7 Hidden Risks of Adding Your Child as a Joint Owner on Your Bank Account in California

Adding a child to your bank account for estate planning purposes is one of the most common shortcuts California families take, and one of the

find what you’re looking for

Adding a child to your bank account for estate planning purposes is one of the most common shortcuts California families take, and one of the

The new FinCEN Real Estate Reporting Rule 2026 changes how certain residential property transfers to trusts and LLCs are handled across California and the rest

Trust lawyers in San Diego do more than draft documents. They help you avoid a probate process that can take over a year, cost tens

Rule Against Perpetuities is one of the most misunderstood phrases in estate planning, and in California, it rarely works the way people think it does.

AI estate planning tools promise savings but can cost California families unnecessary expense and heartache for their loved ones if they fail. Learn the 5

The inventory and appraisal is one of the most important documents you will file as an executor, yet most families have never heard of it

Transferring a deceased person’s vehicle is one of the first practical tasks families face after losing a loved one. The good news? California allows most

Naming your revocable trust as IRA beneficiary could trigger costly Required Minimum Distributions (RMDs) problems. Learn the 5 most common mistakes California families make and

A California small estate affidavit could save your family months of waiting and thousands of dollars in court costs. If your loved one’s estate is

Understanding probate vs non probate assets can save California families months of waiting and thousands in court costs. Learn which assets must go through probate

California intestate succession laws determine exactly who inherits your property if you die without a will, and the results may surprise you. Whether you are

California probate without a will happens more often than most families expect. When someone dies intestate, the court steps in to determine who inherits based

The trust administration process can seem daunting when you’ve just lost a loved one and suddenly find yourself responsible for managing their trust. The good

A California TOD deed avoids probate for your home. But it won’t help if you’re incapacitated, won’t protect your beneficiary’s inheritance, and vanishes if your

When OJ Simpson died in 2024, the drama didn’t end; it simply moved from the courtroom to the probate court. Overnight, his estate became a

Serving as an executor in California can feel overwhelming, especially when you’re grieving and trying to make the right decisions for your family. This article

Your beneficiary designations can override your will, your trust, and your wishes. One outdated form could send your retirement savings to an ex-spouse instead of

Owen Rassman Named Superlawyer for the third year—recognized for exceptional estate planning and probate law in Carlsbad and San Diego.

Gain insights into Heggstad petitions in San Diego. This key guide explains the probate code § 850 and offers trustees and beneficiaries a streamlined way

Navigate estate planning for a beneficiary with addiction issues in California. Learn to protect their interests with spendthrift trusts and smart strategies.

California Estate Planning Case Study: Discover how real families in California overcame complex legal and financial challenges through smart trust-based strategies. From protecting special needs

Understanding the difference between Letters Testamentary vs Letters of Administration is crucial for anyone navigating California probate. These court-issued documents determine who has legal authority

The Independent Administration of Estates Act (IAEA) gives California executors and administrators a streamlined way to handle probate with fewer court approvals and reduced delays.

Selling a house in probate can be challenging. This expert guide outlines crucial steps when selling a house in San Diego probate, clarifying legal processes

Understanding the different types of probate in California is essential for families who are navigating the estate process after losing a loved one. Depending on

Have you ever wondered “Where should I store my estate planning documents?” If so, you’re not alone. In this blog post, we’ll delve deeper into

Attorneys for Living Trust beat DIY kits. Discover 5 California-tested reasons—deeds, funding, and child protections—that help San Diego/Carlsbad families avoid probate and costly mistakes. Keep

San Diego, August 21, 2025 — Opelon LLP is pleased to announce that partner Matt Odgers lawyer has been included in the 2026 edition of

Understand the California Last Will and Testament and learn how it can ensure your wishes are honored with clarity and legality.

You may be wondering if this San Diego Estate Planning Guide guide is relevant to your specific situation. The truth is, estate planning is essential

Naming a beneficiary is more than a legal requirement—it’s a powerful way to ensure your assets reach the people or causes that matter most to

As the year comes to a close, there’s no better time to ensure your estate plan is up to date and aligned with your goals.

