

- Adequate insurance and entity structure: Carry sufficient liability and umbrella insurance, and operate businesses through LLCs or corporations to compartmentalize risk.

- Plan for incapacity and logistics: Keep a secure list of accounts, passwords, and key contacts so your family can act quickly when needed. An “estate guide” is often as valuable as legal documents.

- Minimize family conflicts: Honest communication, a side letter explaining decisions, or a family meeting with your planner can reduce surprises that lead to disputes.

- Manage debt throughout life: Reducing liabilities and arranging life insurance to cover major debts helps keep your estate from being consumed by obligations.

Proactive planning is the most reliable way to protect loved ones from creditor claims, surprise litigation, and unnecessary stress.

Estate Planning Isn’t Only About Wealth: It’s About Control

At its heart, estate planning is about control: deciding who will manage your affairs, who will receive your assets, and how your wishes will be carried out. You don’t need to be wealthy to benefit; everyone gains from naming decision‑makers, documenting wishes, and coordinating beneficiary designations. Without a plan, default state rules and court decisions fill the void, which often leads to delays, expense, and outcomes that don’t reflect your intent.

Simpson’s example shows that even when liabilities are large, a well‑crafted plan preserves whatever control the law allows. That control (not the dollars alone) is the real value of estate planning. Take the time now to draft a roadmap so your wishes are carried out and your family is spared unnecessary legal battles.

How Opelon LLP Helps Clients Avoid “O.J.-Level” Estate Drama

Customized Trust-Based Plans for Every Family

Opelon LLP builds plans around each client’s unique goals. We don’t use one template for everyone. In a free strategy session, we listen to your family situation, inventory your assets and risks, and, when appropriate, design a trust‑centered plan. Whether you’re a young family with minor children, a blended household, a business owner, or someone facing litigation risk, we tailor documents and titling steps to meet your needs and keep your estate out of court when possible.

We focus on practicality: funding the trust, coordinating beneficiary forms, and planning for taxes, incapacity, and creditor exposure. Our goal is to deliver the privacy and control Simpson sought, without the pitfalls. Where needed, we also incorporate asset‑protection measures, special‑needs planning, and succession strategies so your plan works in the real world.

Media-Savvy Guidance for High-Profile or High-Risk Clients

If you or your family are in the public eye or at heightened litigation risk, we add an extra layer of counsel. That may include coordinating with PR professionals, advising on prudent public statements, and using legal techniques that limit unnecessary disclosure.

We aim to handle filings and communications in a way that meets legal duties while minimizing unwanted attention. Our experience with sensitive matters helps clients keep the focus on lawful resolution rather than sensationalism.

We invite you to schedule a free strategy session with one of our estate planning attorneys. This no-obligation meeting, available by phone, video, or in person, helps you understand your options and the next steps. To make the most out of your session, consider bringing any existing estate planning documents, a list of your assets and liabilities, and any questions you might have. This preparation can reduce anxiety and make the process feel more accessible.

We’ll ask about your family, assets, and concerns (debts, special needs, business interests) and then outline a practical roadmap tailored to your goals. Whether you need a plan from scratch or an update to existing documents, this session gives you clarity and next steps.

Book your free session by calling our office or using the scheduling tool on our website. We’ll find a time that works for you and get you moving toward a plan that protects your family and your wishes.

Connect With Our Attorneys for Probate Assistance (Fast Response)

If you’re facing a recent loss and need probate or trust administration help, contact our probate team right away. We understand the urgency and emotional strain of estate administration, and we typically can schedule an initial consultation within 24–48 hours. In that meeting, we’ll assess whether there’s a will or trust, identify immediate tasks (protecting property, paying urgent bills, securing assets), and map a practical plan of action.

Call our office, use the Contact Us form on our site, or email us, whichever is easiest. You don’t need to gather every document before you contact us; we’ll guide you on what is most important. Even if you’re simply named as executor and feel overwhelmed, we can walk you through your duties and options with compassion and clarity.

At Opelon LLP, we combine legal experience with a human approach. We treat clients like family and focus on practical solutions that protect people and their legacies. Let us help you turn a difficult time into a controlled, respectful process that honors the deceased and safeguards those left behind.

(Disclaimer: This article is for general information only and does not constitute legal advice. Reading about O.J. Simpson’s estate is not a substitute for consulting a qualified attorney about your own situation. For tailored advice, please contact Opelon LLP or your legal counsel.)

We warmly invite you to schedule a personalized consultation with one of our experienced attorneys. Our team is ready to provide tailored assistance to your needs, ensuring you receive the guidance and support you require. Whether you have complex estate planning needs or are just beginning the process, we are here to help you every step of the way. Please feel free to contact us directly to schedule a consultation and explore your options further.