Take the first step toward creating a lasting legacy for your family this holiday season. Contact our office today to schedule a consultation and let

Estate Planning for Families helps secure your family’s future. This California-focused guide breaks down everything you need to know about wills, trusts, and more. Protect

With approximately 16% of children in the U.S. growing up in blended families, creating a comprehensive estate plan ensures that assets are distributed fairly and

A California QTIP trust is a powerful estate planning tool designed to provide financial security for a surviving spouse while preserving assets for future beneficiaries.

Estate planning is an essential step for any couple, but with estate planning for LGBTQ+ families, the process can present unique challenges.

Estate planning for single parents is more than just creating a will; it’s about making sure your children are provided for, legally protected, and that

Losing a spouse is an incredibly difficult experience that requires making important financial and legal decisions during a time of grief. This guide to estate

Estate planning for business owners is critical for those want to protect their companies, ensure financial stability, and preserve their legacy.

Estate Planning for New Parents: Protecting Your Child’s Future. As new parents, securing your child’s future is a top priority. Estate planning is a critical

While LLCs offer legitimate advantages in certain situations, placing your primary residence in a California LLC comes with significant downsides.

This article provides an essential guide for small business owners in California on complying with the Corporate Transparency Act (CTA). It covers everything from who

Understanding the history of estate planning, starting from the world’s first recorded set of laws, allows us to appreciate the long-standing human desire to protect

Everyone hopes to live a long life and slide gracefully into a peaceful old age.

Unfortunately, a sad end to someone’s life has been

With an estimated population of 72.24 million, Millennials emerged as the largest generational cohort in the United States in 2022.

Ever wonder what will happen to your hard earned airline miles if you die? Read on to find out.

A trustee holds the keys to your family’s financial future. When you create a California living trust, this person becomes responsible for managing everything you’ve

Proper estate planning for dentists is a crucial responsibility and, when done correctly, ensures your dental practice’s longevity. It preserves your legacy, safeguards your loved

If you are a holder of Bitcoin, this article will help you to understand how to fund a trust with Bitcoin as well as the

Simply put, a HIPAA Authorization is a document where a person allows a medical provider to share their health information with a 3rd party without

A California Revocable Living Trust helps protect your assets, avoid probate, and keep your estate private. Learn how it works under California law and how

Over and over, we read the stories of celebrities who died with an estate plan.

Whether it’s wills, trusts, or co-ownership agreements, you’d think that

California Probate is a Court process required to manage a Decedent’s estate and distribute his or her assets. Probate is statutorily driven, meaning that much

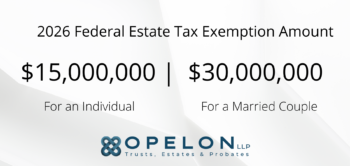

Big changes are here for estate planning in 2026. The federal estate tax exemption has increased to $15,000,000 for an individual and $30,000,000 for a

An irrevocable life insurance trust (ILIT) is an irrevocable trust used to hold a life insurance policy in a way that provides liquidity to the

A California Health Care Power of Attorney is one of the most important documents you will ever sign, yet most people make critical errors that

California Durable Power of Attorney documents prevent one of the most expensive mistakes families make: assuming a spouse or adult child can automatically access bank

Our 21 Step Estate Planning Checklist will ensure that your health care and financial decisions will be carried out during incapacity and after death.

Will vs. trust: which one actually protects your California family from probate court?

If you own a home in San Diego County, this single decision

If you have minor children, you should strongly consider naming a guardian. Here are eight easy steps to guide you through the process of choosing

Estate planning for digital assets may be the most overlooked, yet financially devastating, gap in your family’s protection. With over 100 online accounts per person

A California real estate LLC separates your investment property from your personal assets, limiting your liability if something goes wrong with the rental. For San

Are you curious about how to fund a trust? Great, because we cannot overemphasize the importance of having a fully funded Revocable Living Trust.

Welcome to our California Trust and Estate Probate Blog – your essential guide to navigating the complexities of trust and estate law in California.

Key Takeaways This blog explains California-specific trust and estate planning in clear, practical terms, focusing on trusts, wills, powers of attorney, healthcare directives, and probate. It serves individuals, professionals, and students by providing education, timely legal updates, and actionable guidance to help you plan effectively and navigate probate. Readers are encouraged to engage through questions and comments and follow regular posts that track developments in California law.

Summary This blog offers clear, practical guidance on California trust and estate law, covering trusts, wills, powers of attorney, healthcare directives, and probate. It serves individuals, professionals, and students by educating, updating on legal changes, and encouraging engagement. Posts aim to empower readers to create effective estate plans, navigate probate, and stay current with California-specific developments. Explore regular updates and participate through questions and comments.

This blog aims to demystify the intricate world of estate planning, offering clear, reliable insights for professionals, students, and anyone with an interest in understanding these critical legal aspects.

Whether you’re planning for the future with a California revocable living trust, assisting a loved one with probate, or seeking to broaden your legal knowledge, our blog is the perfect starting point.

Understanding the Scope of Estate Planning and Trust

Estate planning and trusts are crucial components of personal finance and wealth management. They cover a range of areas, including:

Trusts: Trusts are powerful tools for managing, protecting, and passing on your assets. This includes living trusts, testamentary trusts, and special needs trusts, among others.

Wills: Your will is the document that specifies how your assets should be distributed after your death.

Power of Attorney: This designates someone to manage your affairs if you’re unable to do so.

Healthcare Directives: These outline your healthcare wishes if you can’t communicate them yourself.

Probate: Probate is the legal process of validating a will and distributing the estate’s assets.

Understanding these elements is crucial for successful estate planning, ensuring that your assets are handled as per your wishes and providing peace of mind for you and your loved ones.

Who Should Read Our California Trust and Estate Probate Blog?

Our California Trust and Estate Probate Blog is designed for a broad audience.

Whether you’re an individual looking to start your estate planning, a professional seeking a reliable source of legal updates, or a law student seeking a deeper understanding of trust and estate law, our blog provides insights to meet your needs.

Why Our Law Firm Has a California trust and estate planning blog

As experienced attorneys, we believe in empowering our clients and readers with knowledge. Understanding the nuances of estate planning can often seem overwhelming. That’s why we’ve committed to breaking down these complex topics into comprehensible and engaging content.

Through our blog, we aim to:

Educate: Our blog is an educational resource, helping you understand the intricacies of trust and estate probate law in California.

Update: Laws evolve, and so do best practices. We keep you updated on the latest changes, trends, and insights in trust and estate law.

Engage: We want our blog to be a two-way communication platform. We encourage questions, comments, and discussions from our readers.

Empower: Knowledge is power. The more you understand about estate planning, the better prepared you’ll be to make informed decisions for your future.

Explore Our California Trust and Estate Probate Blog

We invite you to explore our California Trust and Estate Probate Blog to enhance your understanding of these vital legal areas.

Look out for our regular updates covering a range of topics – from how to create a comprehensive estate plan to understanding the process of probate in California.

We encourage you to engage with our posts, leave comments, ask questions, and share the articles with those who might find them beneficial. Your participation enriches this learning community.

Conclusion

At Opelon LLP, we believe that understanding trust and estate probate law should not be a challenge but an empowering journey.

Our California Trust, Estate and Probate Blog serves as your companion on this journey, providing the insights and updates you need to navigate the estate planning process effectively.

We look forward to your active participation as we explore the intricate world of trust and estate law in California together.

Owen Rassman is an attorney and Managing Partner at Opelon LLP, a California law firm focused exclusively on estate planning, trust administration, and probate. As a client-facing attorney, Owen advises individuals, families, and fiduciaries on creating and administering sophisticated estate plans and navigating complex probate and trust matters.

Owen holds a Juris Doctor (J.D.), a Master of Laws (LL.M.) in Taxation, and a Master of Business Administration (M.B.A.), providing advanced legal, tax, and strategic planning expertise. He has been recognized as a Super Lawyers® selectee multiple times, an honor awarded based on peer evaluation and professional achievement. Owen is a member of the California State Bar and regularly contributes educational content on estate planning and trust law to help clients make informed decisions about their legacy.

Matt Odgers is an attorney and Managing Partner at Opelon LLP, where he leads the firm’s operations, marketing, and business development functions. While licensed as an attorney, Matt does not provide client representation; instead, he focuses on firm strategy, infrastructure, compliance, and systems that support Opelon’s legal services and client experience.

Matt holds a Juris Doctor (J.D.) and serves as Director of Operations, overseeing internal processes, technology, and growth initiatives to ensure consistent, high-quality legal service delivery. He has been recognized in Best Lawyers: Ones to Watch® in America, a peer-reviewed distinction highlighting emerging leaders in the legal profession, and is a member of the California State Bar.